|

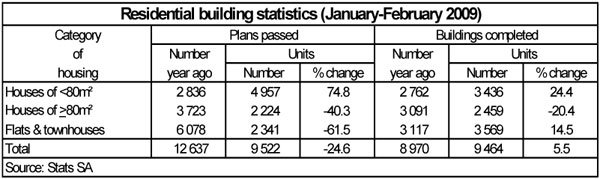

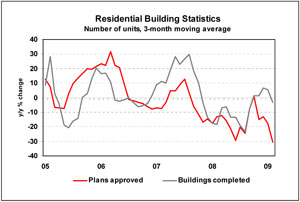

In the first two months of 2009, residential building plans with a total real value of R2,61 billion were approved by local government institutions, which was a massive 53,4% lower compared with R5,6 billion in January-February 2008. However, the real value of residential buildings reported as constructed in January-February this year was slightly up by 0,2% year-on-year (y/y) to R3,26 billion compared with R3,25 billion in same period last year. All real values are at constant 2005 prices. The number of residential building plans approved for houses smaller than 80 m² was sharply higher by 74,8% y/y at 4 957 units in January-February this year. This development will contribute to higher levels of supply in this segment of the market. With regard to houses larger than 80sqm and flats and townhouses, major declines occurred in the number of plans approved on a year-on-year basis (see table below). This is an indication of the extent to which the market for new housing in these segments has slowed down compared to a year ago, largely driven by the economic condition impacting the household sector over a wide front.

With the economy believed to be in a recession, and many households expected to experience financial strain as a result of probable further job losses in many sectors of the economy, the demand for new housing is set to remain depressed in the rest of the year, despite declining interest rates. |

News

Residential building statistics released by Statistics South Africa for January-February 2009 indicate that the building plans approved for new housing slowed down sharply in some segments of the market, while the construction side showed some improvement compared with the same period last year.

Residential building statistics released by Statistics South Africa for January-February 2009 indicate that the building plans approved for new housing slowed down sharply in some segments of the market, while the construction side showed some improvement compared with the same period last year.