|

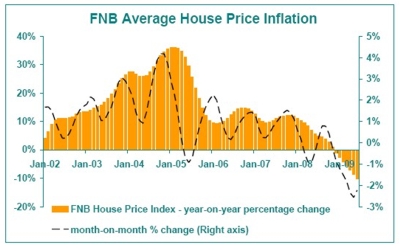

Accelerating Deflation Trend Remains Intact, Albeit A Little Less Severe Following Data Revisions The June FNB House Price Series reflects some backward data revisions, with a significant amount of additional transaction records coming into the updated low volume holiday month of April and the May figures. These adjustments have made the average house price deflation rate look slightly better, though still very weak, coming in at -10.2% year-on-year compared with a revised -8.5% rate for May. On a month-on-month basis, the rate of deflation was -2.2% for June.  This ongoing deteriorating trend was pretty much as expected, with the oversupply of property on the market continuing. Interest rate cuts may well have totalled 450 basis points since December, but this has had no more than a marginal impact on property demand to date, it would appear. Banks remain cautious, although FNB has announced a mild relaxation of credit policy, and household indebtedness as measured by the debt-to-disposable-income ratio remains high due to growth in disposable income being under severe pressure in a recessionary environment. The high debt ratio is sustained by disposable income growth falling at a faster rate than household credit growth in recent quarters. Therefore, the pressured household sector is unable to respond nearly as aggressively to rate cuts today as it did in 1999 and 2003 when indebtedness was far lower. This ongoing deteriorating trend was pretty much as expected, with the oversupply of property on the market continuing. Interest rate cuts may well have totalled 450 basis points since December, but this has had no more than a marginal impact on property demand to date, it would appear. Banks remain cautious, although FNB has announced a mild relaxation of credit policy, and household indebtedness as measured by the debt-to-disposable-income ratio remains high due to growth in disposable income being under severe pressure in a recessionary environment. The high debt ratio is sustained by disposable income growth falling at a faster rate than household credit growth in recent quarters. Therefore, the pressured household sector is unable to respond nearly as aggressively to rate cuts today as it did in 1999 and 2003 when indebtedness was far lower.

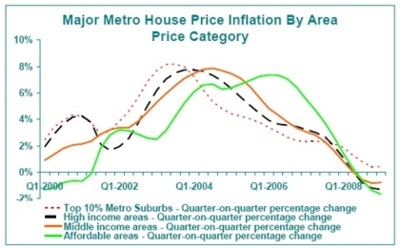

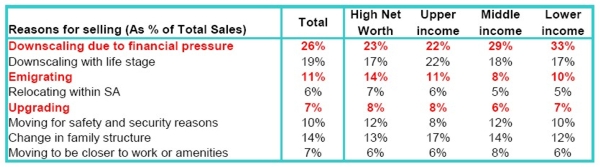

Affordable Segment May Now Be the Weakest Link The price deflation has, over time, become increasingly widespread, with the so-called affordable segment being the most recent casualty it would appear. In separate weighted average price estimates using Deeds data on a quarterly basis, we break the market of the country’s major metros into 4 area price segments, In the first quarter, average house price deflation for the affordable segment of major metro areas was estimated at -3.3% year-on-year, the worst of the 4 area price categories, followed by -2.1% in middle income areas and -3.2% deflation in high income areas. The Top 10% appeared to have stabilised somewhat, holding their value slightly better on average, having shown 1st quarter price increase of 2.9%. The graph above shows how the top 10% peaked first in late-2003, followed by high income and middle income areas. The affordable segment only peaked in terms of price inflation as recently as 2006. Its decline in price inflation since 2006 has been a sharp one, and it is conceivable that this segment is where severe financial strain has been building up. The FNB Property Barometer supports this notion, with survey respondents (agents) from low income areas reporting a greater percentage of sellers selling in order to downscale due to financial pressure (33%) as compared to the higher income areas. This shouldn’t surprise in these recessionary times. Less skilled labour often comes off worse in economic downturns than the more supply-constrained highly skilled labour that supports the higher end of the market, and this would be especially so when it is the likes of manufacturing and mining (big employers of less-skilled labour) that are currently in deep recessions.

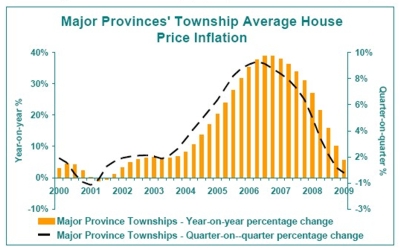

Examining former black township property behaviour for the major 3 provinces (average price R267,449), thus largely metro-dominated, The affordable segment, not so long ago the star performer, is thus possibly the key cause for concern at present, having peaked last in the cycle. It possibly has to battle more than others due to the more severe recessions in certain industries that employ a significant number of affordable segment clientele. Conclusion Recent SARB data pointed to a lack of progress by the household sector in reducing its debt burden, as measured by the debt-to-disposable-income ratio. This ratio, after a 2-quarter decline last year, began to rise again late last year due to disposable income growth falling at a faster rate than household sector credit growth. This is reflective of the severity of the global and domestic recession. The lower income/affordable segment may well be under most strain currently. There are some early signs that the domestic economy may be moving nearer to stabilisation, as it should once economy-wide inventory reduction (in response to a general demand slump) nears its end. The SARB Leading Indicator has begun to move broadly sideways in recent months, a hint that we may be nearing this point. Nevertheless, it remains a weak economy with a strained household sector, which implies the expectation of only moderate interest rate-driven increase in demand, while financial stress-related selling remains rife. The view thus remains that weak demand and an apparent oversupply of property on the market is expected to translate into national house price deflation at least for the rest of 2009. The rate of deflation, though, is expected to gradually subside in the second half of the year. |

Property Advice

namely the top 10% (highest priced suburbs accounting for 10% of total volumes of transactions by individuals over a 5-year period) with a price average of R1.852m, high income areas (the next 30% of the market) with an average price of R1.134m, middle income areas (the following 30%) with an average price of R746,416, and affordable areas (the bottom 30% of areas) with an average price of R350,007.

namely the top 10% (highest priced suburbs accounting for 10% of total volumes of transactions by individuals over a 5-year period) with a price average of R1.852m, high income areas (the next 30% of the market) with an average price of R1.134m, middle income areas (the following 30%) with an average price of R746,416, and affordable areas (the bottom 30% of areas) with an average price of R350,007.

this property segment, too, displays a similar weakening trend to the overall affordable segment, and although not in house price deflation yet, these areas appear pretty close. This data series is also estimated from Deeds data, and in the first quarter it showed year-on-year average price inflation of 5.7%, and while this still represents positive growth, it is sharply lower than the previous quarter’s 10.2%.

this property segment, too, displays a similar weakening trend to the overall affordable segment, and although not in house price deflation yet, these areas appear pretty close. This data series is also estimated from Deeds data, and in the first quarter it showed year-on-year average price inflation of 5.7%, and while this still represents positive growth, it is sharply lower than the previous quarter’s 10.2%.