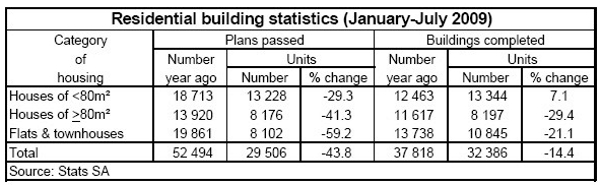

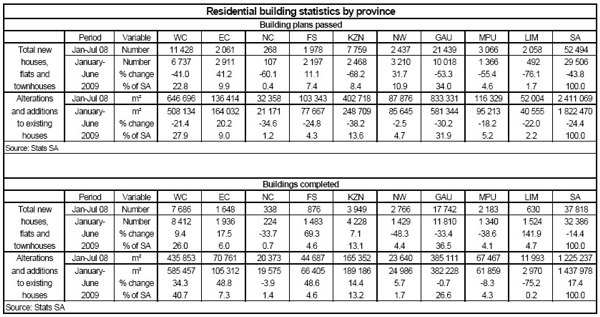

Residential building activity experienced significant strain in the period January to July 2009, according to data released by Statistics South Africa. These statistics indicate that both the planning and construction phases remained under pressure, reflecting conditions in the housing market. In the first seven months of 2009 the real value of plans approved for new residential buildings amounted to R9,92 billion, which was 47,5% lower compared with a real value of R18,89 billion recorded in the same period last year. The real value of residential buildings reported as completed in January to July this year was down by 22,8% at R10,42 billion compared with R13,5 billion in the first seven months of 2008. All real values are calculated at constant 2005 prices. In January to July 2009 the number of residential building plans approved was down markedly in all three segments of housing compared with the same period last year (see table below). The number of new housing units for which plans were approved was down by 73,6% y/y and 24,3% month-on-month (m/m) to a total of 3 222 units in July 2009. This was the lowest number of residential building plans approved since the end of 1993. The total number of new housing units completed was down by 14,4% y/y in January - July 2009, mainly driven by the segments for houses larger than 80 m² and flats and townhouses. The number of houses less than 80 m² was up by 7,1% y/y in the first seven months of the year, supporting the demand for housing at the lower end of the market. In July the volume of housing units constructed was down by 33% y/y, but up by 2,3% m/m to 4 072 units. The total square metres in respect of plans approved for alterations and additions to existing houses were down by 21,4% y/y in January to July this year. However, the total square metres reported as been completed with regard to alterations and additions to existing houses were up by 17,4% y/y in the same period. Domestic economic trends since the start of 2009 adversely influenced employment, household income and consumer and investor confidence. As a result, residential building activity is expected to continue experiencing difficult times for the rest of 2009 and into 2010. Activity in this sector of the economy is only expected to bottom and recover gradually during the course of next year, based on demand and supply conditions for new housing.