|

New Mortgage Growth Still Negative Year-On-Year, But May Be Starting to Turn the Corner Slowly New Mortgage Growth Still Negative Year-On-Year, But May Be Starting to Turn the Corner Slowly

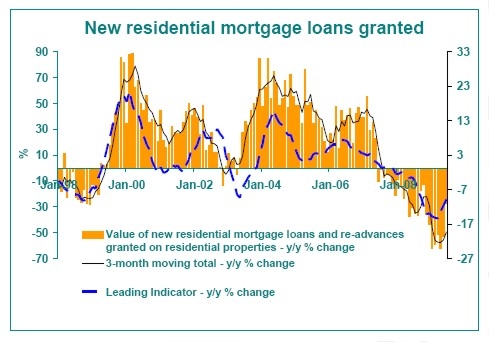

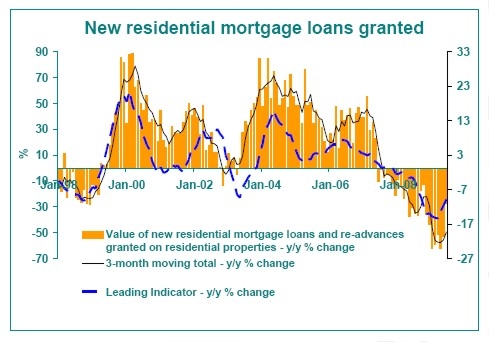

The release of the SARB Quarterly Bulletin for September provides the picture for new mortgage loans in the 2nd quarter of 2009. It showed that for the 2nd quarter as a whole, the year-on-year rate of decline in new mortgage loans and re-advances looked slightly better, recording a -49.3% year-on-year fall as compared to -57.5% for the 1st quarter.

Looking at the figures month by month, however, the improvement appeared more impressive towards the end of the 2nd quarter, with the June year-on-year decline far less at -27.3%. On a quarter-on-quarter basis, the 2nd quarter total of R35.718bn’s worth of loans granted was 1% up on the 1st quarter number.

While one cannot draw hard and fast conclusions about a trend change based on one quarter, it is believed that the 2nd quarter number represents a mild turn for the better as a result of the sharp drop in interest rates and an economic growth rate that looks set to emerge slowly from recession, along with mild relaxation of credit criteria by certain banks. The SARB Composite Leading Business Cycle Indicator began to turn the corner in the 2nd quarter, and the accompanying graph indicates that the rate of growth in new residential mortgage loans granted tracks the Leading Indicator relatively well.

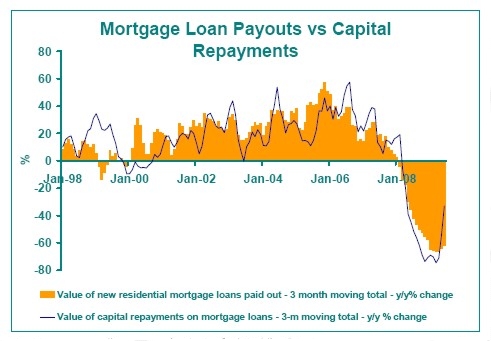

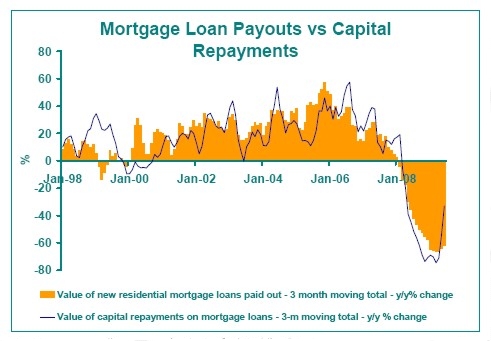

Taking a look at mortgage loans paid out (bear in mind that there is a non-residential component in this number but residential is the big driver), the year-on-year rate of decline also remains extreme. But once again, the 2nd quarter’s decline of -61.7% was slightly less than the 1st quarter’s -66.4%, and by June the year-on-year rate of decline had diminished further to -53.7%.

Therefore, while the picture certainly still remains extremely weak, there are signs that we may be slowly turning the corner after a huge pullback on mortgage (and overall household) borrowing.

On the capital repayments side (also including a non-residential component, but residential is the big component), encouraging is the fact that the SARB reports a significantly smaller year-on-year rate of decline in capital repayments on mortgage loans, to the tune of -33.1% in the second quarter, compared with a massive -74.6% decline in the 1st quarter year-on-year.

For the month of June the year-on-year decline in the value of capital repayments was a mere -12.3%, and quarter-on-quarter the value of capital repayments was +59.4% higher in the second quarter compared to the preceding quarter. This may be an early sign of things to come in terms of a more rapid paying down of total mortgage debt outstanding in the coming months, assisting the currently very high overall debt-to-disposable income ratio to lower levels in future.

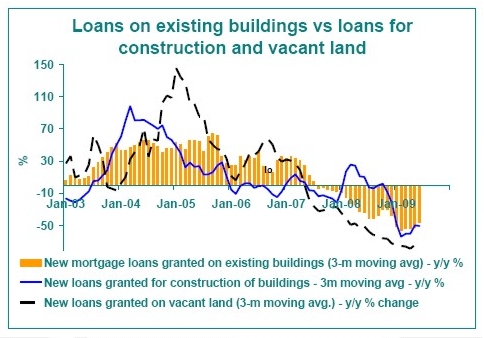

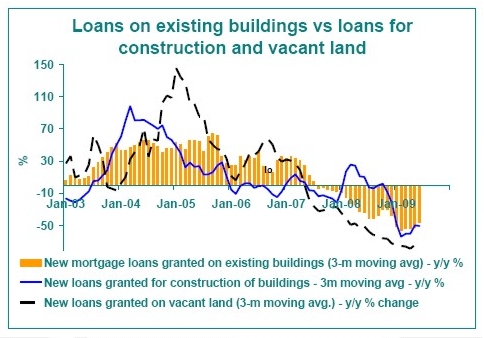

Examining new mortgage loans granted split into loans on existing buildings, construction of buildings and vacant land, not surprisingly is that the funding of vacant land purchases has fared worst (given a sharp drop in new buildings planned). The value of new mortgage loans on vacant land dropped by -73.3% in the 2nd quarter year-on-year, compared to building construction loans falling by a lesser -50.9% and loans on existing buildings declining by 47.1% year-on-year.

The rates of decline of all 3 categories, however, all experienced mild improvements (diminished) in the 2nd quarter compared to the 1st quarter.

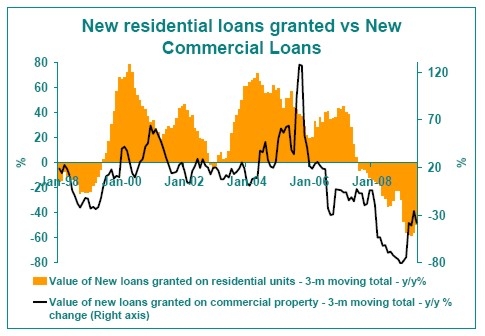

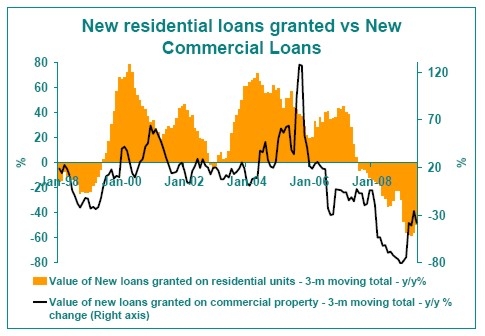

Finally, taking a look at the split between new residential mortgage loans granted and commercial property loans granted, it is clear that the commercial sector has also been severely affected by the economic slowdown. Although the year-on-year rate of decline in new commercial loans granted also appears significantly better than its low of -81.4% for the 4th quarter of 2008, the rate of decline of -38.1% in the 2nd quarter of 2009 remains weak.

Conclusion

Although the SARB New mortgage loan numbers remain very weak compared to prior years, it is believed that the mildly diminished rates of year-on-year decline in value of new mortgage lending indicate a household sector that has begun to respond positively to sharp interest rate cuts, and that moderate strengthening in the growth rates (slowly away from negative to towards positive growth) will follow. In the coming quarters, new mortgage value growth is expected to rely increasingly on a stronger economy, with the SARB Leading Indicator having started to point the way up, and such mild improvement is expected to lead the FNB House Price Index out of deflation in 2010.

|

New Mortgage Growth Still Negative Year-On-Year, But May Be Starting to Turn the Corner Slowly

New Mortgage Growth Still Negative Year-On-Year, But May Be Starting to Turn the Corner Slowly