Statistics released by ooba, South Africa’s largest bond originator, reflect positive growth in housing prices but at a significantly slower year-on-year growth rate.

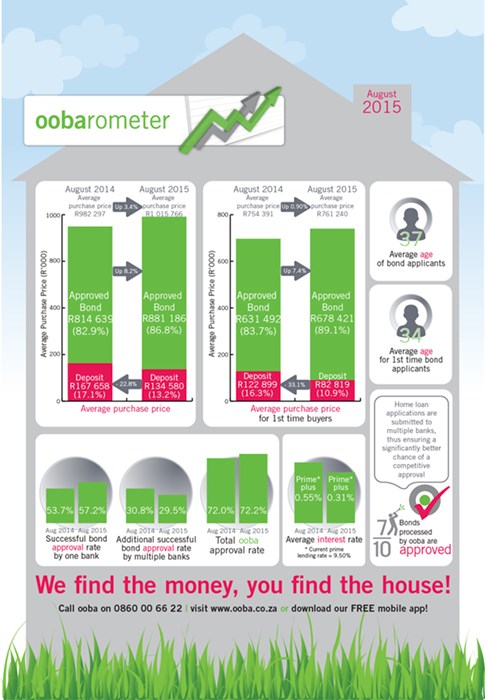

The Average Purchase Price in August 2015 increased by 3.4% from R982,297 in August 2014 to R1,015,766. This low single-digit growth is a marked slowdown from the double-digit growth of 11% recorded in the second quarter of 2015.

Rhys Dyer, ooba CEO says, “This slowdown in housing prices is not surprising given that consumer confidence is at its lowest level in 15 years. This reflects concerns about South Africa’s future, particularly given worse-than-expected Q2 GDP figures, poor economic growth forecasts for the remainder of 2015 and rising interest rates. Self-employed applicants fell to 9% of ooba’s applications received in August, compared to 11% in Q2 2015, reflecting lower business confidence levels.”

The impact of economic concerns is also evident in the First-time Buyer’s market, which showed only a 0.9% year-on-year increase in the Average Purchase Price to R761,240. However, activity in the first-time buyer’s market has remained consistent with more than 53% of ooba’s applications in August coming from this segment.

ooba’s statistics also show that 52% of all home buyers applying for home loan finance in August indicated that they had no access to a deposit, which represents a 4% year-on-year increase in demand for 100% bonds. “This is further evidence of the financial constraints which South African consumers are facing,” says Dyer.

Dyer points out: “The slowdown in housing prices coupled with the still positive lending environment could signal a good time to buy property. Our statistics show that our bond approval rate in August was 3.5% higher and we recorded further improvement in pricing from banks.”

With South Africans facing increasing financial strain, Dyer recommends that home buyers use the services of a bond originator like ooba for prequalification before they are ready to make an offer on a home. “Our free prequalification service incorporates a credit check and affordability rating so that when you make an offer, you can be confident that the banks will approve your bond. This enables prospective buyers to focus on finding their dream home, while we find the money”, concludes Dyer.