Higher-Priced Areas Appear to be Keeping Their Status as the Leader in the Residential Cycle__From Deeds data, using transactions by individuals only, and in areas deemed to be residential property-dominated, we have 4 metro area house price indices based on the average values of areas. Based on average volumes over a 5-year period and values by suburb, the 4 indices shown in the graph below show the “Top 10%” of metro suburbs (average price=1.86m), i.e. the areas with the top average price levels that accounted for 10% of volume over the 5-year period, and High Income areas (average price=R1.1m) which reflect the areas with average value just below the top 10% and which account for 30% of the volume traded. This is followed by what we call the “Middle Income Areas” Index (average price=R739,877) and lastly the so-called affordable Areas Index (average price=R351,026). What the graph below shows us is that the high end lead the cycle upward during the boom, and one can see Top 10% price inflation peaking first in the 4th quarter of 2003 at 36.1% year-on-year. The next peak was High Income areas with year-on-year inflation of 34.4% in the 2nd quarter of 2004, followed by the Middle Income areas in the 4th quarter of 2004 with inflation of 34.6%. Lastly, and much later, in the 3rd quarter of 2006, came the peak in the affordable segment with 32.1% inflation at the time.

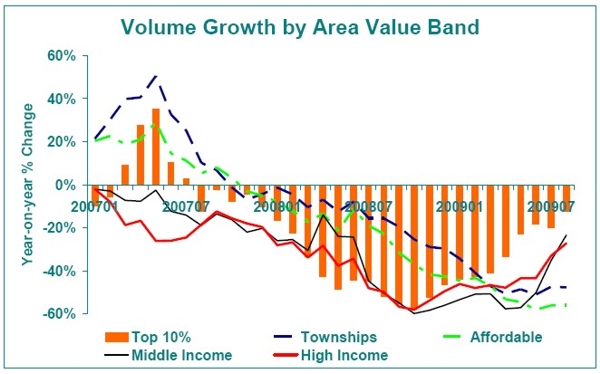

So the sequence of events over the boom years was “higher end first and lower end last. The theory was that, because the property boom was precipitated largely by a massive reduction in interest rates after 1998, the fact that suddenly the credit dependent buyers in the market could suddenly afford a better house than previously, meant that a significant portion of demand initially shifted up the price ladder. This meant that higher end prices adjusted first to the surge in demand early in the decade, and then, as the higher end began to be seen as “over-priced” for many, the demand shift was back down the price ladder in search of greater value for money and affordability, sustaining the boom down at the lower end until a later stage. Eventually, all segments of the market felt the negative effects of rising inflation and interest rates from 2006 onward, and then of course more recently the recession. The Top 10% segment appears to have avoided average price deflation, with low year-on-year inflation of 1.7% in the 3rd quarter of 2009, but for the rest of the segments average price decline has been the order of the day. The Higher Income areas measured -3.6% deflation, the Middle Income areas -2.3%, and the affordable areas -2.7%. However, we know that 2009 has been a year of moderate recovery in demand, which should ultimately see the return of national price inflation very soon, driven once again by huge interest rate cuts starting late in 2008. The question often asked, though, is which segments are showing the better or worse performance? Examining deeds data volumes for our sample of areas used in the price indices, it would appear that the relationship of previous years looks set to hold true. On the 3-month moving average basis up until August, it would appear that, indeed, it is the top end leading the market towards greater stability and, ultimately, house price growth. All segments are in year-on-year decline (although growing month-on-month already), but the Top 10% areas have progressed the most, from a bottom point in rate of decline in volume of -57.5% in October 2008 to -12.5% in August 2009. Recently, the Middle Income areas year-on-year decline has diminished rapidly to -23.4%, which is very similar to the -27.2% year-on-year decline of the High Income areas, but the graph shows an earlier and more sustained improvement in High Income areas from their low point late in 2008. Affordable and Township areas as at August appear to still have been languishing in the doldrums, with year-on-year rates of decline of -55.9 and -47.6% respectively.

Comment The high-low end sequence still, therefore, appears to be holding, suggesting that the higher priced end will enter into rising average price inflation first. It is possible that the Top 10% of areas were less affected by the economic slowdown, as one finds more accumulated saving/wealth amongst higher income households cushion the blow in recessionary times, whereas areas lower down the price ladder are often characterised by households with low savings, causing greater financial stress in bad times. The FNB Property Barometer survey has consistently pointed towards a greater percentage of “selling in order to downscale due to financial pressure” in low income areas as opposed to higher up the ladder. On top of this the tightening up of banks with regard to lending criteria in 2008 possible hampered middle and lower end demand (often a haven for first time buyers) to a greater extent due to a lack of ability to put down deposits for home loans in many cases. The converse holds true, though, in that the recent relaxing of credit criteria should benefit these segments more than the top 10%, and so with a lag, one should expect the more affordable side of the market to follow the higher priced end upward.