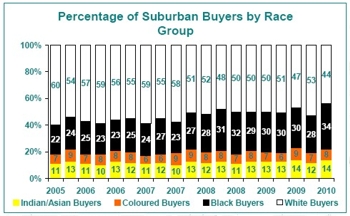

“Emerging” middle class could be the pillar of support for residential market in 2010, due to lower indebtedness amongst income earners below R500k. In this note, we focus on the racial composition of home buying as estimated by estate agents surveyed. Note that our Property Barometer surveys, from which some of this information is derived, is dominated by former “white suburban” estate agents in the major metros of the country, because the “suburbs” are the most highly traded markets. The FNB 1st quarter survey of agents showed buying by the so-called “Black” population group rising to its highest percentage of total buying since this survey question was started back in the 3rd quarter of 2005, while the group classified as “white” dipped to its lowest percentage of total buying since this survey question started. The 1st quarter 2010 survey estimate put white population group buying at 44%, while the black population group’s buying was estimated at 34% of total buying, not that far behind anymore, and a significant jump from the previous quarter’s 53% (White) to 28% (Black).

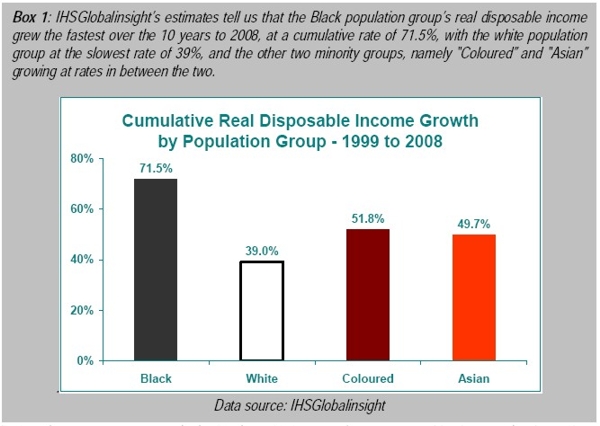

“Emerging” middle class could be the pillar of support for residential market in 2010, due to lower indebtedness amongst income earners below R500k. In this note, we focus on the racial composition of home buying as estimated by estate agents surveyed. Note that our Property Barometer surveys, from which some of this information is derived, is dominated by former “white suburban” estate agents in the major metros of the country, because the “suburbs” are the most highly traded markets. The FNB 1st quarter survey of agents showed buying by the so-called “Black” population group rising to its highest percentage of total buying since this survey question was started back in the 3rd quarter of 2005, while the group classified as “white” dipped to its lowest percentage of total buying since this survey question started. The 1st quarter 2010 survey estimate put white population group buying at 44%, while the black population group’s buying was estimated at 34% of total buying, not that far behind anymore, and a significant jump from the previous quarter’s 53% (White) to 28% (Black).  One data point is too early to draw conclusions, admittedly, but we believe that there is strong reason to expect the Black group’s buying to show strongly in 2010. While the long term trend towards a higher rate of Black buying is reflective of the steady transformation of the labour market, we doubt that this transformation alone will be the reason for a strong showing in Black group buying in 2010. This is because, in the 2008/9 recession, job shedding was the name of the game, so it is likely that transformation of the labour market stalled temporarily, and with it such widely divergent income growth rates between race groups as those seen over the past decade (see box below).

One data point is too early to draw conclusions, admittedly, but we believe that there is strong reason to expect the Black group’s buying to show strongly in 2010. While the long term trend towards a higher rate of Black buying is reflective of the steady transformation of the labour market, we doubt that this transformation alone will be the reason for a strong showing in Black group buying in 2010. This is because, in the 2008/9 recession, job shedding was the name of the game, so it is likely that transformation of the labour market stalled temporarily, and with it such widely divergent income growth rates between race groups as those seen over the past decade (see box below).

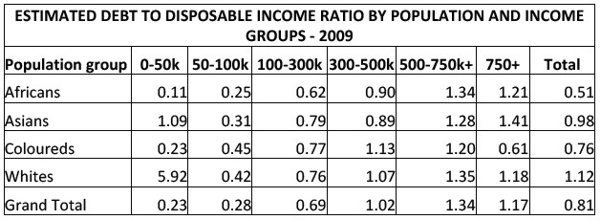

Rather, the strong start to 2010 in the Black population group’s percentage of buying, may be due to the combination of last year’s interest rate cuts and this group’s ability to grow its borrowing at a faster rate than the White, Coloured and Asian groups, which in turn is due to segments of it being less indebted relative to disposable income than the other population groups’ more established middle classes. This would partly conflict with a view held by some that this “Emerging” Black Middle class had been on a borrowing spree during the boom years, and may be in worse debt shape than other population groups. Our “conflicting” suspicion is based on Bureau of Market Research estimates of the household debt-to-disposable income ratio per race group and income band, as summarised in the table below.

According to the BMR estimates, the Black groups in the income bands R500k-R750k (1.34) and R750k-plus (1.21) have debt ratios very much in line with the national average for that income segment, having seemingly fully adjusted to the high borrowing/high spending western-style habits of their peers in other race groups. But it is down below the R500k income level where the Black population group appears to be in significantly better shape from an indebtedness point of view, having seemingly not yet caught up with “the Joneses”. The ratios of 0.90 and 0.62 for the R300-500k and R100-300k income bands respectively compare well with the higher 1.07 and 0.76 ratios for the White population group members within those two bands. As a result, following significant interest rate cuts last year, the Black population groups within these two segments may well have room to grow their new borrowing at a significantly faster rate than do the other three minority population groups, even should their disposable income not grow any faster than the other race groups in the same income brackets, implying that they can also grow their home buying at a faster rate. Assuming mortgage loan repayment-to-income ratios of up to 30%, this would be supportive of the market priced up to R1.3m. However, in reality, though, the average repayment-to-income ratio would be a lot lower than 30% in these more conservative days of affordability calculations and deposit requirements. Hence, it is likely that these less indebted Black income earners below the R500k income mark would be having a more profound impact on the market below the R1m price mark... Is this where we’re seeing the more significant increase in Black buying? Well, the agents surveyed in the Barometer tell us that in the lower income segment (self-classified by agents and with an average price of R616,900) the percentage of Black households buying is as high as 46% of total buying, suggesting indeed a “bias” of this group towards lower priced suburban areas. So, in closing, although the economy is slowly recovering, 2010 may still see job creation at a snail’s pace, as job creation recoveries tend to lag economic growth recoveries. In the absence of strong job creation, it could well be that the gap in income growth rates by race groups is drastically reduced for the time being, with all groups “chugging” along moderately. In this environment, the Black population group in the income bands below R500k becomes very important for residential demand, due to its estimated lower levels of indebtedness, meaning that they can grow their borrowing faster. In short, therefore, the jump in the Black population group’s suburban buying as a percentage of total buying in the 1st quarter may be less than a co-incidence, and we could see this group providing an important pillar of support for the market in 2010, especially in the sub-R1m market. This may not be solely the result of the group’s superior income growth (which should resume as job creation ultimately recovers), but also due to its noticeably lower level of indebtedness amongst income earners below the R500k mark.