This article is sponsored by 1life

How do you preserve generational wealth?

Have an estate plan

An estate plan guides you and your heirs and helps you manage, protect and distribute your assets and wealth according to your wishes, in as efficient a way as possible.

Estate planning includes:

- Drawing up a will, which details who inherits what

- Setting up a trust and naming a guardian for your minor children

- Naming beneficiaries on any pension funds and retirement annuities, life cover and funeral policies

- Structuring your estate so that your assets are preserved for future generations. For example, this might mean setting up a trust and transferring your assets to the trust so that your heirs benefit from the income the assets generate, but cannot touch the capital

- Handing over your family business or some of your assets to your heirs before you pass so you minimise tax payable on death.

Top tip: Ask a professional estate planning expert such as a financial adviser, lawyer or fiduciary professional for help with your estate plan.

I didn't come from money but my children will

Grow and protect your wealth

Quite simply, growing and protecting your capital is one of the best ways to make sure your wealth lasts through multiple generations.

This means doing things like:

- Learning how to manage money well. We recommend that you complete the financial education course on Truth About Money and regularly read articles and blogs on personal finance, investments and how to manage your money

- Maintaining your assets, for instance, keeping your family home and any other property you own in good condition

- Keeping the family business profitable and having a succession plan in place so you keep the business in the family

- Making good investment choices so that your investments perform better than inflation

- Keeping your capital invested, and whenever possible, reinvesting the income your capital generates

- Using the income your assets generate to live on only when you reach retirement.

One example: You invest R300 000 in a unit trust fund. The unit trust fund earns interest and dividends, which you reinvest. When you are retired you use the interest and dividends to pay for some living expenses. But you don’t touch the capital amount - the R300 000 you initially invested. It remains as part of your estate, to be passed on to the next generation.

Top tip: It is best to ask a financial adviser for help on how to protect your wealth and make good investment choices.

Share wealth generation goals with your family

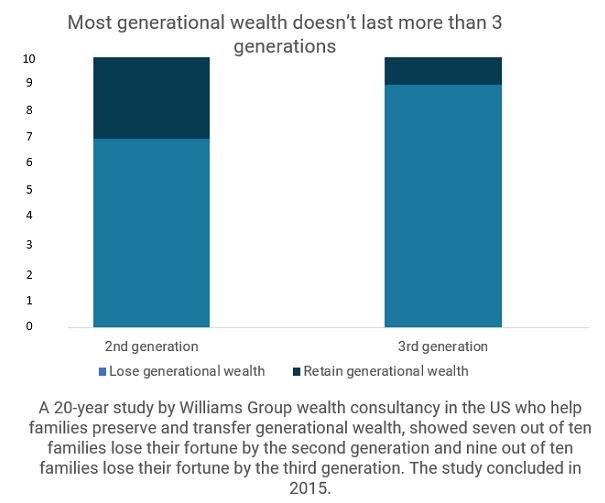

Family fortunes don’t last forever. In fact, there are studies to show that most don’t last more than two or three generations. One of the most common reasons why wealth doesn't last more than three generations is because people don't talk about money! So when the inheritance comes, it is a wonderful surprise. But with no guidance on how to keep it, any generational wealth inherited gets spent - pretty quickly.

Here’s how to avoid that happening to your family:

- Let your children know what you are doing to create generational wealth, such as investing and taking out life insurance, and why.

- Share your money values and philosophy, and how money makes a meaningful difference to your life, for instance, by opening up excellent education opportunities for children. Talk about how financial security can bring lasting peace of mind, and how preserving it can benefit future generations in your family. Encourage them to aim to save money themselves, and to be debt-free rather than buying expensive items on credit.

- Have many money conversations with your family - one talk isn't enough. Schedule a meeting at least once a year so you are all up to date with your wealth creation and preservation plans. Make wealth creation and preservation a habit!

Empower your family

Include your family in your wealth creation plans and activities. Depending on their skills and interests, family members might help you manage a second property, or make investment decisions, or monitor the performance of investments. They will see how you manage your money and build wealth - and hopefully follow your good example!

Have a written family wealth plan

Be open and honest and include your family in your wealth preservation plans, then formalise your thoughts in a family plan or family constitution. Include what your family’s generational wealth goals are, how you can achieve them and how you will actively manage and preserve your wealth so multiple generations benefit.

Start today!

Don’t wait until you’re wealthy - you can start preserving wealth and creating a wealth preservation mindset today. Make creating financial security a family goal, and you’ll keep the family focused on building and preserving wealth for the long-term - not spending it! Your family will thank you in the years ahead.

Read more about generational wealth in our first two articles in the series: What is generational wealth? and How to create generational wealth.