The latest TPN (Tenant Profile Network) report, according to Stats SA, mentions that 75% of landlords are actually micro-landlords (own one to ten properties and rent them out). If you are this type of landlord it is important to be quite careful in selecting the type of unit you will invest in and what rental category it falls under.

Although rental payment trends in the first quarter of 2012 have basically remained the same as the second half of 2011, it is interesting to see that what I have said all along about the categories of buy to let property to invest in still rings true.

When analysing the national payment profiles of tenants, in the lower-middle rental category, R3 000 to R7 000, the percentage of tenants who pay on time is the highest of all the categories at 72%. In this profile, the number of late payers is at 12% (the lowest percentage). The R7 000 to R12 000 category is second highest at 71% who pay on time and it is interesting to note that in the R12 000 + rental category only 61% paid on time.

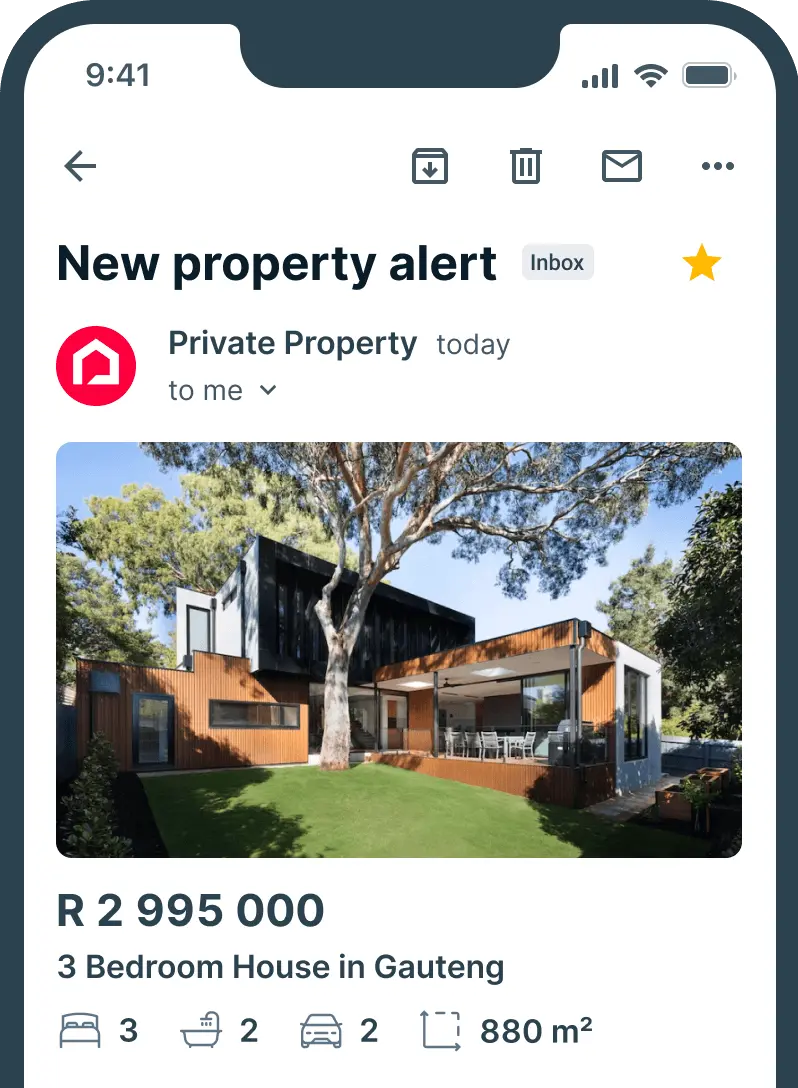

This shows that it is better to spread the risk of your property investments by buying two or three smaller units with perhaps R4 000 to R5 000 rent each month rather than buying one house at a price of R2 million and renting it out. With many units they tend to “carry each other”, so if for whatever reason one unit is standing empty, there is still an income from the other units you are renting out. On the other hand, if you have one large house that you rent out and that tenant does not pay, you are stuck with having to cover the larger bond with no safety net.

Landlords and letting agents must be on the lookout for “risk” or warning signs that are on the rise, such as:

Tenants using their deposit as the last month’s rent, which should not be allowed as the deposit might be needed for repairs or damages to the unit.

Applications to rent in the name of other family members. This is usually an indication of a bad credit or rental record.

Tenants with delinquent credit profiles who would prefer to rent from private landlords to avoid their credit records being checked.

Possibly the most serious, there have been fraudulent proofs of payment handed over at the time of the key handover and if this happens the landlord will have a lengthy and expensive eviction process to go through.

Fraudulent ID and account statements submitted as part of the rental application.

If you are considering buying to let, choose an experienced letting agent to manage your properties, he will be able to vet applicants thoroughly and help you avoid costly and time wasting mistakes.