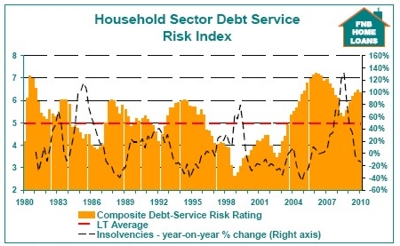

Are “tight” bank credit criteria appropriate? Perhaps more so than some would think, with the household sector’s vulnerability remaining highHousehold sector credit numbers for the month of May showed no improvement in growth from the previous month, remaining unchanged year-on-year at 3.8%. Such a slow pace of credit growth often gives rise to calls on banks, especially in credit-driven industries such as the property sector, to relax lending criteria further to facilitate stronger borrowing growth, which simplistically viewed would be the way to get the residential property market “back on track” (at least for a while). However, such views would be just that – simplistic, and lending institutions currently have a lot to think about, or should have at least. The reality is that recent household sector data point to an environment that can still be termed “high risk”, and this is probably no time for “heroes”. We could probably learn some valuable lessons from the recent US financial crisis. When the United States Federal Reserve cut its Fed Funds Target rate to 1% in its previous interest rate down-cycle, starting from around the 2001 US recession, it managed to breathe life back into an ailing economy, reportedly aided by more cheap money also flowing in from high-savings eastern economies to buy up debt instruments of dubious quality. However, the Fed had not reduced the many risks to the US economy that come from having high indebtedness levels. To the contrary, relaxed monetary policy and lending criteria helped already-high debt levels still higher, setting the country up for the ultimate crisis at a future stage when interest rates once again rose (as they always ultimately do), and an external shock in the form of the 2008 commodity price spike hit the economy. Their residential property market took a hammering, and the greatest financial crisis since the Great Depression took place. In South Africa, we managed to avoid a financial crisis, but our own household sector’s indebtedness level remains far from healthy. This is despite insolvencies being on the decline, home loans banks arrears situations having improved, property demand being higher than a year and a half ago, and both the economy and household disposable income once again growing positively in real terms. Despite such abovementioned improvements, the recovery to date can be classified as a “high risk” one, and important is not to fall into the US trap and bluff oneself into believing that all is well. Rather, one should examine the reasons for any improvements in household credit quality. The reality is that the main driver of this improvement has been a reduction of interest rates to a new low last seen a few decades ago, and NOT through a major improvement in terms of a reduction in indebtedness. The latter is what the country needs more of, because as quickly as interest rates can decline, so they can and will rise again at some stage in future, and if they were to unexpectedly rise in the near term, the still-high level of household sector indebtedness (by our own historic standards at least) would mean that bad debt levels would probably quickly rise back to “unacceptably” high levels. The SARB Quarterly Bulletin showed the household debt-to-disposable income ratio declining to 79.4% in the 1st quarter of 2010, assisted by a slow rate of household credit growth and recovering disposable income growth that now outstrips credit growth, but far more of this is required. The road back to lower levels of household sector vulnerability will be a long and slow one, which should not be built predominantly on interest rate cuts and more relaxed lending criteria. Rather, it will require a few years of household credit growth which is substantially slower than household disposable income growth, so as to reduce the debt-to-disposable income ratio significantly. This will further reduce the all-important debt-service ratio (the cost of servicing the household sector interest rate hikes without “severe pain”. At present, we’re not there yet, and we shouldn’t fool ourselves. So are home lending banks’ credit criteria too strict, and killing the market? That’s always a tough one to answer. Certainly they’re a lot stricter than 4-5 years ago at the height of the boom. But then with a currently far higher household indebtedness level than back in the boom years, it is likely that even should criteria hypothetically be as loose as they were back then, less households would still be in a strong enough financial position to qualify for home loans. In addition, the high level of indebtedness makes the household sector far more vulnerable to economic shocks or interest rate hikes at present, compared with back in the boom times, which in effect leaves the housing market highly vulnerable to shocks, and this should keep lenders vigilant. Therefore, relatively cautious lending criteria, and slow household credit growth (including slow residential mortgage growth) leading to further decline in the household debt-to-disposable income ratio over the next few years, should probably be viewed in a positive light for the time being. Household sector debt-service risk declining, but still remains at high levelsData releases in recent days indicate that the level of risk to the household sector’s ability to service its debt in future may have started to make progress in terms of a reduction, albeit slow, towards lower levels. However, this level of “debt-service risk” remains high. Our Household Sector Debt Service Risk Index declined slightly in the 1st quarter, from 6.5 previous to 6.4.  This is the first decline in the index value since late- 2008. The index level is determined by 3 factors, namely the household sector debt-to-disposable income ratio, the direction of the trend in the household debt-to-disposable income ratio, and prime rate relative to the “structural” inflation rate. In order to get an estimate of the “structural” consumer price inflation rate we use a 5-year average consumer inflation rate. The nearer prime rate is to this 5-year average consumer inflation rate (i.e. the lower the level of “real” prime rate by this measure), the higher the risk/vulnerability score, because this would suggest a more limited scope for interest rate cutting and a higher risk that the next interest rate move would be up. The recent decline in the index was driven by the fact that the SARB Household Sector Debt-to-disposable income ratio declined mildly from 79.9% previous to 78.4% in the 1st quarter of 2010. A level of 6.4, however, remains high in comparison to the long term average level of 5, this long term average being from 1970 to 2010. The reasons behind the high level of risk portrayed by the index are twofold. Firstly, although the household debt-to-disposable income ratio is gradually making its way down from the high of 2 years ago, at 79.4% its level remain very high by historic standards. Secondly, relative to 5-year average inflation levels, prime rate is currently at a relatively low level, suggesting limited scope for further interest rate cutting. However, we do believe that the 1st quarter decline in the index value could be the start of a declining trend, with better growth in disposable income, since the end of the recession, facilitating further decline in the debt-to-disposable income ratio in coming quarters. Unpacking the drivers of household debt-service riskMay household sector credit growth remains slow.

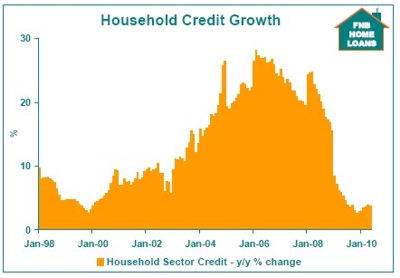

This is the first decline in the index value since late- 2008. The index level is determined by 3 factors, namely the household sector debt-to-disposable income ratio, the direction of the trend in the household debt-to-disposable income ratio, and prime rate relative to the “structural” inflation rate. In order to get an estimate of the “structural” consumer price inflation rate we use a 5-year average consumer inflation rate. The nearer prime rate is to this 5-year average consumer inflation rate (i.e. the lower the level of “real” prime rate by this measure), the higher the risk/vulnerability score, because this would suggest a more limited scope for interest rate cutting and a higher risk that the next interest rate move would be up. The recent decline in the index was driven by the fact that the SARB Household Sector Debt-to-disposable income ratio declined mildly from 79.9% previous to 78.4% in the 1st quarter of 2010. A level of 6.4, however, remains high in comparison to the long term average level of 5, this long term average being from 1970 to 2010. The reasons behind the high level of risk portrayed by the index are twofold. Firstly, although the household debt-to-disposable income ratio is gradually making its way down from the high of 2 years ago, at 79.4% its level remain very high by historic standards. Secondly, relative to 5-year average inflation levels, prime rate is currently at a relatively low level, suggesting limited scope for further interest rate cutting. However, we do believe that the 1st quarter decline in the index value could be the start of a declining trend, with better growth in disposable income, since the end of the recession, facilitating further decline in the debt-to-disposable income ratio in coming quarters. Unpacking the drivers of household debt-service riskMay household sector credit growth remains slow. The recent slow rate of growth in the value of household debt outstanding is half of the story when it comes to reducing the household debt-to-disposable income ratio from its 2008 cyclical high. Today’s release of May household sector credit data shows unchanged year-on-year growth in total household sector credit outstanding of 3.8%. The rate of increase in household sector credit growth remains low relative to recent disposable income growth numbers, and importantly, is estimated to be growing slower than disposable income. This reflects the conservative nature of lending/borrowing at present, following a recession in which both lenders and certain borrowers felt the pressure of the high levels of indebtedness in the economy. Household Disposable income recovers in the 1st quarter of 2010

The recent slow rate of growth in the value of household debt outstanding is half of the story when it comes to reducing the household debt-to-disposable income ratio from its 2008 cyclical high. Today’s release of May household sector credit data shows unchanged year-on-year growth in total household sector credit outstanding of 3.8%. The rate of increase in household sector credit growth remains low relative to recent disposable income growth numbers, and importantly, is estimated to be growing slower than disposable income. This reflects the conservative nature of lending/borrowing at present, following a recession in which both lenders and certain borrowers felt the pressure of the high levels of indebtedness in the economy. Household Disposable income recovers in the 1st quarter of 2010  The recent recovery in economic conditions has reduced the household sector’s vulnerability in 2 ways. Firstly, it has assisted with a mild recovery in nominal disposable income growth, from a low of 2.5% year-on- year in the third quarter of 2009, to 6% by the 1st quarter of 2010. The fact that the SARB estimates the disposable income growth rate to be above that of household sector credit implies a decline in the household debt-to-disposable income ratio. The second positive development has been the steady decline in consumer price inflation to levels below that of strengthening nominal disposable income growth, translating into a return to positive growth in real disposable income, increasing the household sector’s real purchasing power. The net result of the above – a decline in the household debt-to-disposable income ratio early in 2010

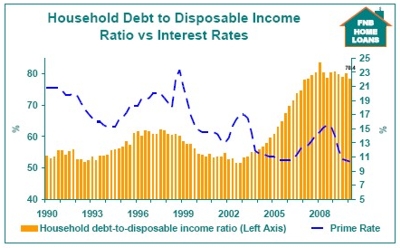

The recent recovery in economic conditions has reduced the household sector’s vulnerability in 2 ways. Firstly, it has assisted with a mild recovery in nominal disposable income growth, from a low of 2.5% year-on- year in the third quarter of 2009, to 6% by the 1st quarter of 2010. The fact that the SARB estimates the disposable income growth rate to be above that of household sector credit implies a decline in the household debt-to-disposable income ratio. The second positive development has been the steady decline in consumer price inflation to levels below that of strengthening nominal disposable income growth, translating into a return to positive growth in real disposable income, increasing the household sector’s real purchasing power. The net result of the above – a decline in the household debt-to-disposable income ratio early in 2010  The net result of ongoing slow growth in household sector credit and a faster household sector disposable income growth rate, has been some decline in the debt-to-disposable income ratio from 79.9% previous to 78.4% in the 1st quarter of 2010. With both interest rates and the debt-to-disposable income ratio declining, the all-important debt-service ratio has declined significantly too.

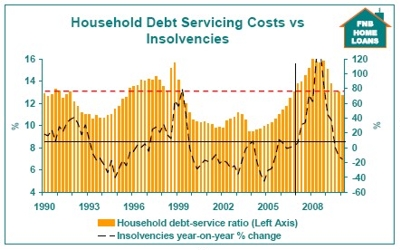

The net result of ongoing slow growth in household sector credit and a faster household sector disposable income growth rate, has been some decline in the debt-to-disposable income ratio from 79.9% previous to 78.4% in the 1st quarter of 2010. With both interest rates and the debt-to-disposable income ratio declining, the all-important debt-service ratio has declined significantly too.  The household debt-service ratio (the estimated total cost of servicing the household sector debt burden, interest + capital, expressed as a percentage of disposable income) has declined significantly from a 1st quarter 2008 high of 15.9% to a 1st quarter 2010 level of 12.7%. The debt-service ratio is a good predictor of default rates on home loans, as well as correlating very well to insolvencies growth. The 13% level of debt-service ratio appears to have been a crucial level in the past cycle, and when the ratio moved above this level it would seem that this is where the severe household sector pain set in, with insolvencies growth skyrocketing from early-2007. The decline in the debt-service ratio over the past 2 years has provided much relief to the household sector when servicing its debt. However, the “problem” is that this decline in the ratio has been far too dependent on interest rate cuts, and too little on a reduction in the debt-to-disposable income ratio to date. In addition, the debt-service ratio is only marginally below our crucial 13% level. Any interest rate hiking at such levels would almost immediately send the ratio up to unacceptably high levels once again, implying that the household sector still has very little ability to absorb any unexpected surprises. This is very unlike the rate hiking cycle of 2002, where the household debt ratio was far lower, meaning that 4 percentage points’ worth of interest rate hikes took the debt-service ratio up from a mere 9.7% to an 11.2% peak, proving hardly troublesome at all. The heavy reliance on interest rate cuts, as opposed to a more substantial decline in the household debt-to-disposable income ratio, is the reason why the Household Debt-Service Risk Index remains at such high levels. In short, therefore, the household sector’s recent recovery in terms of ability to service debt we would term a “high risk” recovery. Significant further progress in lowering the debt-to-disposable income ratio over the next few years is required before we reach a lower level of vulnerability that can be described as “comfortable”. In conclusion Household sector credit growth remains pedestrian at 3.8% year-on-year in May, which should not necessarily be seen as a negative. Assuming the economy continues to grow positively, it can be expected that nominal household disposable income growth could continue to outstrip household credit growth during the remainder of 2010. This is crucial in reducing the household debt-to-disposable income ratio further from its currently high level, and in so doing further reduce household debt-service risk. The pressure on the household sector has improved (declined) and so too its credit quality, it would appear. However, we regard this as a “high risk” improvement, because it has been based largely on interest rate cuts, which have reduced the debt-service ratio significantly, as opposed to any major reduction in the debt-to-disposable income ratio. This means that the household sector remains highly vulnerable to any unexpected or unwanted surprise such as interest rate hiking. In the coming quarters, however, further decline in the debt-to-disposable income ratio is expected to reduce the household sectors level of debt-service risk.

The household debt-service ratio (the estimated total cost of servicing the household sector debt burden, interest + capital, expressed as a percentage of disposable income) has declined significantly from a 1st quarter 2008 high of 15.9% to a 1st quarter 2010 level of 12.7%. The debt-service ratio is a good predictor of default rates on home loans, as well as correlating very well to insolvencies growth. The 13% level of debt-service ratio appears to have been a crucial level in the past cycle, and when the ratio moved above this level it would seem that this is where the severe household sector pain set in, with insolvencies growth skyrocketing from early-2007. The decline in the debt-service ratio over the past 2 years has provided much relief to the household sector when servicing its debt. However, the “problem” is that this decline in the ratio has been far too dependent on interest rate cuts, and too little on a reduction in the debt-to-disposable income ratio to date. In addition, the debt-service ratio is only marginally below our crucial 13% level. Any interest rate hiking at such levels would almost immediately send the ratio up to unacceptably high levels once again, implying that the household sector still has very little ability to absorb any unexpected surprises. This is very unlike the rate hiking cycle of 2002, where the household debt ratio was far lower, meaning that 4 percentage points’ worth of interest rate hikes took the debt-service ratio up from a mere 9.7% to an 11.2% peak, proving hardly troublesome at all. The heavy reliance on interest rate cuts, as opposed to a more substantial decline in the household debt-to-disposable income ratio, is the reason why the Household Debt-Service Risk Index remains at such high levels. In short, therefore, the household sector’s recent recovery in terms of ability to service debt we would term a “high risk” recovery. Significant further progress in lowering the debt-to-disposable income ratio over the next few years is required before we reach a lower level of vulnerability that can be described as “comfortable”. In conclusion Household sector credit growth remains pedestrian at 3.8% year-on-year in May, which should not necessarily be seen as a negative. Assuming the economy continues to grow positively, it can be expected that nominal household disposable income growth could continue to outstrip household credit growth during the remainder of 2010. This is crucial in reducing the household debt-to-disposable income ratio further from its currently high level, and in so doing further reduce household debt-service risk. The pressure on the household sector has improved (declined) and so too its credit quality, it would appear. However, we regard this as a “high risk” improvement, because it has been based largely on interest rate cuts, which have reduced the debt-service ratio significantly, as opposed to any major reduction in the debt-to-disposable income ratio. This means that the household sector remains highly vulnerable to any unexpected or unwanted surprise such as interest rate hiking. In the coming quarters, however, further decline in the debt-to-disposable income ratio is expected to reduce the household sectors level of debt-service risk.

Property Advice