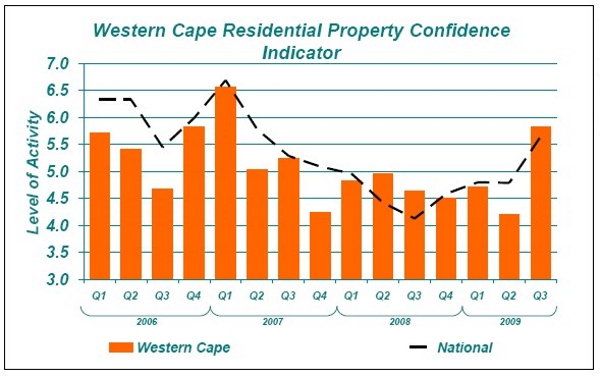

The 3rd Quarter Cape Metro FNB Residential Property Barometer pointed to a significant jump in activity levels in the region, after a very weak 2nd quarter level. This suggests that the region is beginning to feel the positive impact of the series of interest rate cuts that took place in the 1st half of 2009. The Property Barometer is a survey of a sample of estate agents in the major cities of the country regarding their personal experience of market conditions. The main Barometer question relates to the level of demand activity, and agents are asked to rate the level of demand that they experience on a scale of 1 to 10. After an initial rise in the first quarter to 4.71, agents estimated activity to have declined back to 4.21 in the second quarter. The 3rd quarter level of 5.82 is thus a significant rise in what was a very weak demand level. The 3rd quarter survey was undertaken in mid-August, after the bulk of the SARB’s 2009 interest rate cuts to date.

The 3rd Quarter Cape Metro FNB Residential Property Barometer pointed to a significant jump in activity levels in the region, after a very weak 2nd quarter level. This suggests that the region is beginning to feel the positive impact of the series of interest rate cuts that took place in the 1st half of 2009. The Property Barometer is a survey of a sample of estate agents in the major cities of the country regarding their personal experience of market conditions. The main Barometer question relates to the level of demand activity, and agents are asked to rate the level of demand that they experience on a scale of 1 to 10. After an initial rise in the first quarter to 4.71, agents estimated activity to have declined back to 4.21 in the second quarter. The 3rd quarter level of 5.82 is thus a significant rise in what was a very weak demand level. The 3rd quarter survey was undertaken in mid-August, after the bulk of the SARB’s 2009 interest rate cuts to date.

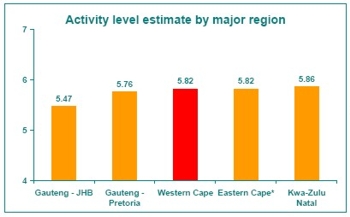

Coastal region survey respondents are more optimistic than their inland counterparts  The jump in the Western Cape’s activity rating means that the agents surveyed from that region are more upbeat about activity than their Gauteng counterparts, although all regions have seen an improvement. The 3 major coastal metros, namely eThekwini (5.86), Mandela Bay (5.82), and Cape Town (5.82) are now more upbeat in their estimates of activity compared with Joburg’s 5.47 and Tshwane (5.76). Greater seller realism may be setting in The estimated percentage of properties sold at below asking price showed a significant decline from 91% in the 2nd quarter to 83% in the 3rd quarter, while the average time of a property on the market prior to being sold declined sharply from 22 weeks and 2 days in the 2nd quarter to 16 weeks and 1 day in the 3rd. Together, these two indicators point towards more realistic pricing by sellers. The greater realism may not only be due to sellers setting prices lower, but also due to the market catching up to price levels, therefore making previously unrealistic price levels now a little more realistic in a stronger market.

The jump in the Western Cape’s activity rating means that the agents surveyed from that region are more upbeat about activity than their Gauteng counterparts, although all regions have seen an improvement. The 3 major coastal metros, namely eThekwini (5.86), Mandela Bay (5.82), and Cape Town (5.82) are now more upbeat in their estimates of activity compared with Joburg’s 5.47 and Tshwane (5.76). Greater seller realism may be setting in The estimated percentage of properties sold at below asking price showed a significant decline from 91% in the 2nd quarter to 83% in the 3rd quarter, while the average time of a property on the market prior to being sold declined sharply from 22 weeks and 2 days in the 2nd quarter to 16 weeks and 1 day in the 3rd. Together, these two indicators point towards more realistic pricing by sellers. The greater realism may not only be due to sellers setting prices lower, but also due to the market catching up to price levels, therefore making previously unrealistic price levels now a little more realistic in a stronger market.

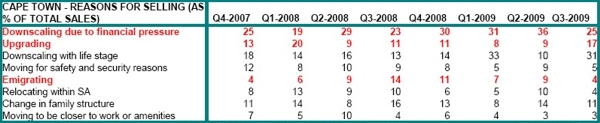

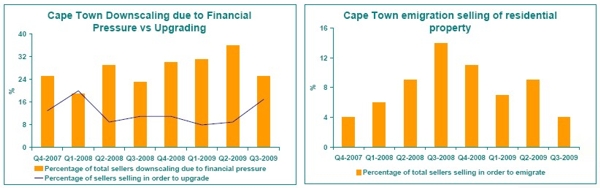

Reasons for selling property in Cape Town

Selling in order to downscale due to financial pressure declined significantly in importance, dropping from 36% of total selling to 25% from the 2nd quarter of 2009 to the 3rd. Simultaneously, selling in order to upgrade jumped from 9% of total selling to 17% over the same period. Both of these numbers suggest that interest rate cuts have now had a significant impact in terms of alleviating the pressure on households as a whole. As a percentage of total selling, emigration selling in Cape Town showed a surge during 2008, similar to the trend in other metros, but never reached as high a level as the likes of the Gauteng metros or eThekwini. After a peak of 14% in the 3rd quarter of 2008, there has been a broad decline in emigration selling’s significance to only 4% of total selling by the 3rd quarter of this year, according to the estate agents surveyed.

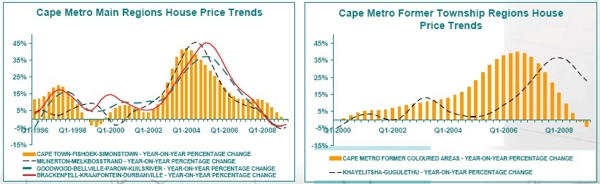

Main Cape Metro Estimated Price Trends (using Deeds data) still pointed to oversupplies and widespread price deflation, but some turns for the better were apparent.

Although house price deflation was widespread in many parts of Cape Town in the 2nd quarter of 2009 (using Deeds data to estimate), there were indeed a few areas that appeared to have started diminishing year-on-year price deflation as demand picked up:

Cape Town-Fishoek-Simonstown (avg. price = R1.137m) showed slight price deflation of -0.4% y/y in Q2 2009. This means that, to date, this sub-region appears to have experienced the least price deflation of any of the metro’s sub-regions, and it is believed that land scarcity around Table Mountain has contributed to this, through preventing a major oversupply of new stock from having been created during the property boom years.

Out to the North of the metro, where land is seemingly more plentiful, and a major supply of new stock was created in the boom years, price deflation appears more widespread. Milnerton-Melkbosstrand (avg. price = R774,659) showed price deflation of -4.8% y/y in Q2 2009, while Goodwood-Parow-Bellville-Kuilsriver (avg. price = R811,655) showed price deflation of -3.2% y/y. Brackenfell-Kraaifontein-Durbanville (avg. price = R773,467) showed deflation of -3.1% y/y. However, all 3 areas’ deflation rates, while still significant, reflected improvements on the previous quarter.

Of the former Apartheid-era “Township” areas, the Cape Metro former coloured areas (avg. price = R279,990) showed price deflation of -3.5% y/y in Q2 2009. The former Black Township areas of the Khayelitsha- Gugulethu region (avg. price = R228,380) still showed huge price inflation of +26.6%, although decelerating.

The Cape Metro as a whole (avg. price = R881,102) showed price deflation of -1.5% y/y in Q2 2009

Interpretation/Conclusion Although not expected to be a strong recovery, the 3rd quarter Barometer points to significantly stronger situation in the Cape Town residential market, following a period in which demand activity battled to improve. The 3rd quarter jump in demand was significant, while other key indicators such as average time on the market and percentage of sellers achieving their asking price have also improved. Deeds data runs a bit behind, but while area price deflation was still widespread as at the 2nd quarter, one could begin to observe some of the Cape Town regions’ price indices beginning to turn for the better. To date, the market improvement is largely the result of interest rate cuts, and the banks’ responses to better market conditions by relaxing lending criteria has reinforced the trend. In the near term, though, the economy is expected to provide more support for the market as we emerge from recession.