|

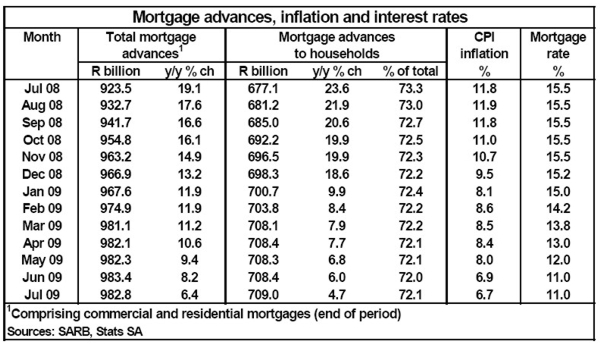

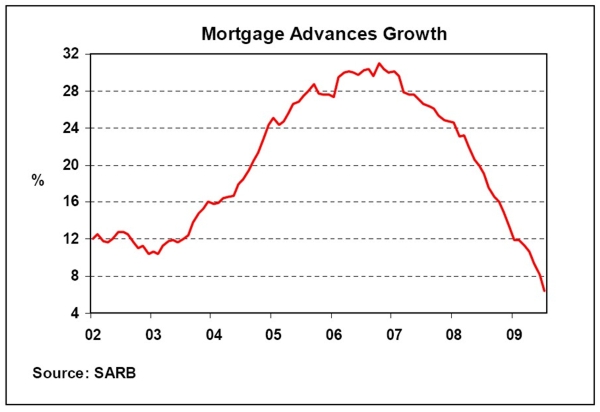

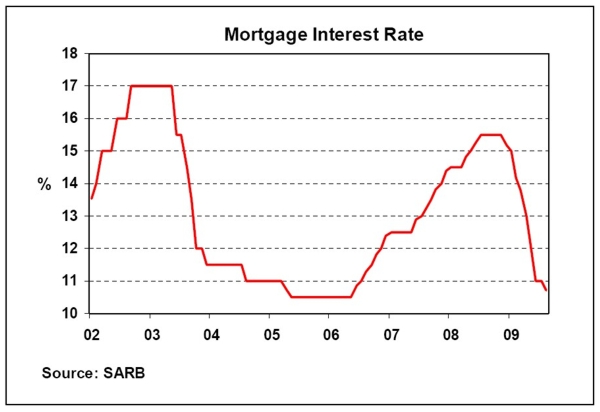

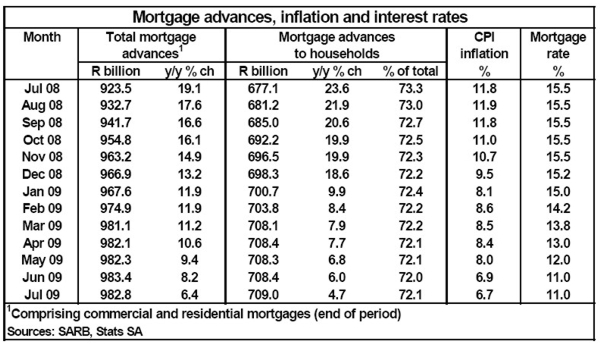

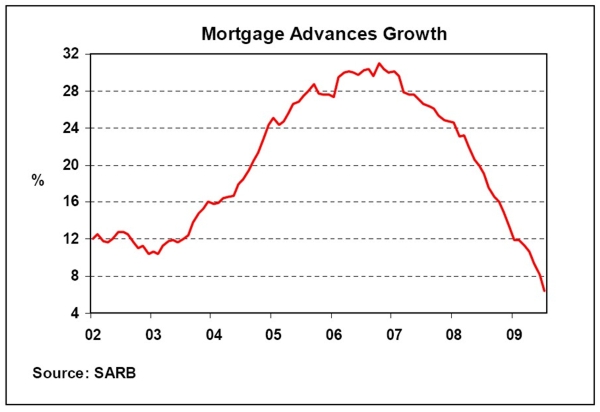

Data released by the South African Reserve Bank indicates that the year-on-year (y/y) growth in the value of mortgage advances by monetary institutions (the net outstanding balance on mortgage loans at these institutions) tapered off further to 6,4% y/y in July 2009, from 8,2% y/y in June. This was the lowest year-on-year growth in outstanding mortgage balances since May 2000, when it was 6,3%. On a month-on-month basis, the outstanding balance on mortgage loans was down by 0,1% in July, which was the first month-on-month decline since September 2002.

Growth in the value of mortgage advances to households, largely related to residential property, came in at 4,7% y/y in July, down from 6% y/y in June. Based on a level of R709 billion in July, the amount of outstanding mortgage balances in the household sector had a share of 72,1% in total mortgage debt in July, while having a share of 69,9% in total credit extended to the household sector in July.

With house prices deflating on a year-on-year basis since late 2008, this trend appears to be at a lower turning point, based on the Absa house price index up to July this year. On a month-on-month basis, house price deflation is slowing down since April this year.

Nominal year-on-year house price deflation is forecast to continue in the rest of 2009, slowing down towards the end of the year, while on a month-on-month basis prices may be rising by year end. House price growth of around 2% is forecast for 2010.

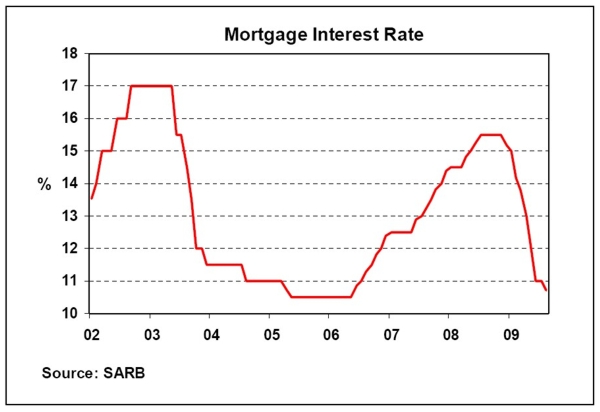

Mortgage advances growth is projected to slow down further towards the end of 2009, based on prevailing economic conditions and employment declining, impacting household income and the demand for housing and mortgage finance. Against the background of the economy expected to start recovering late this year, together with the lagged affect of lower interest rates, mortgage advances growth is forecast to gradually improve from the first quarter of 2010.

|