October property statistics released by ooba, South Africa’s largest bond originator, show an increase in residential property prices, despite current weak economic growth.

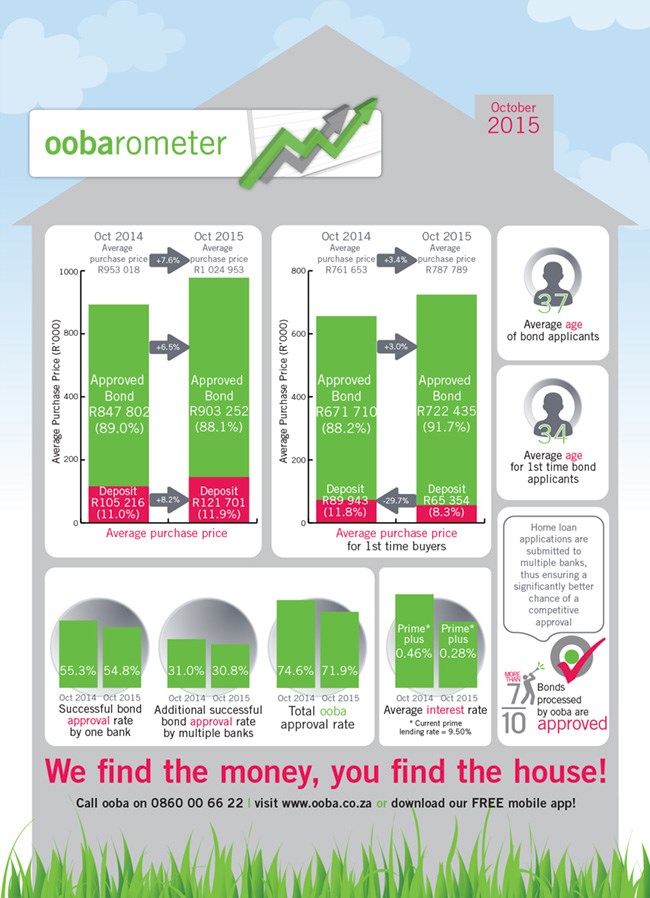

ooba’s Average Purchase Price rose by 7.6% year-on-year price to R1,024,953 in comparison to the price growth of 5.7% recorded in the third quarter of 2015. First-time Buyers’ Purchase Price showed a milder year-on-year increase of 3.4% to R 787,789.

“The moderate acceleration in house price growth is primarily due to demand for residential property exceeding supply, as a result of stock constraints. However, home buyers are under increased financial duress which is evident by the 2.7% drop in Approval Rates and the higher percentage of applications that ooba is receiving for 100% bond finance,” says Rhys Dyer, ooba CEO.

First-time Buyers continue to drive the market, with 54% of all ooba’s applications received in October from this segment. “As this segment of home buyers generally do not have access to deposits, increased First-time Buyer activity accounts for ooba’s statistics showing a 2% year-on-year increased demand for 100% bonds,” adds Dyer.

Despite lower approval rates, lenders are continuing to compete for the home loans market, evidenced by the 18 basis point year on year improvement in the Average Interest Rate recorded in October at prime plus 0.28% compared to prime plus 0.46% a year ago.

Another emerging trend is a slight resurgence in activity in the buy-to-let market, constituting 5% of all applications received by ooba in October, up 2% from the previous year.

“Economic pressure on prospective property buyers affects the affordability of housing as well as the ability to obtain a bond. By using ooba’s bond origination service, prospective buyers can secure the most favourable home loan deal. Our free prequalification service ensures that prospective buyers are shopping in an affordable price bracket. This allows home buyers to focus on finding their dream home, while we find the money,” concludes Dyer.