|

One of the important foundations that needs to be laid for any residential property market improvement is a solid household financial base, given that the household sector is largely responsible for driving residential property demand. The road to improving the household sector financial state is a long one, exacerbated by current global economic conditions and the resultant domestic economic recession. In recent times, much has been made of “mortgage stress”, which is undoubtedly at relatively high levels at the current times. However, data available points to the possibility that the start of an improvement in household sector credit quality, including a decline in mortgage loan defaults rates, may not be far off.

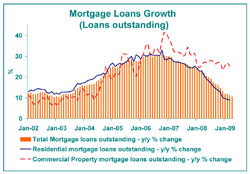

This ongoing decline in mortgage growth is the lagged response to a slowing residential property market, which has its roots back in early-2005, while more recently a slowing in the commercial property sector has also been playing a lesser role.

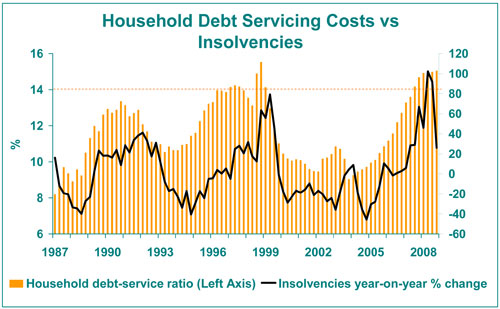

This lowly household credit growth number is believed to be lower than the rate of growth in nominal household disposable income for the first quarter, given that total labour remuneration recorded an 8.9% year-on-year growth rate in the quarter, and this is believed to have translated into a further decline in the household debt-to disposable income ratio. Implications of the Above Statistics – Some Credit Quality Improvement Probably Not Far Away The declining trends in both mortgage growth and household sector credit growth are strongly reflective of the cutback in new lending/borrowing that set in during recent years in response to the then rising inflation and interest rates, and resultant rising financial stress in the household sector. The impact of the more recent economic recession and resultant real income decline probably has yet to be reflected in the numbers. The declining growth in mortgage loans outstanding is an important part of the long road back to improved mortgage credit quality, and the signs are that such improvements may not be far off. Important for the health of the mortgage loan book is that the overall household debt ratios improve (decline) in such times as these where real household sector disposable income is declining. This appears to be taking place, with declining household credit growth now implying probable further decline in the household debt-to-disposable income ratio. A declining debt-to-disposable income ratio, along with declining interest rates as of late, means that the household debt-service ratio (cost of servicing the household debt burden expressed as a percentage of household sector disposable income) has probably peaked and is on its way to lower levels. An improved ability by the household sector to service its debt should mean lower default rates. Indeed StatsSA figures show that insolvencies growth has declined sharply from a peak of 99% year-on-year in the 2nd quarter of 2008 to 21% by the 4th quarter of last year, and negative growth may not be far off. Similarly, the start of a decline in non-performing mortgage loans also looks likely in the near future, though this is not to deny that the levels of bad debt remain troublesomely high for the time being. The decline in the debt-to-disposable income ratio along with the debt-service ratio is expected to ensue at least until well into next year. Although interest rate cuts may well spark a mild rise in new loans granted, it will probably be a long time before the growth in the total mortgage or household credit outstanding begins turns the corner due to leads and lags between new lending trend changes and capital repayments catching up. Given the shaky global and local economic conditions, any rise in new lending is expected to be mild, as it is unlikely that lending institutions will come “out of the starting blocks” quickly this time around. |

Property Advice

Mortgage Loans and Household Sector Credit Growth Continues Decline in April

Mortgage Loans and Household Sector Credit Growth Continues Decline in April  The growth in the country’s total mortgage loans outstanding continued its decline in April, and this was believed to be largely driven by the ongoing decline in residential mortgage loan growth. On a year-on-year basis, the value of total mortgage loans outstanding grew by 10.5% in April, down from 11.3% in March, continuing a declining trend that started late in 2006. While the data split between residential and commercial mortgage loans runs a month behind, one can see that total mortgage loans growth closely tracks the far larger residential mortgage component which accounts for near 80% of total mortgages. Year-on-year, March residential mortgage loans outstanding grew by 8.9%, which also reflected further decline in a long declining growth trend.

The growth in the country’s total mortgage loans outstanding continued its decline in April, and this was believed to be largely driven by the ongoing decline in residential mortgage loan growth. On a year-on-year basis, the value of total mortgage loans outstanding grew by 10.5% in April, down from 11.3% in March, continuing a declining trend that started late in 2006. While the data split between residential and commercial mortgage loans runs a month behind, one can see that total mortgage loans growth closely tracks the far larger residential mortgage component which accounts for near 80% of total mortgages. Year-on-year, March residential mortgage loans outstanding grew by 8.9%, which also reflected further decline in a long declining growth trend.  A similar declining trend continues in the monthly data for total household sector credit outstanding, whose year-on-year growth declined from 6.2% in March to 5.9% in April.

A similar declining trend continues in the monthly data for total household sector credit outstanding, whose year-on-year growth declined from 6.2% in March to 5.9% in April.