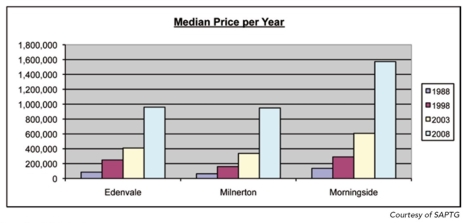

Knowledge Factory’s SAPTG undertook an analysis of an average priced property over the past five, 10, 15 and 20 years to determine the long-term value of property.

The SAPTG data revealed some interesting statistics, and the current middle-market value was determined as properties valued/sold between R750 000 and R1,5m.

They then identified properties that sold at a value between R750 000 and R1,5m from 2006 to 2008. These properties were then used to calculate the median price per year from 1988 to 2008. The 20-year compound annual growth rate (CAGR) was also calculated and extrapolated until 2012.

The data indicated that middle-market properties appreciate at a CAGR of 13,15%, calculated over 20 years. The median price in 2008 was R970 000, with the extrapolated value at R1 590 462 in 2012.

While statistically it may be evident that middle-market homes do attract a reasonable value growth, what do the estate agents have to say?

Herschel Jawitz, chief executive of Jawitz Properties, says generally, the higher the value, the greater the level of appreciation. “The value of middle-market homes may be constrained by affordability factor – what can middle-income buyers pay for these homes before they are priced out the market? The middle market is very interest-rate sensitive and is therefore much more sensitive to economic conditions,” he says. Jawitz also mentions that the middle market has probably suffered the highest price decline relative to both the upper and lower priced markets as homeowners have been forced to sell and demand has fallen substantially.

Tony Ketcher, MD of Seeff Randburg, says that there will always be demand in this price range because it is often here that folk enter the market for the first time. “What has happened with the ‘credit crunch’ is that certain buyers have down-scaled their expectations. For example, maybe a goal two years ago was to buy something in what was regarded as more affluent suburbs like Fourways and Sandown. These buyers are now looking in the more affordable suburbs like the ones mentioned above. We have had our most successful agents in 2008 operating in these areas,” says Ketcher. “If one tracks price growth, history has proven that these areas can be good investments. Weltevreden Park has experienced growth at 17.82% per year over the past five years and 12.77% per year over the past three years. Montgomery Park has had a similar experience – 16.71% per year over the past five years and 10.18% per year over the past three years,” Ketcher says.

Lew Geffen, chairman of Lew Geffen Sotheby’s International Realty, has been tracking average property prices in Johannesburg since 1990. “We have drawn in a nominal growth line of 9% per annum. The property market was out of sync during the years 1990 to 2002 emanating from the apartheid era, which sank the property market to artificial lows. Since 1998 we have been catching up to where we should have been and are now over the trend line due to phenomenal demand as a result of low interest rates and a burgeoning population,” says Geffen. “The affordability of properties is now a factor and that is why we have seen a slowdown in sales volumes.”

The appreciation trends for middle market homes, it seems, is not limited to areas within Gauteng. Tony Hickman, KwaZulu- Natal Committee chairman of Seeff, and MD of Seeff Westville, says that middle-market homes have definitely and always will appreciate over time as there are more prospective buyers in this price range than higher up the price scale. He cites an example of a four-bedroom family home on dead level land with a swimming pool in a good area of Westville in KwaZulu- Natal. This property was sold by Seeff in October 2004 for R880 000. The same property was recently resold for R1,2m – despite having deteriorated in condition as the first purchasers emigrated and rented the property out, so it was not maintained to the same standard.

“This is one of many similar examples of homes in Westville and Cowies Hill in the R900 000 to R1,5m price range where the average selling price is currently about R1,3m,” says Hickman.

Laurie Wener, MD of Pam Golding Properties Western Cape, operating in the Cape Town metropolitan areas, refers to properties priced between R2,5m and R4,5m when she says that under current market conditions, this sector is under pressure as most purchasers at this level require mortgages and those are in short supply, as are qualified buyers. “There are some examples where investors have bought apartments in Cape Town’s central city at the R2,5m mark with 90% bonds. The market is now unwilling to pay more than R2m for the same apartments, which are also taking time to sell. Any property purchased within the past two years at this level will most likely sell at a loss now,” she says.

What does the future potentially hold for properties in the middle market?

Jawitz says the prognosis for this sector will always be positive. “The middle class should be the fastest growing sector of our economy in the years to come, which will provide steady demand for middle-market homes. In the short term, however, this market will remain under pressure due to economic conditions.”

Ketcher says the decline in property prices over the past year in middle-market suburbs will create demand for various reasons. “There are owners who need to sell, possibly because of relocation, the need to upgrade size and also, unfortunately, distressed sellers under pressure to pay the mortgage,” he says. “It is pertinent to mention that the price declines we are experiencing are cyclical and one must look at a property investment over the longer term – three to five years – for good returns. There are good deals to be had at basement prices and if you have the confidence that prices will grow over the next few years, you have a good buy.”

Ketcher would suggest that a purchase of a property now in the R900 000 to R1,5m range will see growth over the next three to five years. He says that the returns may not be at the levels experienced in 2004 (32%), but there will be positive growth. And, he says, if we keep inflation under control, then the returns will be positive in real terms.

Hickman too says their prognosis for this sector of the market is positive as more and more buyers will enter the market in this price range as the economy develops. “Obviously the property market is going through a very difficult period but when the turnaround inevitably comes, we see the middle-market homes coming into their own again and offering excellent investment potential and growth well into the future.”

Martin Schultheiss, CEO of Harcourts Africa, says there is no doubt that the middle to lower end of the market is the place to invest for property growth. “Over the next 10 years we are predicting to have 19 million people move into the formal housing market and there to be an upliftment of society,” he says. “We have numerous examples where you have an area experiencing sudden demand and good growth. Even during the recession, the demand for middle-income housing continues. The investors in property today are spending more time focusing on this market as opposed to the top end market,” he says.

In Knowledge Factory’s SAPTG research, median values were used as opposed to averages as a median is statistically accepted as being a more accurate “general” value as it indicates the middle ranked value in a set of data, as opposed to the average, which calculates the total value divided by the number of records. Extreme (very high and very low) values will skew average values, whereas the median is simply the middle value in a series of numbers and is therefore not affected by severe outliers.

Article courtesy of  and is taken from their May/June 2009 Issue.

and is taken from their May/June 2009 Issue.