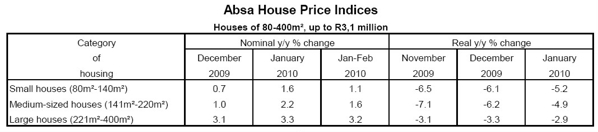

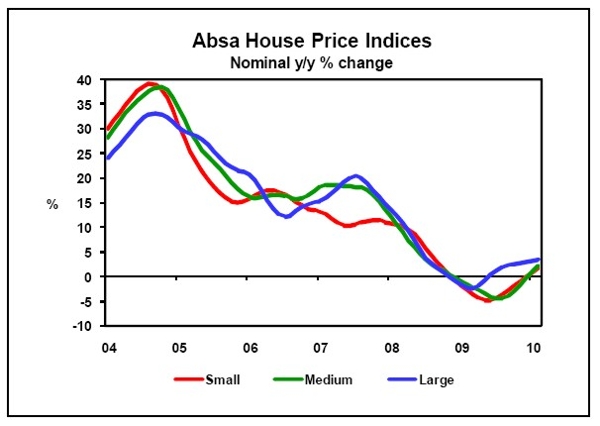

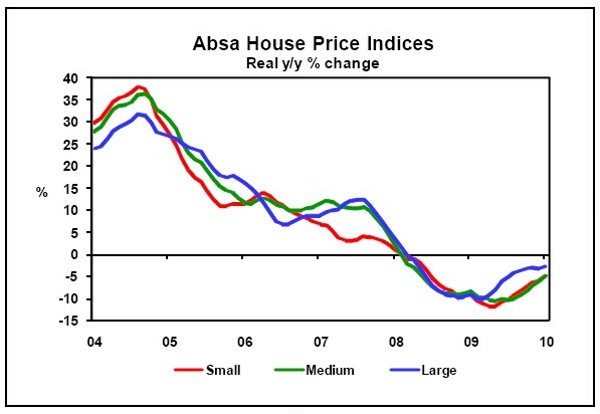

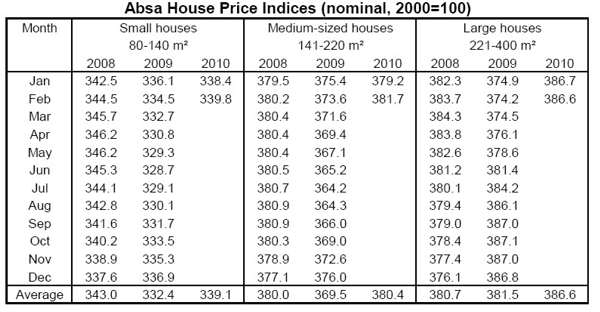

The average nominal value of homes for which Absa approved mortgage finance increased further in February 2010, with all three categories of housing, as defined by Absa (small, medium and large), recording a positive nominal year-on-year rise in values. In real terms, house prices were still lower in February compared with a year ago. With CPI inflation trending down further in recent months, house prices continued to contract at a slower pace in real terms up to January this year. In the category of small houses (80m²-140m²), the average nominal value was up by 1,6% year-on-year (y/y) in February this year, compared with a revised growth rate of 0,7% y/y recorded in January. This caused the average nominal value of a small house to come to about R676 800 in February. The average value of houses in this category was a real 5,2% y/y lower in January, after declining by 6,1% y/y in December last year. The average nominal value of medium-sized houses (141m²-220m²) increased by 2,2% y/y in February, after a revised increase of 1% y/y was registered in January. This brought the average nominal value in this segment of housing to a level of around R953 600 in February. After adjustment for the effect of inflation, the average value of medium-sized houses was a real 4,9% y/y lower in January, after a decline of 6,2% y/y was recorded in December 2009. In the segment of large houses (221m²-400m²), the average nominal value increased by 3,3% y/y in February this year, up from 3,1% y/y in January. This brought the average value of a large house to a nominal R1 408 000 in February. In real terms, the average value of a large house was 2,9% y/y lower in January, compared with real price deflation of 3,3% y/y registered in this segment of the market in December last year.

After emerging from recession in the second half of 2009, the South African economy is expected to grow by a real 2,8% in 2010, mainly driven by the recovery in the global economy, while domestic demand is expected to gradually pick up from the levels of last year. The FIFA World Cup event is also set to boost domestic economic activity around the middle of the year. CPI inflation slowed down marginally to 6,2% y/y in January, from 6,3% y/y in December, and is forecast to be below the 6% level on average in the 1st quarter of the year. However, the electricity price hike of 24,8% for 2010/2011, announced in February, remains the major threat to the inflation outlook for 2010. Against this background, interest rates are projected to remain unchanged up to late this year before being raised by 50 basis points in an attempt to keep CPI inflation below the 6% level. With the economy recovering and employment increasing up to the end of last year, which will support growth in household disposable income, the residential property market is expected to gather further momentum in 2010. Growth in the nominal value of houses is forecast to be around 6% higher in 2010 compared with 2009.