Gearing, return on investment (ROI) and gross yield - explained. Ensure that you fully understand, the responsibilities and costs of property ownership

WHAT DOES 'GEARING' MEAN, WHEN INVESTING IN PROPERTY?

If the total costs of ownership on your rental investment is greater than the rental return you receive, then your property is negatively geared. Negative gearing can cause substantial financial strain if not firmly anticipated and planned for.

Vacancies would increase such strain tenfold as your rental return would be severely impacted, especially in the early years, when your rental pool may only be one or two properties. If you do not have the finances to cover loan repayments, body corporate or estate levies and rates and taxes, such a situation can quickly become debilitating. Ensure that you budget correctly and take negative gearing into account.

Furthermore, ensure that you understand fully, the responsibilities and costs of property ownership. Plan for rental management fees, rates, taxes, levies, insurance, maintenance and repairs, bond and interest payments, monthly utilities, conveyancing fees, transfer duties, bond registration and all the other expenses that may impact the viability of your rental investment.

Once your investment is cash flow positive you can consider investing in another property, and in this way gradually build up your property portfolio and in turn grow your wealth.

About negative gearing and the costs of ownership

Always leave yourself enough room to move, should the interest rate rise rapidly, or some other external influences affect the market dramatically. Keep an eye on your bond rates and ensure you have enough time to fix any variable rates should the economy start going south. As much as leverage can be your best friend in investment property, it also has the potential to be the worst enemy to the ill prepared property investor.

Ensure that you budget correctly

Before making any investment, you must ensure that you are in a suitable financial position to afford to do so. Forecast your expenses and ensure that you don’t put yourself in a position where you can no longer afford to hold on to your investment and where you may be forced to sell quickly. Forced sales are rarely good sales.

Assess your income, your discretionary income, your monthly bills, and your discretionary spend and then ask yourself three questions:

Question 1: How much can I realistically and consistently afford for a deposit, purchase costs, ongoing bond repayments and other, often forgotten, monthly property expenses?

Question 2: How long would I be able to carry my investment in the event of a vacancy, rental delinquency or eviction?

Question 3: Should the economic environment dramatically change and interest rates soar, how much of a change in interest rates would I be able to handle?

DON'T INVEST WITHOUT RUNNING THE NUMBERS FIRST

We understand that maths is not everyone’s strong point. This having been said, all the formulas required can easily be found in Excel or Google Sheets.

Keeping a spreadsheet to evaluate properties on the fly is a very useful tool. Evaluate all facets relating to both your primary investment strategy as well as your chosen exit strategies.

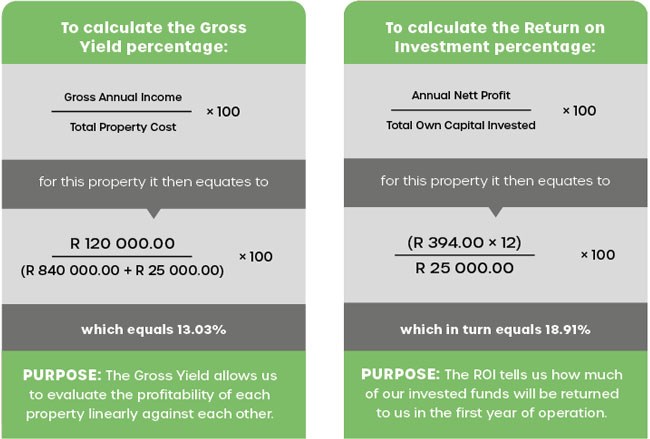

The two most commonly used metrics for evaluating property investments are Yield (also known as Gross Yield) and Return on Investment (ROI). These are not by any means the only ones a professional property investor should keep in mind.

Let’s say, for example, that:

- The investment property is worth R 840 000.00;

- Conveyancing fees, transfer duties or VAT, bond registration charges etc. all amount to a further R 25 000.00.

- The property has the potential to bring a realistic rental of R 10 000.00 per month.

- Monthly expenses, other than the bond repayment, will amount to a further R 1 500 per month.

- The capital appreciation of the property is expected to average at 6% for the immediate future.

Then:

- The annual gross rental income is 12 x R 10 000.00 = R 120 000.00.

- The annual nett rental income before paying the bond is: R 120 000.00 – (12 x R 1 500.00 = R 15 000.00) = R 105 000.00.

- A 100% bond at 10% interest over 20 years requires a repayment of R 8 106.00 per month.

- Total monthly expenses are then R 8 106.00 + R 1 500.00

= R 9 606.00, leaving a nett profit of R 394.00 pm.

Now that you know where to start...

you understand some of the financial aspects of investing...

and we have touched on the investment evaluation metrics...

The next step in your Buy-to-Let Investor Guide is "Costs to take into account when running the numbers":

- Where to start?

- The financial aspects of investing in property

- The metrics used for evaluating property investments

- Costs to take into account when running the numbers

- Managing tenant relationships professionally

- Education, team and exit strategy