The property market in Knysna has now finally turned the corner after several slow years, and is once again enjoying popularity as one of SA’s top choices.

That’s the word from Renate du Rand, owner of the RealNet franchise in Knysna, who notes: “Most of the surplus stock that had been on the market for some time has now been absorbed and we are even experiencing stock shortages in certain price categories and sectors, such as waterfront properties in the Thesen Island and Knysna Quays developments.

“This is driving prices up and a one-bedroom loft apartment in the Dry Mill luxury apartment block on Thesen Islands now starts at R2,5m – although this is inclusive of furniture and a private mooring.

“Prices for free-standing houses start at R5m and range all the way up to R17m, while in the Knysna Quays, the starting price for three-bedroom units is R2,65m, and that for four-bedroom units is R5,4m.”

She says her franchise has recently also had many enquiries for lifestyle farms and smallholdings on the Garden Route and recently sold a 4ha stand adjacent to the N2 for R500 000.

“A 15ha smallholding near Halkerville sold for R1,8m, and 26ha in an indigenous forest sold for R1,95m. We also have some other attractive properties listed, including 4ha of grazing land in Rheenendal for R950 000; a 28ha farm bordering the N2 for R2,5m and a 4200ha game farm in the Baviaanskloof.

Du Rand says current homebuyers in Knysna are mostly from Johannesburg, Cape Town and abroad, and that many are retirees, so are not dependent on home loans. “Quite a number of people are also purchasing now for future retirement use and renting their properties out on long-term leases in the meanwhile.

“The whole Garden Route area has once more become sought-after and as a result, business owners, developers and property investors are also finding it worthwhile to increase their footprint here again. We have recently concluded several transactions for retail centres and shopping centres, as well as income-producing commercial properties.

“For example, we recently sold the Rhapsody Centre in St Francis Bay to an SA investor who is expecting a 9% net return on his investment.”

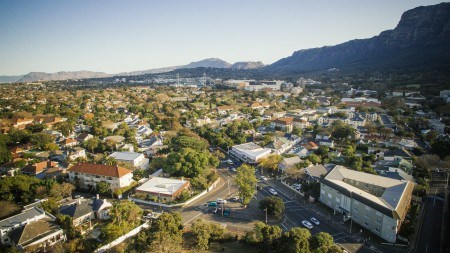

Other excellent investment and business properties currently listed, she says, include a mixed-use property with commercial/ office space as well as some new apartments, in George (see photo). “Returns of close to 10% can be expected here, since it is situated close to national retailers and a shopping mall.”