|

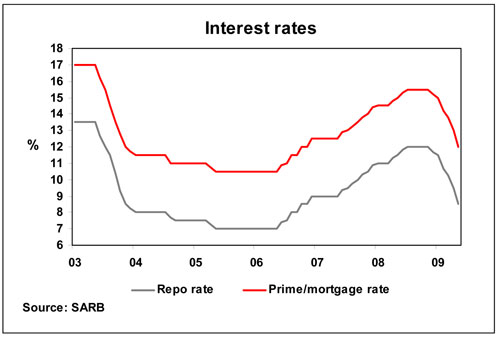

The Reserve Bank’s Monetary Policy Committee (MPC) cut the key monetary policy interest rate – the repo rate – by a further 100 basis points to 7,5%, effective from 29 May 2009. In response, Absa announced that its lending rates to the public, i.e. prime and mortgage rates, will be cut by the same magnitude to a level of 11,0%. Interest rates have been cut by a cumulative 450 basis points since December 2008. The Reserve Bank’s Monetary Policy Committee (MPC) cut the key monetary policy interest rate – the repo rate – by a further 100 basis points to 7,5%, effective from 29 May 2009. In response, Absa announced that its lending rates to the public, i.e. prime and mortgage rates, will be cut by the same magnitude to a level of 11,0%. Interest rates have been cut by a cumulative 450 basis points since December 2008.

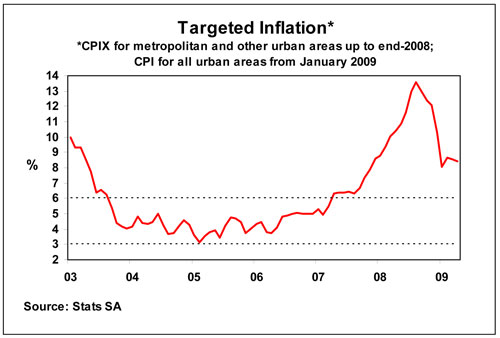

Data on a number of domestic economic indicators (gross domestic product, CPI and PPI inflation, money supply and credit extension) were released this week. These indicators and global economic conditions, as well as proposed electricity price increases, international oil price and rand exchange rate movements, impacting inflation, were taken into account by the MPC in their latest decision to cut rates. The CPI inflation rate for all urban areas was marginally down to 8,4% year-on-year (y/y) in April this year, from 8,5% in March and 8,6% in February. The PPI inflation rate for April was down to 2,9% y/y from a level of 5,3% in March.

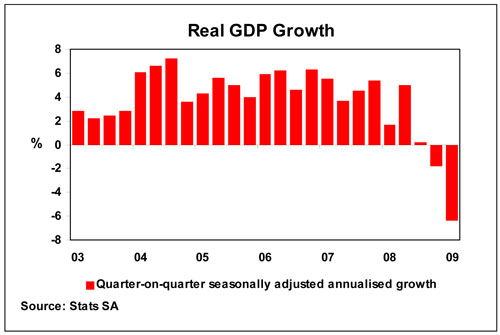

The South African economy is now officially in a recession (two consecutive quarters of negative growth in real gross domestic product (GDP)), after a contraction of 6,4% at a real seasonally adjusted annualised quarter-on-quarter rate in the first quarter of 2009 (-1,8% in the fourth quarter of 2008). This sharp decline was to a large extent driven by substantial contractions in the mining and manufacturing sectors. In view of these developments, the economy is believed to record negative real growth for the full year, after growing by a positive real 3,1% last year. The housing market continued to suffer in recent months, with nominal house price growth declining by 2,7% y/y in April this year, according to Absa’s calculations. In real terms, prices dropped by about 10% y/y in April. Despite the further drop in interest rates, the housing market is expected to remain depressed until late 2009 on the back of an underperforming economy, impacting employment, consumer confidence and the demand for housing.

Growth in mortgage advances to the household sector, largely related to residential property, slowed down to 7,7% y/y in April 2009, from 7,9% y/y in March, resulting from low levels of activity in the housing market, impacting the demand for mortgage finance.

With interest rates down by a cumulative 450 basis points since December 2008, mortgage repayments are now 23,8% lower than late last year when the mortgage rate was 15,5%. Mortgage repayments are on average now only 3,4% higher than in June 2006 when the mortgage rate was at a level of 10,5%.

On the back of the abovementioned developments and expectations, the residential property market is forecast to only bottom towards the end of the year and to gradually pick up during the course of 2010, largely driven by the lagged effect of lower interest rates and an expected economic recovery next year. House prices are forecast to drop in both nominal and real terms this year, after growing by a nominal 3,8% last year, which came to a real decline of 7%.

|