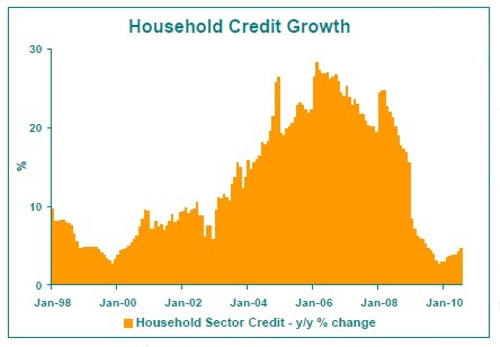

Household credit growth still slow, and any further rise may not be a good thing at present. July SARB credit data, released today, continued to show pedestrian growth rates for both total mortgage advances as well as for overall household sector credit, although there has been some mild acceleration in recent months. The total value of mortgage advances outstanding rose 4% year-on-year, up from a 3.4% growth rate in June. The slight rise in mortgage advances growth in recent months has been largely due to the 2009/early-2010 mini-recovery in the residential property sector, which started to drive the residential mortgage book growth slightly higher. Commercial property mortgage value growth, on the other hand, has still been slowing mildly in recent months, which should be expected given the commercial sector’s tendency to lag the residential sector. Given signs of the start of a renewed slowdown in the residential market in recent months, which is expected to see new mortgage borrowing growth dropping off in the near term, we do not believe that the mildly rising trend in growth in mortgage advances outstanding is sustainable yet. We therefore don’t foresee residential mortgage loans growth posing any significant upside threat to SA’s currently high household debt-to-disposable income ratio in the foreseeable future. Growth in total household sector credit outstanding is slightly higher than mortgage growth, driven more by the consumption related instalment sales credit as well as “other loans and advances”. As at July, total household sector credit growth measured 4.6% year-on-year, up from a previous month’s rate of 4.3%. We view the pedestrian growth in household sector credit in a positive light at present, due to SA’s currently high household debt-to-disposable income ratio, which keeps the household sector vulnerable to any external shocks. We believe a significantly lower debt ratio is required, given a very high risk of a global double-dip recession, and the resultant threat that such unwanted economic events can pose to household cash flows. The current growth rate in household sector credit probably remains slow enough to allow for further decline in the debt-to-disposable income ratio (78.4% in Q1 of 2010) for the time being, given some recent recovery in nominal disposable income growth. But any slide in economic growth in the near term (and GDP growth has indeed begun to slow) would probably stall the declining trend in the debt ratio, keeping the household sector and the residential property in their fragile state.