Today’s announcement to hold the repo rate steady at 3.5% marks a full year that South Africans have been able to make the most of a historic low lending environment, says Carl Coetzee, CEO of BetterBond. “With the prime lending rate currently at 7%, the lowest it has been in 55 years, the property market is enjoying an unexpected boom. Notwithstanding the challenges of the pandemic, the knock-on effect of five consecutive repo rate cuts last year, has resulted in a significant market turnaround that is showing no sign of slowing down.”

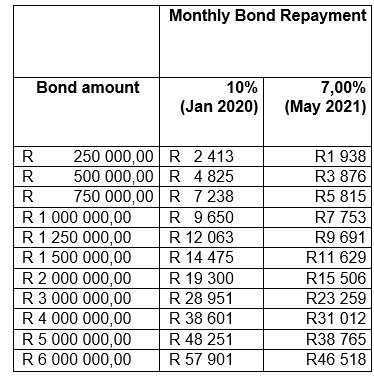

Many homebuyers have been able to afford up to 30% more than they could in January 2020, when the prime lending rate was at 10%. “The South African Reserve Bank’s (SARB) decision to hold the repo rate steady at 3.5% sends a strong message to aspirant homebuyers and homeowners that there is still plenty of time to make the most of this favourable lending environment,” says Coetzee.

Coetzee adds that, while the South African Reserve Bank has projected two interest rate hikes of 25bps each in the second and fourth quarters of the year, SARB governor Lesetja Kganyago recently indicated that an “accommodative” approach is more likely to support the economy for as long as possible. “It would make sense to keep the repo steady at or below 4% for as long as possible, for the effects of the lower lending rate to have the desired impact,” said Coetzee. “Furthermore, even if the repo rate does increase by 0.5% later in the year, the prime lending rate will still be at its lowest in five decades. It’s unlikely that consumers will see a prime lending rate of more than 10% for a few years yet.”

The table below shows the difference a prime lending rate of 7% makes on a monthly bond repayment, compared with the 10% lending last seen at the start of 2020.

After a year of low interest rates, the housing market is still showing signs of strengthening, said Coetzee. “House prices, a good indicator of the state of the market, are increasing with house price inflation sitting at 4.5% for March. This is a significant improvement on the 2.5% recorded in March 2020.” Also positive is that the average time homes are on the market has dropped in the past year from 14 weeks to eight, adds Coetzee. Demand is outpacing supply, with property portals reporting as much as a 16% drop in listings.

Bond application volumes continue to increase, says Coetzee. “In March, the volume of bond applications increased by 40% year-on-year, with close to 70% being from first-home buyers,” he added.

“The sustained low interest rate environment will go a long way to stimulating the property market, and indeed the economy. While the honeymoon is certainly not indefinite, there is some comfort in knowing that the repo rate is likely to remain at, or below, 4% at least until September next year, creating opportunities for buyers to apply for a bond for their dream home.”

Writer:Frith Thomas