As municipal rates keep going up, the longer sellers keep their property on the market, the higher the holding costs will be.

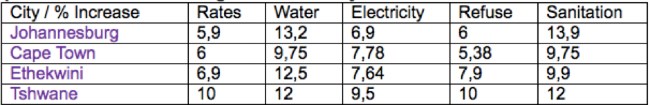

From 10% rate hikes in Tshwane, to 13.2% water tariff hikes in Johannesburg, across the board municipalities have greatly increased rates and service charges as of July 2016.

According to Berry Everitt, CEO of the Chas Everitt International Group, empty nesters are combatting this increase by downsizing to smaller properties to save on the month-to-month costs of running a large home. What’s more, property developers and young families are eager to get their hands on these properties, so they’re in demand. However, not everyone has the option to downsize their homes and for those selling, the rate hikes are bad news.

Here are the rate and tariff increases per city:

When selling your property the effect of overpricing it, based on the above increases, is that your property will stay on the market longer than it should. This extra time on the market then eats into your pocket, as the holding costs of owning and running a home that you no longer need mounts up. These holding costs include bond repayments, home insurance, maintenance costs, monthly levies, as well as municipal rates and service charges.

Everitt advises that, “Looked at another way, every month’s delay in selling your home effectively diminishes the profit you stand to make on the sale, and it does not make sense to hold out for an unrealistic asking price on the one hand while losing money on the other.”

Aside from large holding costs to sellers, buyers are less likely to even look twice at a property that is priced too high, and this means that your home sits on the market even longer. Now, not only are buyers not interested in your home, but you’re paying amounts that you may not be able to afford, to keep it running while it’s on the market.

Tips for sellers on pricing their property correctly:

- Consult a reputable estate agent to help assess the value of your home.

- Make sure a comparative market analysis has been done, in order to compare your property price with that of other properties in your area.

- Make sure your home and garden are well-maintained as this has a large effect on pricing.

- Ensure that you have researched the market that you’re selling to.

- If you’re selling privately, make sure to research property prices in your area and consider hiring a professional valuator.