While it might all seem like doom and gloom with regards to the economy, savvy property investors who target the right areas can still get excellent returns.

What are the best performing rental markets?

We all react to economic stress in a different way. Some of us avoid reality in an attempt to ride an invisible wave above what is while others feed off the fear and uncertainty that invariably exists. There is a third option, however. One that looks beyond the obvious to seek out the information needed to transcend the current climate. Michelle Dickens has access to precisely this kind of information as MD of TPN, a property specialist credit bureau, and her most recent research reveals astoundingly high performance in what she terms as ‘pockets of excellence in the current rental market.

Landlords should target rentals in this price range

“There are 2.1 million households in formal rental accommodation in South Africa. Of the 1.4 million lease agreements that TPN profiles, 22% pay below R3000 a month, 59% are positioned in the R3000 to R7000 rental bracket, and 14% are in the R7000 to R12 000 bracket. Only half a percent are paying above R25 000 a month. So really, we are sitting with almost 80% of tenants paying below R7000 per month. The sweet spot in terms of the rental collection is the R3000 - R7000 bracket with the most challenging tenants paying below R3000 a month.”

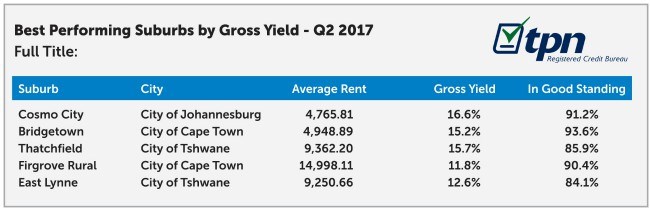

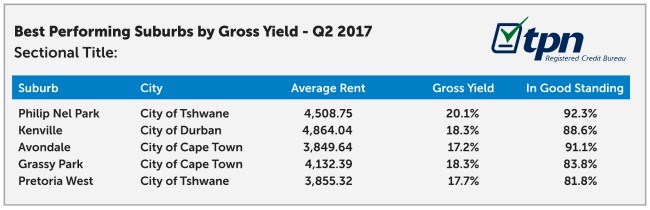

Best performing suburbs

Dickens further explains, “Besides these broad figures, it is critical to determine exactly which suburbs perform the best in terms of average yield when planning your property investment strategy. This is where the results are surprising! 9 out of the top 20 suburbs that offer the highest yield in the country for sectional title schemes are in the city of Tshwane, with the top-performing suburb Philip Nel Park in the west of Pretoria averaging a yield of 20.1% over the last five years. With 92.3% of tenants currently in good standing on their rental payments, that is a pretty impressive return on investment. In terms of full title properties, the highest yield in the country is to be found in Cosmos City in Johannesburg with a good-standing rental payment percentage of 91.2%.”

How landlords can mitigate risks

Deon Botha shares his experience in mitigating risks in the residential property market as CEO of RentMaster, a South African company specializing in guaranteeing rentals, “While there is no doubt that we are still seeing the results of the 2008/9 banking crisis adversely affecting the property sector, there is more good news than just the Western Cape bubble for those who look.

Residential property is a critical socio-economic driver and there will always be demand for housing. With so many millions living in the informal settlements but starting to enjoy the benefits of economic empowerment, there will be increasing demand for incremental housing closer to the workplace.

Property as an investment has always had a broad appeal, especially to the less sophisticated investor distrustful of the intangible nature of other options. As the old people always say, “Safe as houses”. Do your research properly and residential property can be a very rewarding investment. The risks of bad tenant behavior are easily mitigated. Proper screening, professional collections, and sound overall management practices are required. Make sure you work with professional service providers and stay on top of things at all times.”

How investors can identify the best areas for rentals

Dickens reminds us that “it is easy to be caught up in the elaborate prophecies of doom in a recession. The wiser option may be to gain insight into the market on a level that allows you to hone in on the pockets of excellence that exist.

Naturally, you want to take a look at the yield in that specific area but there are other important factors to take into consideration as well. How are tenants paying their rent in that suburb? What are the vacancy rates and property expenses as well as the ratio of tenants to landlords? An area where the occupiers are mostly tenants is not always upheld as well as where a large portion of dwellers are homeowners.”

While many may flounder at the ‘impending doom’ that awaits us all, the rest of us gear up for a challenge knowing that with the right support, magic is made in times of adversity.