Last year I wrote a lot about the ten fundamentals that encouraged me to buy more residential investment units. ABSA and FNB released data recently so I thought it would be a good to revisit some of the relevant indicators that they comment on to see if residential property is still a viable asset class.

1.Rising property prices

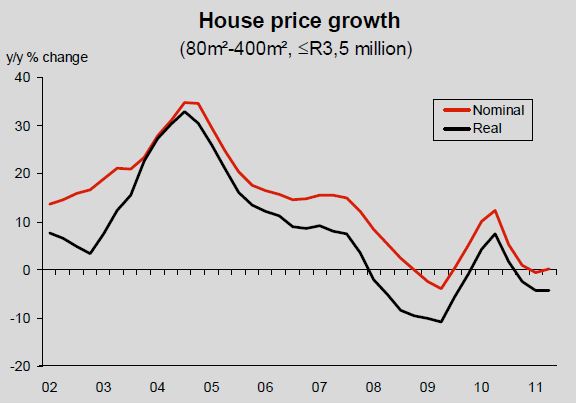

IN 2010 it looked like we had hit bottom and prices were back in positive terrain. The graph below shows that we have subsequently had a relapse, with prices dipping again. Looking at the graph we can see the line flattening out already with the potential to turn positive more steeply as we go into spring. Obviously within this generalisation covering all residential property types that ABSA issues bonds to, there is some property that is growing strongly. I see much of it promoted on privateproperty.co.za. So if you buy well, the opportunities are boundless.

While returns in property as suggested by ABSA in the above graph, are up for interpretation, even at these levels there is some positive yield with the use of debt or leveraging in funding the purchase.

2. Lowest interest rates since 1974

Nothing has changed here even though there was strong speculation that we would be well into a cycle of rate increases by now. What has changed? I guess there are a few macro-economic factors, but the result is we have very slow growth in the economy and the SARB have decided to keep rates down to try to get some stimulus going. It is predicted that nothing will change here even though inflation will knock through the prescribed ceiling before year end.

3. The bubble factor

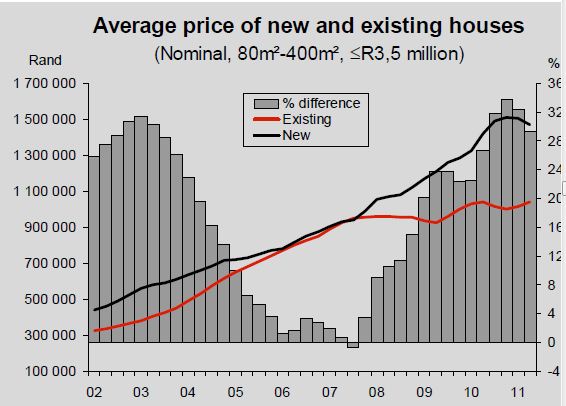

If a “bubble” is defined as a period where replacement cost is equal or lower than the selling price of a home, the opposite must also be true. A wise economist once professed ( I believe it was Erwin Rode) that when the price of a new house is the same or less than a second-hand home a bubble exits. This makes sense to me as clearly second hand houses are older and should be trading below what a new modern house would trade for, but if demand is so high that demand is driving up prices to beyond replacement cost, then the market has gone mad and a bubble exists. The below graph shows that although there is some moderation due to building costs dropping to an all time low, there is still a significant gap between old and new. So there is not much incentive for the market to produce new houses leading ultimately to a shortfall in available housing, pushing rentals and prices firmer.

4. Rental yield

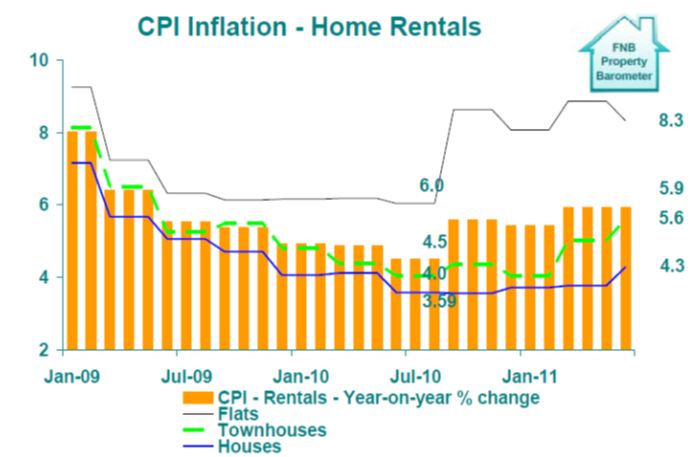

In the current market, most sane investors are investing for yield. Again there is great disparity between luxury houses (that don't get good yields) and entry level flats and townhouses. Everything hinges around rentals for me because ultimately tenants will move from renting to buying and prices will rise with demand. But even with the low interest rates, this is not happening and rentals are firming strongly. See the FNB graph below.

Above are 4 of the fundamentals i discussed last year, and i will follow with the others in a later post.

So what is your view on these comments?