The year started off well with a storm of real estate activity and normalization of the market leading up to the world cup. But this quarter has been very unexciting with little activity with house prices dropping off marginally.

Is this something we should worry about?

Not in my view….but let’s look at the fundamentals. First let’s look at the 5 reasons economists tell us are the reasons why house prices are stagnant;

Economy - The South African Economy is still sluggish with GDP expected in the range of between 2.75%-3.75%. The firm rand has kept our exporters subdued and job losses continue and family income remains constrained.

Surplus of stock – there is no doubt that the boom of the last few years created more stock than the market could absorb, and developers are still struggling to offload their remaining stock.

Disposable income – the average consumer is still under pressure from high levels of debt, and lower income. While the interest rate decreases have put more cash in the hands of the average family, increased utilities, electricity, rates, water and tolls have eroded some of this.

Credit conditions – Banks stringent credit conditions have kept the market subdued and it has become very difficult for first time home owners to get into the market.

Consumer confidence – Demand drives prices upwards and there is no doubt that public perception has moved negative toward property.

So we know why the statics show prices dipping but first let’s look at the real facts.

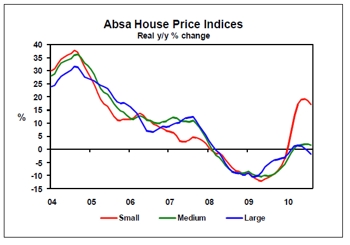

ABSAs figures (see graph below) show that overall the price of the average home grew only by 2.9% AFTER inflation so far this year, which at worst case tells us that on average your property investment or home appreciated faster than the cost of living. As investors we try to identify property that will appreciate faster than average and again the average small house is still looking good.

Typically a buy to let property, according to ABSA figures , would probably enjoy a growth over inflation of 13.8%. if you have rental income to add of say 5% 9 (Nett) on the value of the property you should still be earning a very tax efficient 18.8% on your gross investment – still good for me.

But here is my view of what is most likely to happen considering the 5 problem points above. Government has much in its arsenal to stimulate growth and with the Medium-Term Budget statement expected on 27 October and the next SARB MPC meeting on 16-17 November, we should see some adjustments to the sails. basically in a world of low interest rates our interest rates are still too high. One of the most obvious tools available to the reserve bank would be to drop interest rates further, taking pressure off the rand, and putting disposable income in the hands of consumers and business.

Consumer confidence should not be an influencing factor when considering real estate investment, but growing consumer confidence will push up demand for housing, and according to FNB /BER consumer confidence stood at +15 and confidence about own financial prospects fluctuated in +20 to +25 territory. So consumers are more confident than they have been since post 2004 when we experienced an unprecedented consumer boom. So if this is anything to go by, consumer confidence is moving strongly positive, but yet to boil over into consumption and real estate.

Affordability is still our biggest challenge but the average household debt is decreasing strongly and together with a more generous credit outlook that we are experiencing from the banks, this can only be a positive influence. A further interest rate decrease, which seems inevitable, will further improve both affordability and confidence.

Finally we see the volume of stock from developers drying up, even a few new schemes now finding their way onto the market. This is a real indication that prices will firm and new stock will not come at a discount for much longer. Again FNB building survey shows that although residential building plans submitted for approval are up, the completed buildings are only 50% of where they were at the peak in the third quarter of 2008.

Less stock coming on to the market and increasing demand.

A combination of even some of the solutions to the 5 points above will lead to price inflation in housing...