It is advisable for the end-user, when approached by an originator or aggregator, to ask the right questions and always read the small print.

It was not so long ago that each bank had a sales force of home loan consultants

that used to call on agents to secure bonds for their particular bank, but that

all changed around six years ago when they decided to outsource this service to

originators in an attempt to save costs. The idea was that originators would

earn a fee or introductory commission for their services and the banks would be

able to cut their fixed costs.

Initially, the major estate agents grouped together to form these

‘mega-originators’ and were essentially ‘shareholders’ or partners in the

origination company. This gave the origination companies huge volumes and the

muscle to negotiate generous contracts with the banks for themselves.

Originators now control around 60% of the 10 billion Rand a month home loans

business.

When the originators took over the role previously performed by the banks’

mobile sales consultants, this empowered the end-user by offering freedom of

choice as well as an independent ‘guide through the home loan maze’. If the

client was declined by their bank of first choice or the conditions offered were

onerous, the originator would negotiate with another bank. The result is that

banks have become more competitive - always aware that the originator can advise

the client of more favourable packages. It provided the originator with a unique

ability to negotiate, advise and recommend better rates and packages from

competing banks.

With the bond market so competitive, we are noticing a proliferation of home

loan aggregators, who are essentially bond sales personnel and are remunerated

by one of the bigger mortgage originators (not the bank) with whom they have

negotiated deals. However, as aggregators they do not deal directly with the

banks, resulting in slower service to the client. Some aggregators only have

access to one bank or are incentivised to ‘switch’ their client to the bank that

remunerates them to a greater extent. Some companies are even mistaken for

originators, but sell only their own product and represent none of the

traditional banks at all.

It is advisable for the end-user when approached by an aggregator or originator

to ask the right questions, like who they are tied to and what sort of

credibility they have. A lot of advertising is being done promising ‘cash

backs’, absurdly low rates and discounted attorney costs, which can be quite

misleading to the unsuspecting consumer. A home loan is one of the most

important transactions an individual will negotiate in their lifetime. It is

long term and clients need to read all the small print on the letter of grant

and bond documents before committing themselves. At the end of the day, the

originator has the client for a very short period, but the bank has the client

for the period of the bond, which is usually from 20 to 30 years.

As in any financial transaction, clients need to be very fussy as to whom they

give their personal details to. Confidentiality on the originator’s part should

be top of the list of priorities.

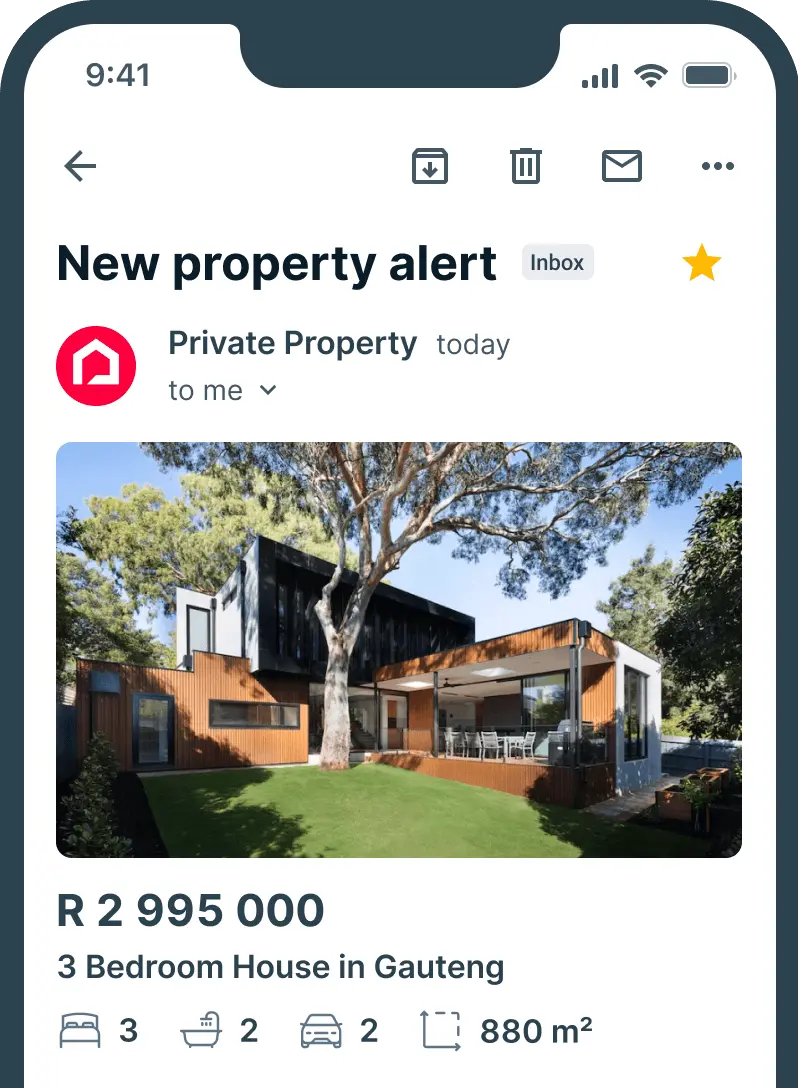

Private Property Listings offer a lot of services to the public including a

professional home loan sales team who are qualified to provide origination in

securing a private deal. Consultants receive ongoing training from the banks on

new products and services and Private Property runs an in-house training

facility, ‘The Smart Centre’ that ensures adequate training is received by all

members of the team. The service to clients is free and convenient.