From the beginning of the year, the South African Reserve Bank (SARB) has announced a number of interest rate cuts that have affected the economy in various ways.

Recently, the SARB announced that the interest rate would decrease by 25 basis points, resulting in the repo rate falling to 3,5% and the prime lending rate being at 7%.

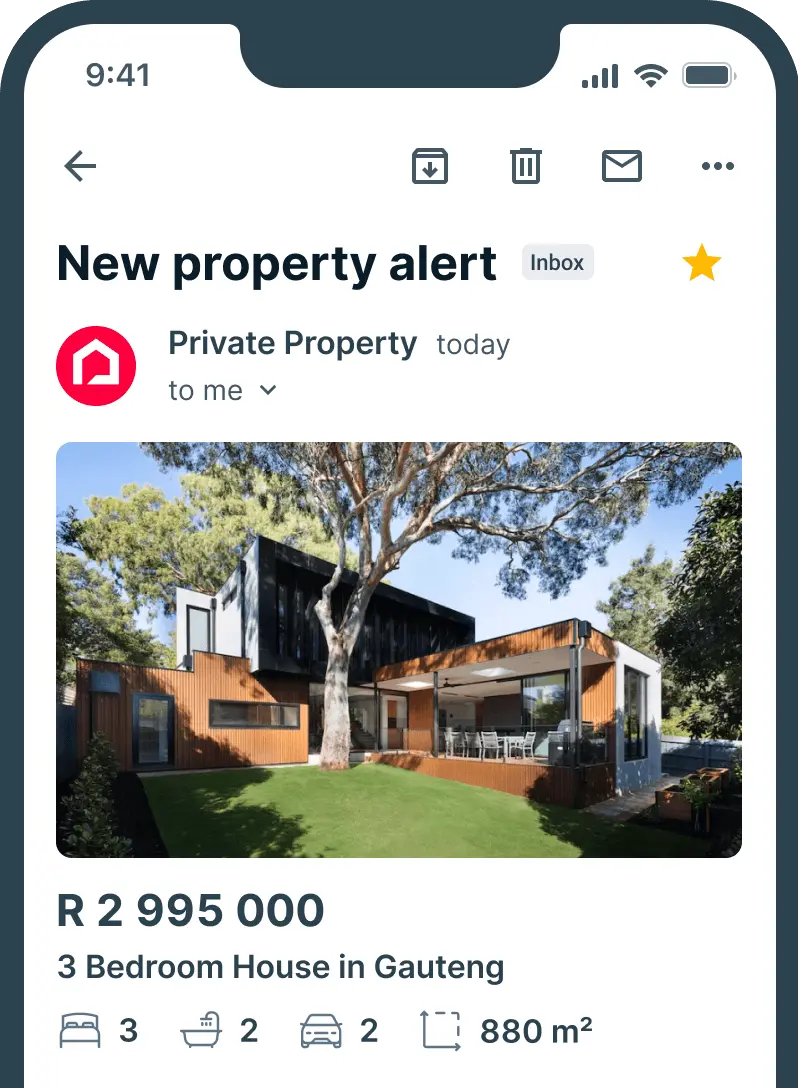

This, in addition to economic conditions exacerbated by the Covid-19 pandemic, has led to a buyers’ market, making this the most favourable time to buy a new property.

If you’re thinking of purchasing a new property right now, you need to make sure that your finances are in order.

Here’s a checklist of financial matters that you should deal with prior to purchasing a new home:

1. Budget

Before buying a new home, you need to create a budget for what you can afford. Have a price range in mind and never go over your maximum spend.

If you choose to apply for a variable interest rate home loan, you also need to think about how your mortgage installment fee may change depending on the interest rate.

What will happen when the interest rate increases? Be sure to factor this in before committing to a mortgage.

2. Clear your consumer debt and improve your credit score

Clearing debt is an important part of preparing for homeownership. Clear unnecessary consumer debt from credit and store cards. Consumer debt tends to build interest quickly and all the money you’re using to pay your consumer debt could be used towards paying your mortgage.

By paying your consumer debt, you also ensure that your credit score is positively affected, which will be vital when banks decide whether to grant you a home loan or not.

Make sure you check your credit score regularly (at least monthly), and make amendments where necessary, so that you have a higher chance of having your home loan application approved.

3. Bills

Besides debt, other financial obligations must be considered prior to applying for a home loan.

Think about your children’s school fees, life cover, retirement fund, medical aid etc. You should still be able to afford to pay all these when you add on a home loan.

Otherwise, you may have to shift some of your financial obligations to free up money for your home loan. Perhaps paying R1000 for a cable TV package isn’t viable anymore, maybe your child can attend a school closer to home or maybe you need to cut eating out almost every day from your budget.

Whatever it is, make sure your financial adjustments make sense.

4. Savings

Savings are important to have, with the Covid-19 pandemic showing us that emergencies can occur at any time. Make sure you generally have savings in the bank that you only access in emergency situations.

Having savings in the bank before purchasing a property will also make taking the leap easier. Some of your savings can be used to pay for a deposit, as well as other costs involved with purchasing property.

5. Deposit and other costs (transfer fees, levies)

As mentioned previously, you will need to make sure that you have money set aside for your deposit, as well as other costs like; transfer fees, bond registration fees, conveyancer fees, homeowner’s insurance etc.

A deposit is usually 20 - 30% of the purchasing price. Remember, the bigger your down payment, the smaller your home loan instalment will be.

6. Pre-approval

A part of getting your finances in order is applying for pre-approval with a bond originator. This will give you a concrete idea of what you may be able to qualify for. Although having your own set budget is important, pre-approval is a more accurate representation of what financial institutions will be willing to lend you.

Keep all these factors in mind and make the necessary adjustments so that you can purchase your ideal home.