“Supply always comes on the heels of demand” – Robert Collier.

I am sure Robert Collier would agree that the opposite is also true. By “reducing supply will eventually increase demand” as too much money chases too few goods. It’s no secret that we are coming out of one of the worst recessions on record, which has had a marked effect on demand for property, especially residential property. (Commercial usually follows the cycle months later). Demand decimated the supply side of the industry. If demand is depressed for long enough, the supply of new houses will dry up as developers and speculators leave the market in increasing numbers, and in fact that is what has happened.

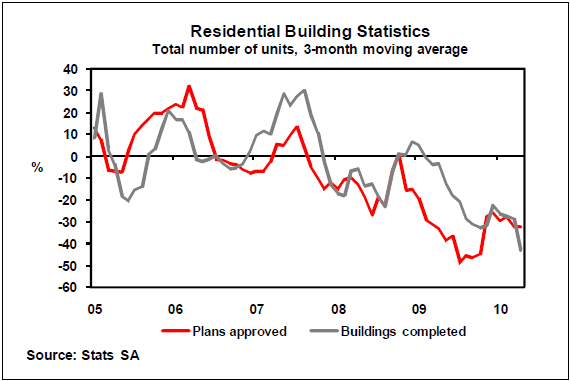

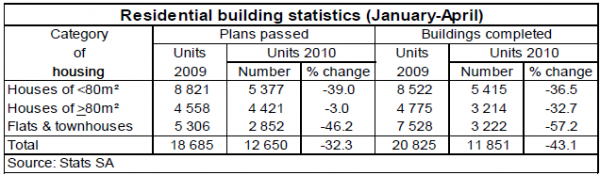

Stats released by ABSA on the 15 June show further deterioration in the volume of housing units completed so far in 2010 and an equally low number of new plans approved. Let’s face it 2009 was a bad year for property and any developer still submitting plans for approval was pretty determined, but look at what has happened in 2010, the year of the world cup and an economy surprising even the most optimistic of economists!

In the chart below “buy to let” products, predominantly flats and townhouses, decreased a further 46.2% from a pretty poor period of 2009!

I accept that reading the residential property market involves looking at all the fundamentals together. We will have to look at the effect of Job losses, the surplus stock left over from the boom, as well as the residential rental market.

I will argue in favour of house price increases for all these examples in a separate blog, but if you have strong opinion please comment below.

A recent NEWS article on the PP features a town called Lephalae. The town (previously Ellisras) is the place where Eskom’s new multibillion rand Madupi power station is being built, and already rentals have increased to the point where you can’t find a 2 bedroom apartment to rent for less than R6500 per month. The shortage of stock means that investors buying into residential developments can expect a rental yield of over 12 % plus strong capital growth. (If you don’t believe me look at the development featured below)