According to global real estate services provider, Savills, real estate investment worldwide has shown staunch resilience in the face of the Covid-19 pandemic. Says Paul Tostevin, director, Savills World Research: “Global real estate investment volumes bounced back in 2021.

Attractive among investors seeking diversified income streams, funds targeting real estate reached new highs last year, with more than 1 250 funds targeting USD365 billion in capital between them, according to Preqin*.

“In the 12 months to November 2021, total real estate investment volumes were up by 38% on the same period the previous year. While office investment remains below pre-pandemic levels, volumes in the highly sought-after industrial sector are up 54%. We expect to see the strong performance of industrial to continue in 2022.

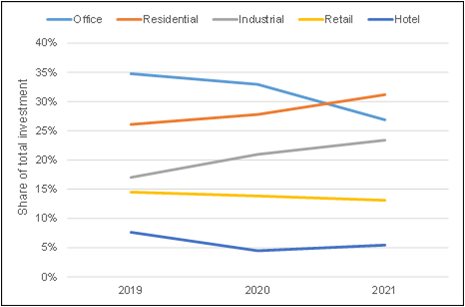

“However, the big story for global real estate investment last year was that residential - namely multifamily, but also encompassing student and senior housing - became the largest sector for property investment globally, overtaking offices for the first time (see chart below). Investors are attracted to its secure, income-generating qualities, underlying demand and resilience against technological disintermediation. Strong demand is likely to continue in 2022, but a dearth of standing stock means that development will be the entry point for many.

“One headwind is inflation, together with the prospect of rising interest rates. Indications suggest that much of the inflation we are seeing is linked specifically to the economic bounce back, and therefore may be temporary. Real estate in general is perceived as a good hedge against inflationary pressures, particularly in the case of assets with shorter lease terms or where rents are index linked.”

Share of total global real estate investment, by year

Source: Savills Research using RCA

Source: Savills Research using RCA

Dr Andrew Golding, chief executive of the Pam Golding Property group, which is Savills’ exclusive residential real estate partner in Africa, echoes these sentiments. “For the year 2022 to date the residential property market got off to a good start, demonstrating a continuance of the positive sentiment and brisk activity levels experienced during 2021.

“Despite indications that interest rates are on a slow, but steady, upward trajectory, fierce competition between banks for market share ensures a favourable lending environment which, coupled with an ongoing strong demand for homes among first-time and repeat buyers alike, is expected to provide South Africa’s housing market with a solid underpinning during the year ahead.”

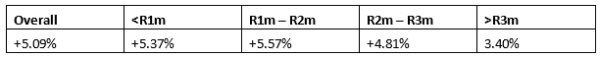

Dr Golding says from an investment perspective, Lightstone’s forecasted scenarios suggest that home values could rise by between 3.4% and 5.1% in 2022. According to the Pam Golding Residential Property Index, national house price inflation (HPI) averaged at 5.1% last year, compared to 3.7% in 2020 and 2.6% in 2019. The Western Cape region recorded the strongest growth in prices in 2021, at +6.2%, followed by KwaZulu-Natal at +5.3% and Gauteng +4.5%.

Also, according to the Pam Golding Residential Property Index, nationally, the lower price band below R1 million, continued to register uninterrupted growth in 2021. However, the R1 million – R2 million price band registered the strongest growth during the year as a whole (see below).

Says Sandra Gordon, Pam Golding Properties senior research analyst: “While the Covid-boost in growth in freehold prices has also ended, with price growth rapidly losing momentum, freehold price growth averaged +6.2% in 2021 versus +3.0% for sectional titles. The coastal (within 5km of the coastline) price premium continues to widen, reaching +1.3% in September 2021 (latest data) and averaging at +1% for the year to date, compared to just +0.04% in 2020.”

Adds Tostevin: “The rise in remote working allowed workers to leave cities in search of more space, but the death of the city, that some had predicted, has proved to be unfounded. What the pandemic has achieved, however, is throwing light on the need for cities to evolve and improve their livability.

“This has direct implications for real estate. Cities need to encompass a wide mix of uses, moving away from single use districts. There remains much opportunity in residential, particularly bringing more to city centres, diversifying central business districts. In the acutely competitive logistics sector, emerging niches such as last mile (the last step in a package’s delivery process), offer urban opportunities.”

*Preqin is a London-based investment data company