While we should not read too much into the property price stats and analysis released every month by the banks and others, I can’t help keep an eye on the broad trends to reaffirm my own investment appetite. There is so much news about the on-going European and American debt crisis, and the potential knock on effect it will have on our own economy that one needs re-affirmation and motivation to stay the course with real estate investment, and to be even bolder as others shy away from buying residential real estate.

Without getting too heavy I found the facts quite obviously shouting out in favour of this asset class.

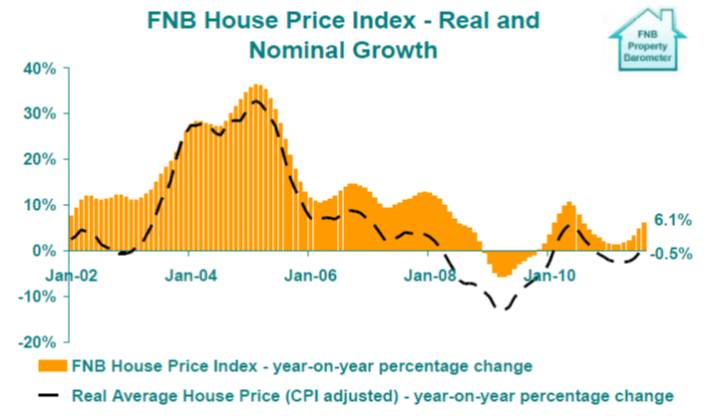

Take a look at the graph below. If you were pretty average and bought an average property in 2000 for cash, and held on to it for all of 11 years, even having the benefit of living in it for the period, you would have done pretty well growing your money by_ 214%_. And according to FNB, even if you had taken inflation (CPI) into account you would still be up 64%. I can’t help thinking that this must be the ultimate advert for real estate investment. Can you imagine if you had taken advantage of leverage, and rented the house out to cover the bond what your returns could have been?

Another thing we should read into this is that in a particularly poor economy the index was the highest ever at 314, 6, so property you could say has never been so expensive.

I (like many other residential investors) am working on the assumption that house prices will remain flat for the next 12 months at least, and will buy property that is being sold below market value in an area where rental yield is good and where I can earn a nett income to cover my expenses after paying a small deposit. So any positive growth in the next 12 months is a bonus. So the stats shown below are again encouraging.

The FNB House Price Index rose by 6.1% in August compared with August a year ago, and an improvement over July. The black line shows the real increase after adjustment for inflation and it seems like the average house is again growing in value at a rate faster than inflation!

Too much analysis of these broad averages is misleading and if you are an astute investor, you will probably have selected property that is performing better than average, and you will have geared it to accelerate your returns.

But as they say the stats don’t lie.