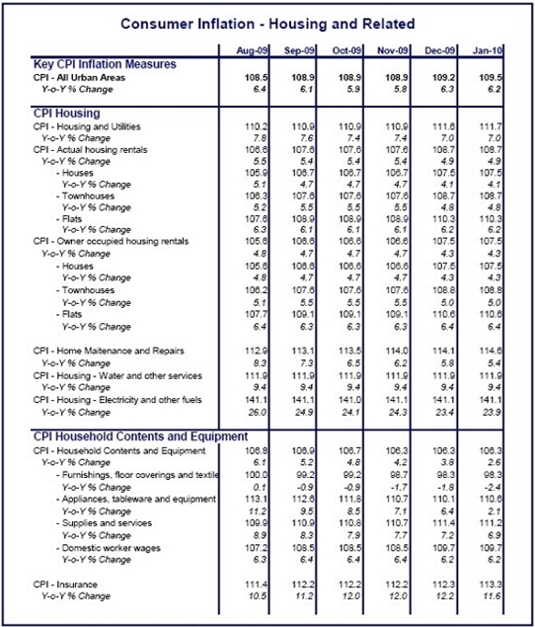

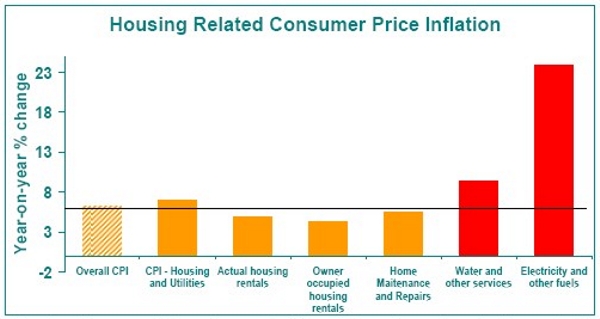

Yesterday’s CPI numbers for January, along with a 24.8% hike in Eskom tariffs, confirm that home affordability issues aren’t what they used to be. The “new” affordability issue is less about the simple house price and the cost of credit and increasingly about home assessment rates and utilities costs passed on from state monopolies. The housing and utilities sub-index is the biggest single contributor to overall CPI inflation, not only having implications for overall CPI inflation and future interest rate trends but also for the way people live, and thus for long term changes to the composition of residential property stock. THE NUMBERS The release of the January consumer price index (CPI) numbers shows the housing and utilities component of the index to be the most troublesome, inflating year-on-year by 7.0%, and today’s Eskom tariff hike announcement suggests that it will continue to be the main cause for concern for the foreseeable future. The housing and utilities sub-index makes up 22.56% of the total CPI, the largest weighting of any of the main sub-components. Its inflation rate of 7% is not the highest, but it remains above the upper CPI target limit of 6%, and because of its heavy weighting in the total CPI it contributed the most to overall CPI inflation, i.e. 1.6 percentage points of the 6.2%. Breaking down the sub-components of the housing CPI, there are no prizes for guessing that, even prior to the huge tariff increase announcement today, Eskom has been a key driver of the housing CPI inflation problem, with the “electricity and other fuels” sub-index inflating by a massive year-on-year inflation rate of 23.9%. Far behind, but still troublesomely high, is the sub-index for “water and other” services, which also includes municipal assessment rates, showing year-on-year inflation of 9.4%.

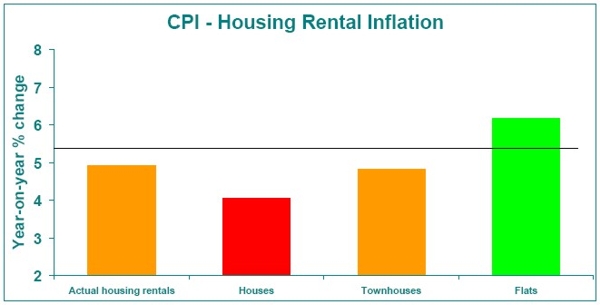

Keeping the overall housing and utilities index from skyrocketing out of control was a very weak rental market, as tenants feel the financial stress from the recent recession as much as home-owners. As a result, the actual rental sub-index inflated by a mere 4.9%, while owners’ equivalent rental (derived from actual rentals but with different sub-weightings) also inflated by a tame rate of 4.3%. THE OUTLOOK The situation looks unlikely to change over the next few years, with the housing CPI remaining the “problem child”. Firstly, one should expect that at some point we may see some recovery in the rental market, causing the heavily-weighted rental indices to contribute more to the overall inflation rate. Secondly, NERSA has announced an electricity hike of 24.8% for 2010, with similar hikes to come in the next few years. In addition, water and sewage infrastructure is also under increasing pressure, and I would expect the utilities providing this infrastructure, along with financially pressed municipalities, to be encouraged by Eskom’s success in passing the costs on to the consumer, and it would come as little surprise if we saw some future acceleration in the inflation rate for the “water and other services” sub-index too. In short, therefore, although the CPI for housing’s inflation rate stands above the 6% target limit at 7%, we are of the belief that this may still represent something of a low point, given the current rental market weakness, and that a higher housing-related inflation rate is likely to be forthcoming later in 2010. This has the obvious implications for overall CPI. It partly drives the Firstrand view is that overall CPI inflation will stickily remain in the upper half of the CPI 3-6% target range, and that there thus exists little scope if any for further interest rate reduction. CONSIDERATIONS FOR HOME BUYERS With interest rates believed to be at or near to the bottom of the cycle, prospective home buyers would obviously do well to do interest rate scenario planning, asking the question “what if interest rates were to rise by the usual 4-5 percentage points? Could I still afford the bond repayment?” If not, perhaps look to buy cheaper. But the affordability issue now clearly extends far beyond merely the cost of servicing a bond, to the issue of these sharply escalating costs related to housing. Assessment rates and utilities tariffs to homes are largely unavoidable, and with all these entities being monopolies, and their charges being compulsory, the consumer has limited alternative. Besides electricity and water saving measures, the only alternative is to buy a smaller home (to reduce operating costs) or cheaper house (to reduce assessment rates). Prospective home buyers would do well to do the scenario planning in the area of rates and tariffs too, therefore, planning their purchase on the assumption that the current rates and tariffs paid on the targeted property will probably rise dramatically in the next few years. A NOTE ON THE LONG TERM IMPLICATIONS FOR RESIDENTIAL PROPERTY These property-related “rates and tariffs” increases have a number of potential impact points for homeowners as well as some of their service providers. Firstly, the obvious way of countering home operating cost increases is to buy a smaller home on a smaller stand, with less electricity and water-consuming luxuries such as a large garden, swimming pool and domestic workers’ quarters. Secondly, and something that goes hand in hand with buying a smaller and more manageable home, is to jettison certain services such as domestic home and garden staff. This provides significant policy challenges to government, as the domestic worker sector has been an important employer of less skilled people. Declining average size of stand and of home, and resultant diminishing use of domestic workers by the average middle class suburbanite, has arguably been a long term gradual trend taking place for a few decades. This has been due to increasing land scarcity around major metros, an ongoing trend. But adding sharp rapid increases in housing-related services costs to the mix can speed up the trend in increasing demand for smaller properties relative to big ones. In the short term, it is tough for the household sector to adapt, as it is not possible to rapidly change the composition of housing stock. Many home owners bought homes some years ago when costs relating to home operation were relatively cheap. Adjustment is a long term process, and there could well be insufficient supply of smaller-sized units to facilitate a rapid adjustment. We accept that infrastructure investment demands along with environmental issues may make more costly water and electricity a “necessary evil” in years to come. In addition, somebody will be required to pay for a comprehensive public transport system, one of the further big issues that will be in the headlines during this decade, and densification of living will probably be necessary along transport corridors in order to provide the “mass demand” for such services. This may necessitate government financial/tax incentives for densification in certain areas too. It must be appreciated, however, that when property is involved, adapting to major cost changes such as the above is a slow and costly process. One would have hoped, therefore, that sanity would prevail and that the up-scaling of tariffs would be phased in more gradually, allowing the housing market, as well as the domestic worker labour market, and importantly the urban planners, time to adapt gradually. These are the “new residential property affordability” issues set to be a key focus in the new decade, and we believe that this will lead to returns on smaller-sized residential units outperforming the larger ones during the current decade, as households increasingly try to adapt to steadily rising home operating costs. The CPI for housing shows recent rental inflation exceeding that of townhouses, which in turn exceeds the rental inflation on houses. While this is believed to be the result of recent income pressures rather than tariff increases, the tariff increases are expected to encourage “more of the same”, i.e. a trend towards densification in smaller-sized units on smaller sized stands, with less luxuries such as domestic workers’ quarters and swimming pools. In addition, this long term trend may be sped up. The “cut-back” process has already been in play for a few decades. The focus, however, was traditionally more on stand size reduction along with staff quarters and swimming pool reductions, but less on building size reduction. During the current decade we expect to see a far more significant reduction in average size of residential building too.