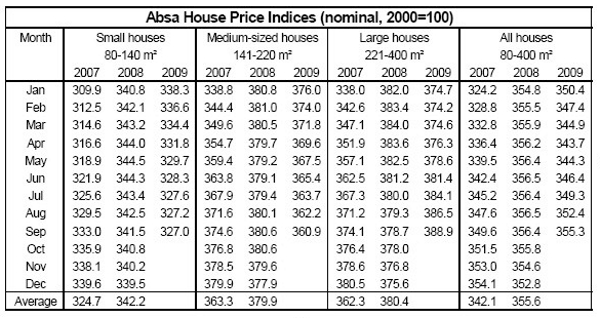

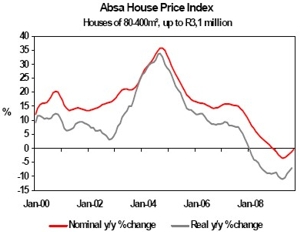

Nominal year-on-year price deflation in the South African housing market slowed down further in September 2009, based on Absa’s calculations. If the latest trends are to continue, house prices may start to rise on an annual basis before the end of the year. On a month-on-month basis, prices continued to rise in September after reaching a lower turning point in April this year.

Middle-segment house prices

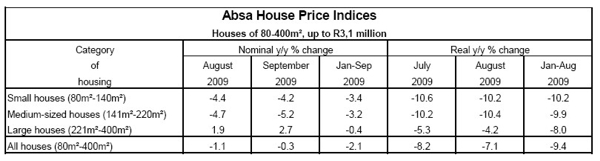

Middle-segment house prices (see explanatory notes) were down by a nominal 0,3% year-on-year (y/y) to R966 300 in September 2009, from a revised -1,1% y/y in August. On a monthly basis, house prices increased by a nominal 0,8% in September, from a revised increase of 0,9% in August. By September, the average house price was 3,4% up on the low reached in April 2009. In real terms, house prices in the middle segment were down by 7,1% y/y in August (-8,2% y/y in July).

Small house prices

Prices of small houses (80m²-140m²) were a nominal 4,2% y/y lower in September (-4,4% y/y in August after revision). This brought the average nominal price of houses in this segment to about R651 400 in September. In real terms, the average price of houses in this segment of the market was 10,2% y/y lower in August, after declining by 10,6% y/y in July.

Medium house prices

With regard to medium-sized houses (141m²-220m²), the average nominal price declined by 5,2% y/y in September (-4,7% y/y in August after revision), which brought prices in this category of housing to an average of R901 700. This translated into a real price decline of 10,4% y/y in August (-10,2% y/y in July).

Large house prices

The average nominal price of large houses (221m²-400m²) was up by 2,7% y/y in September this year (up 1,9% y/y in August after revision). This brought the average nominal price to R1 416 400 in September, which was R53 500 higher after bottoming at a level of R1 362 900 in February this year. In real terms, the average price of large houses was down by 4,2% y/y in August, compared with a decline of 5,3% y/y recorded in July.

Residential property market is still experiencing tough times

The residential property market is still experiencing tough times on the back of an economy that is in recession, which adversely impacts the household sector over a wide front. There are, however, indications that the worst may be over for the local economy and that a recovery is to commence towards the end of the year.

House price trends appear to have turned the corner and with mortgage interest rates down by 500 basis points compared with late last year, as well as the recently selective relaxation of mortgage lending criteria by banks, property market conditions in general are expected to improve, but the process of recovery will most probably be slow and gradual.

In view of nominal year-on-year house price deflation slowing down over the past few months, prices may start rising on an annual basis again in the near future if current trends are to continue. Based on these trends as well as nominal price deflation of 2,1% on average in the first nine months of 2009 compared with the same period in 2008, prices may record a decline of less than 2% for the full year. In real terms, house prices are forecast to decline by around 9% this year.

In 2010, nominal price growth of between 2% and 3% is expected, with prices forecast to decline somewhat further in real terms next year based on projections for nominal house price growth and headline consumer price inflation.

Explanatory notes: The Absa House Price Indices, available back to 1966, are based on the total purchase price of houses in the 80m² - 400m² size category, priced at R3,1 million or less in 2008 (including improvements), in respect of which mortgage loan applications were approved by Absa. Prices are smoothed in an attempt to exclude the distorting effect of seasonal factors and outliers in the data. As a result, the most recent index and price growth data may differ materially from previously published figures.

Explanatory notes: The Absa House Price Indices, available back to 1966, are based on the total purchase price of houses in the 80m² - 400m² size category, priced at R3,1 million or less in 2008 (including improvements), in respect of which mortgage loan applications were approved by Absa. Prices are smoothed in an attempt to exclude the distorting effect of seasonal factors and outliers in the data. As a result, the most recent index and price growth data may differ materially from previously published figures.