Nominal growth in the U.S. housing market continues in 2014. Existing home sales rose 1.3 percent to a 4.65 million unit pace. The gain was the first since December and was driven by a big uptick in sales of condominiums and co-ops.

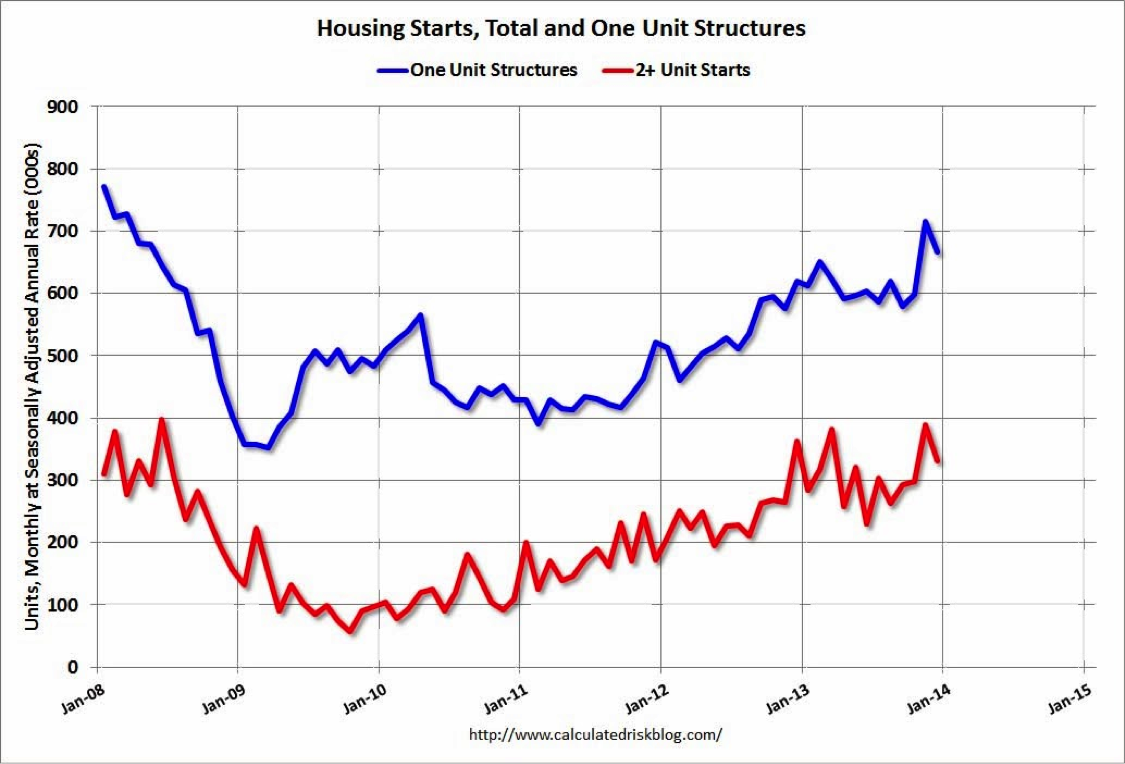

Despite the modest increase in sales, there are signs of robust recovery within the existing home market. Decline from the housing bust is continuing to gradually recede. Housing starts (new construction homes) are on a strong climb, up 85% since 2009 lows. Distressed sales have steadily fallen over the past year, with bank-owned inventory and short sales shrinking to 5 year lows, and investors account for a smaller proportion of homebuyers. Inventories increased during the month, which is a good sign for the market. Many potential buyers have been put off by the lack of available inventory or have been out-bid by cash buyers. Cash buyers still represent a large proportion of buyers, reflecting tighter underwriting standards and more stringent income documentation requirements.

New home sales improved this past month, with sales jumping 6.4 percent to a 433,000-unit pace. Sales for March were also revised higher. Most of April’s gain was concentrated in the Midwest, where sales surged 47.4 percent during the month. That gain may have been helped by milder spring weather. Sales fell by 26.7 percent in the Northeast, rose 3.1 percent in the South and were unchanged in the West. The big rise in sales in the Midwest, an area where prices tend to be more modest, combined with the decline in sales in the Northeast, where new homes tend to be fairly pricey, helped pull both median and average new home prices lower in April. Both are also lower on a year-to-year basis, suggesting that builders are discounting a bit more and selling more homes that are less expensive homes.

The lack of improvement in the housing market is leading to calls for policy changes. Last week FHFA director Mel Watt stated that Fannie Mae and Freddie Mac would not reduce loan limits on mortgages eligible to be purchased by Fannie Mae and Freddie Mac. This week, Federal Reserve Bank of New York President Bill Dudley floated the idea that the Fed may not want to let its mortgage-backed securities portfolio roll off once the Fed winds down its securities purchase program this fall. Both proposals recognize that there has not been enough improvement in the housing market to begin to withdraw the extraordinary support put in place over the past few years.

But let’s talk about affordability and debt as an indicator of growth potential. Understanding how financing drives home values in the U.S. will help you profit from “blue sky” sub-markets and avoid the pitfall of investing in overvalued markets.

Some noteworthy stats:

65% of Americans own their home vs. rent (down from 69% in 2004)

71% of homeowners have a mortgage, hence, the importance of following availability of financing and it’s cost – Americans don’t buy a purchase price, they buy a monthly payment.

This is a very important paradigm shift for residential investors: home prices are a product of our capital markets.

Consider the two scenarios:

Home price: $200,000

Conventional loan down payment (20%): $40,000

Monthly payment on the balance (30-year amortization, 5% rate): $859

The same loan at 6% rate (1% point higher than the example above) produces a $959 monthly payment.

If we apply the same debt-to-income ratio, the home would have to be priced at $179,125 (more than 10% less) to result in the same $859 monthly debt burden.

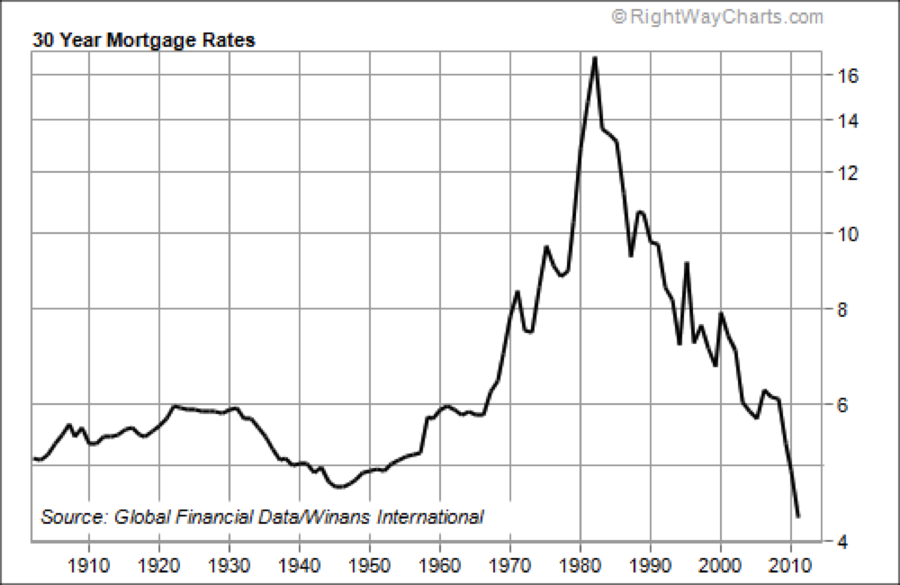

With mortgage rates expected to return to historic norms in the coming years (6.5% is “normal” in the U.S.), home prices would have downward pressure with a 2%

In a debt culture, this is why it is so important to watch interest rates, especially in less affordable markets where home prices are high relative to local incomes.

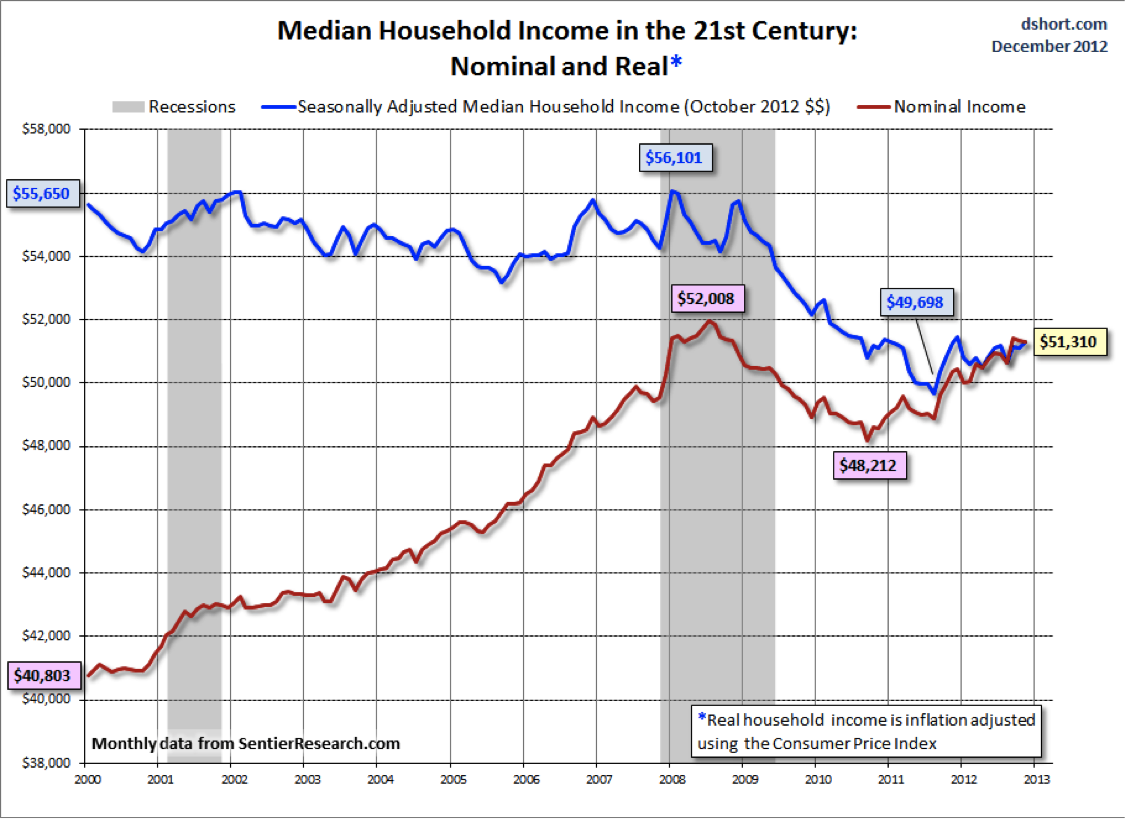

Real median incomes in the U.S. haven’t climbed since 1999. Practically speaking, American housing costs are a heavier burden today than 15 years ago, hence, the importance of investing in affordable markets for safety and sustainable growth. That is, markets where conventional mortgage payments are ideally no more than 15% of local incomes.

How do we calculate affordability by this measure?

Here are the steps:

Step 1: Research the average home price for the Metro Statistical Area (MSA) you are considering. In this scenario, we’ll call it $190,000 (the average U.S. home price today).

Step 2: Research the average household income for the MSA you are considering. We’ll use $52,000 (the U.S. average)

Step 3: Translate the home price ($190,000) into a monthly payment based on today’s debt assumptions on a 30-year mortgage. In this case, the principle and interest payment on 80% of our purchase price would be $748 per month.

Step 4: Divide our monthly loan payment by our monthly household income to arrive at our housing expense ratio. Our scenario: $748 / $4,333 = 17%.

Since we used U.S. averages, we could say the average American household spends 17% of their gross household income on housing debt. If we were to encompass all housing costs, we would also include the cost of property taxes, hazard insurance, and homeowner’s association fees, if applicable, to arrive at our true total housing expense which is how lenders calculate debt to income ratios.

Note: the maximum housing expense allowable for conforming loans is 28%.

Understanding how to identify affordable markets in a slowly recovering economy will shelter you from saturated markets and posture you for maximum safety and appreciation potential.

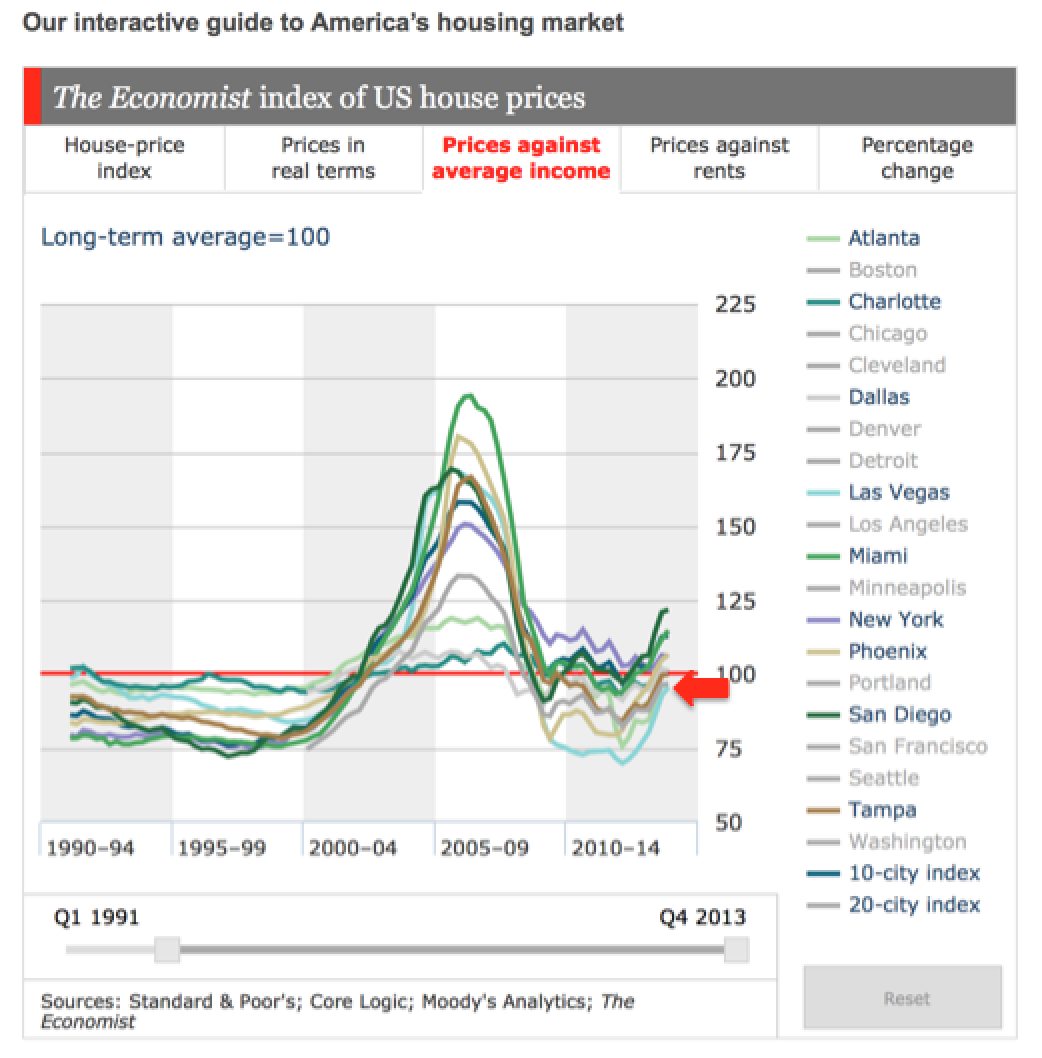

As you will see from The Economist graph below, which is the most thorough data available, Atlanta and Las Vegas as the two most affordable markets in USA.

We believe investing is all about the Right Information and the Right Partners. In Atlanta we have all the right information, along with it being the 4th biggest city in USA, the number one place to live in 2013 and most importantly the population and economy growing. All these fundamentals leads to long term sustainability and success and it is why we have been investing million of dollars in Atlanta for the last couple of years. Our partners our outstanding and we currently have over 80% of our clients who invest with our partners in Atlanta reinvesting, which proves what they offer.

In comparison we have not invested in Las Vegas, because we don’t have the Right Partners on the ground and thus no matter how good the opportunity is we cant execute on it. There is no point on buying a bargain – residential or commercial, if you can’t collect the income as then you basically are not buying an investment.

If you want to be successful there are only two things you need to have – the Right Information and the Right Partners. Without either you will fail, like over 80% of international investors who actually lose money!

At IPS and Wealth Migrate, with 227 years of International Real Estate Experience, facilitating investment in 10779 investments to a value of $1,32 billion on 5 continents, we have the ability to help you find the right information and the right partners, whether it is direct investment or through our world class crowd funding platform. For more information go to www.ipsinvest.com or www.wealthmigrate.com

John Chin

USA Asset Manager