|

The South African economy is in recession after contracting for three consecutive quarters up to the second quarter of 2009. However, real GDP declined markedly less in the second quarter (-3% q/q) compared with the first quarter (-6,4% q/q).

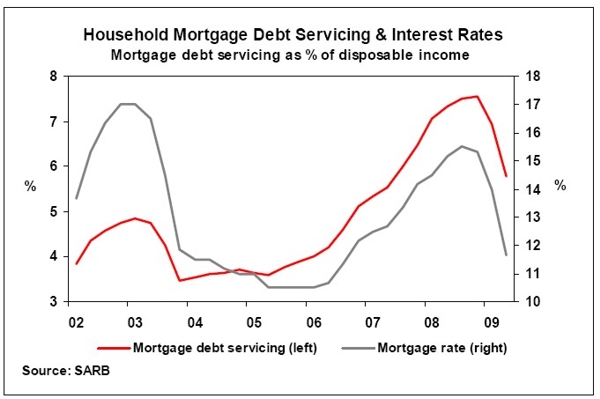

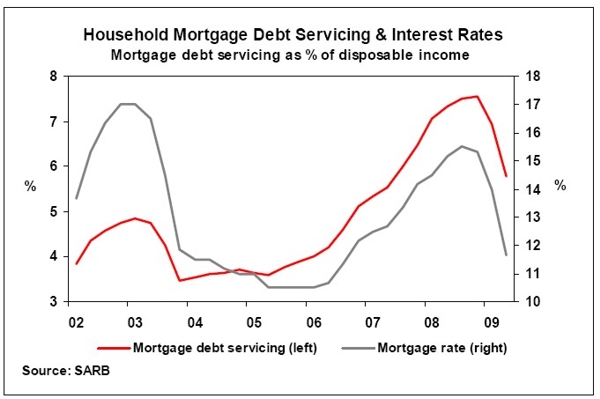

Interest rates have been cut by 500 basis points since late 2008, with prime and mortgage interest rates back to their mid-2006 levels of 10,5%, which resulted in lower debt repayments. Despite lower interest rates, the household sector continued to experience financial strain. Households still have to deal with a relatively high ratio of debt to disposable income (76,3% in the second quarter of 2009), mainly as a result of low growth in their nominal income on the back of deteriorating business conditions and major job losses in most sectors of the economy in the first six months of the year.

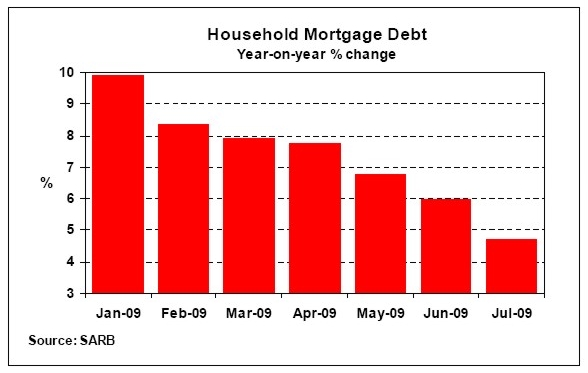

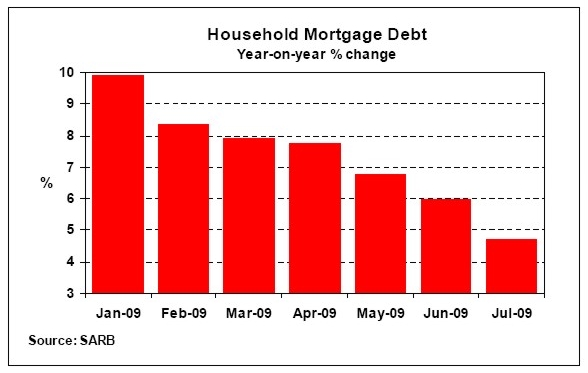

Year-on-year growth in the value of mortgage advances to households slowed down to 4,7% in July 2009 from 6% in June, while on a month-on-month basis, very little growth was recorded since April this year. This is a reflection of conditions experienced in the housing market over the past few months, which affected the demand for mortgage finance. Growth in mortgage advances to households is expected to slow down further towards the end of 2009.

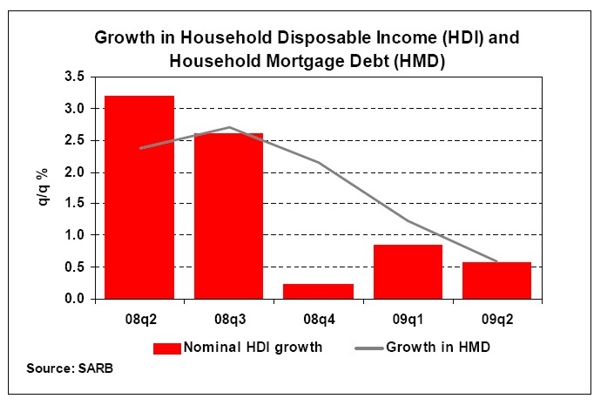

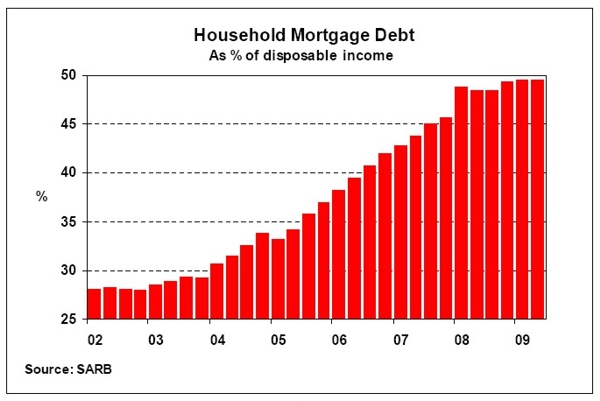

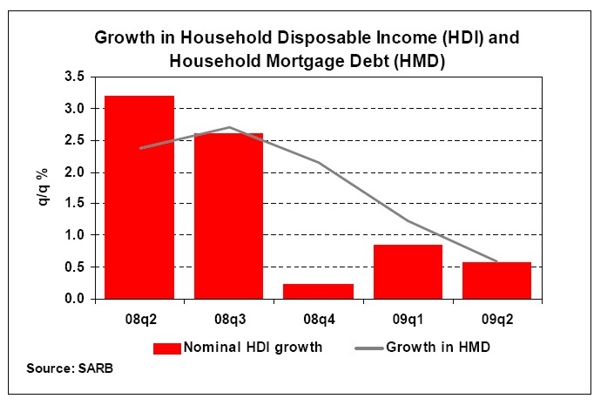

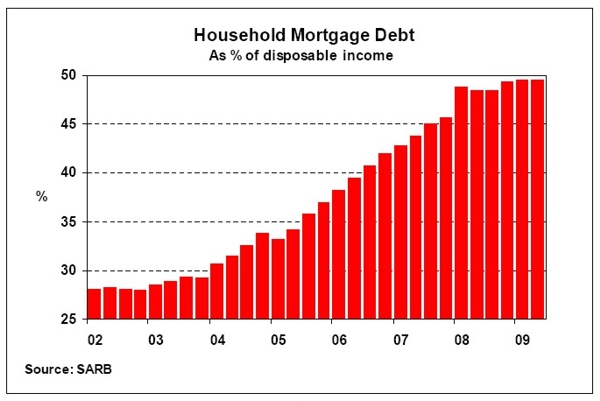

The ratio of outstanding household mortgage debt to disposable income came in at 49,5% in the second quarter of 2009, unchanged from the first quarter. This was the net result of trends in the growth of mortgage advances to households and their nominal disposable income in the second quarter of the year compared with the first quarter.

The cost of servicing household mortgage debt as a percentage of disposable income was at a level of 5,8% in the second quarter, markedly down from 6,9% in the preceding quarter and 7,6% in the fourth quarter of 2008, mainly driven by lower interest rates. The ratio of household mortgage debt to total household debt was, at 64,9%, somewhat higher in the second quarter of 2009 than in the first quarter (64,5%). These trends reflect the tough economic and property market conditions experienced in the first half of the year.

|