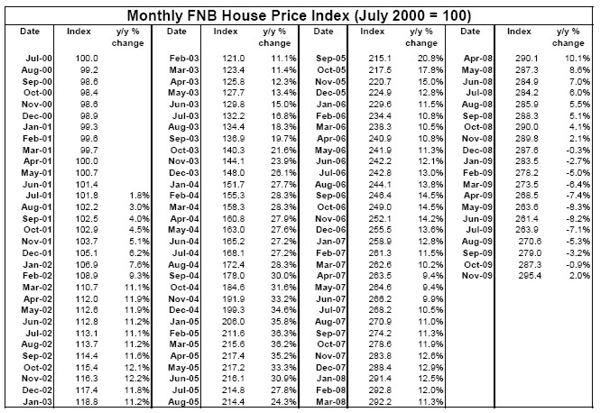

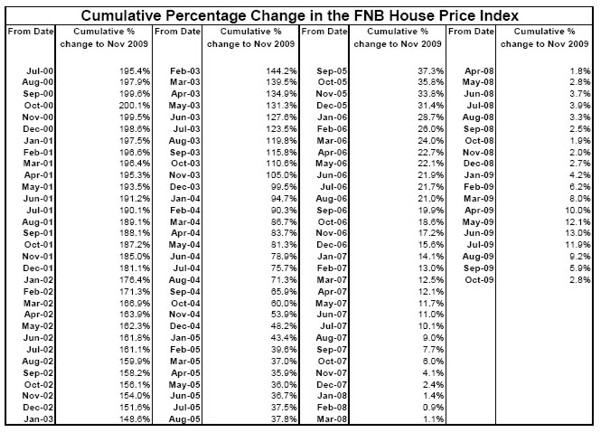

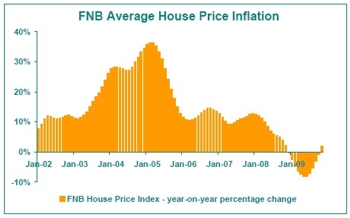

Year-On-Year Rise Returns to House Prices after Almost a Year of Decline The FNB House Price Index showed renewed year-on-year house price inflation in November, after a period of deflation starting back in December 2008. The index rose year-on-year by 2%, after a previous month’s revised figure of -0.9% decline.

On a month-on-month basis, the index has been rising solidly for some months, but due to seasonality in the numbers we place less emphasis on the 2.8% increase for November. On a cumulative basis, the index is now 195.4% higher than the July 2000 level, the point at which the FNB House Price Index started at a level of 100. The average house value for the month of November was measured at R773018.

On a month-on-month basis, the index has been rising solidly for some months, but due to seasonality in the numbers we place less emphasis on the 2.8% increase for November. On a cumulative basis, the index is now 195.4% higher than the July 2000 level, the point at which the FNB House Price Index started at a level of 100. The average house value for the month of November was measured at R773018.

In Real Terms, House Price Deflation Persists, But at a Diminishing Rate Although consumer price inflation has been slowing since the 2nd half of last year, at a 5.9% year-on-year rate it is still too high for REAL house price deflation (i.e. when house prices are adjusted for consumer inflation) to yet have been wiped out. As at October, real year-on-year house price deflation was still as much as -6.5%, although due to the combination of declining consumer inflation and diminishing house price deflation, this had diminished substantially from a low point of -15% year-on-year in May.

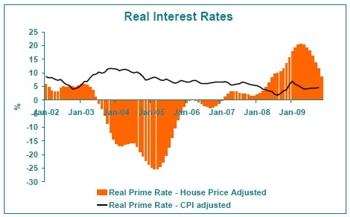

In Real Terms, House Price Deflation Persists, But at a Diminishing Rate Although consumer price inflation has been slowing since the 2nd half of last year, at a 5.9% year-on-year rate it is still too high for REAL house price deflation (i.e. when house prices are adjusted for consumer inflation) to yet have been wiped out. As at October, real year-on-year house price deflation was still as much as -6.5%, although due to the combination of declining consumer inflation and diminishing house price deflation, this had diminished substantially from a low point of -15% year-on-year in May.  Real Prime is Declining, but it’s Still No Place for a Speculator Two measures of real prime rate are shown in the graph. Given the SARB’s focus on the CPI inflation target, it is not too surprising that prime rate adjusted using the CPI is relatively stable over time, generally staying positive, and recently at levels around 4.5%, rising a little in recent months as inflation declines and interest rates no longer do. The 2nd measure of real prime rate, though, is more relevant when determining the viability of short term property speculation. Here, we adjust prime rate with house price inflation to get to real prime rate, and although this rate is declining steadily due to improving house price inflation, at 8.5% this real prime rate remains significant. No place for speculators on a large scale just yet it would seem. Comments Although this is the first month of return to year-on-year price increase, the November number is actually just the continuation of an improving trend which started in the form of diminishing house price deflation from around June, a lagged response to gradually rising demand from early in the year as interest rates began to fall. The improving demand and price situation makes for the likelihood of a better year in 2010, with not only the rest of this year’s interest rate stimulus still to feed through but also increasing signs of economic growth recovery. The SARB Leading Business Cycle Indicator continues its month-by-month rise, and real economic growth has emerged from negative territory to record a 0.9% quarter-on-quarter annualised rate in the 3rd quarter. The pace at which house prices have returned to inflation, a few months earlier than previously expected, leads us to believe that our previous forecast of 5% average price increase for 2010 is slightly on the conservative side, and that an upward revision would be in order. We remain expectant of single-digit average price inflation for next year, but a slightly higher rate than the previous forecast to the tune of 7-8%.

Real Prime is Declining, but it’s Still No Place for a Speculator Two measures of real prime rate are shown in the graph. Given the SARB’s focus on the CPI inflation target, it is not too surprising that prime rate adjusted using the CPI is relatively stable over time, generally staying positive, and recently at levels around 4.5%, rising a little in recent months as inflation declines and interest rates no longer do. The 2nd measure of real prime rate, though, is more relevant when determining the viability of short term property speculation. Here, we adjust prime rate with house price inflation to get to real prime rate, and although this rate is declining steadily due to improving house price inflation, at 8.5% this real prime rate remains significant. No place for speculators on a large scale just yet it would seem. Comments Although this is the first month of return to year-on-year price increase, the November number is actually just the continuation of an improving trend which started in the form of diminishing house price deflation from around June, a lagged response to gradually rising demand from early in the year as interest rates began to fall. The improving demand and price situation makes for the likelihood of a better year in 2010, with not only the rest of this year’s interest rate stimulus still to feed through but also increasing signs of economic growth recovery. The SARB Leading Business Cycle Indicator continues its month-by-month rise, and real economic growth has emerged from negative territory to record a 0.9% quarter-on-quarter annualised rate in the 3rd quarter. The pace at which house prices have returned to inflation, a few months earlier than previously expected, leads us to believe that our previous forecast of 5% average price increase for 2010 is slightly on the conservative side, and that an upward revision would be in order. We remain expectant of single-digit average price inflation for next year, but a slightly higher rate than the previous forecast to the tune of 7-8%.