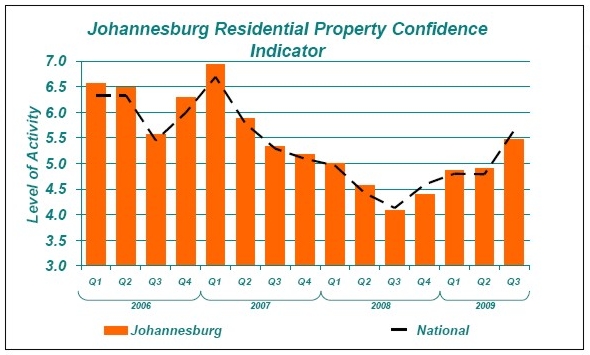

The 3rd Quarter Joburg FNB Residential Property Barometer pointed to a further rise in residential demand activity levels in the region. It would now appear that the positive effect of 5 percentage point’s worth of interest rate cuts since December 2008 is increasingly being felt in the property transaction volumes, with banking sector relaxations in lending criteria also playing a positive role. The Property Barometer is a survey of a sample of estate agents in the region regarding their personal experience of market conditions. The main Barometer question relates to the level of demand activity, and agents are asked to rate the level of demand that they experience on a scale of 1 to 10. After an initial rise in the preceding 3 quarters from 4.1 as at the 3rd quarter of 2008 to 4.9 in the 2nd quarter of this year, agents estimated that activity jumped more significantly from the 2nd quarter to a 3rd quarter level of 5.47. The 3rd quarter survey was undertaken in mid-August.

The 3rd Quarter Joburg FNB Residential Property Barometer pointed to a further rise in residential demand activity levels in the region. It would now appear that the positive effect of 5 percentage point’s worth of interest rate cuts since December 2008 is increasingly being felt in the property transaction volumes, with banking sector relaxations in lending criteria also playing a positive role. The Property Barometer is a survey of a sample of estate agents in the region regarding their personal experience of market conditions. The main Barometer question relates to the level of demand activity, and agents are asked to rate the level of demand that they experience on a scale of 1 to 10. After an initial rise in the preceding 3 quarters from 4.1 as at the 3rd quarter of 2008 to 4.9 in the 2nd quarter of this year, agents estimated that activity jumped more significantly from the 2nd quarter to a 3rd quarter level of 5.47. The 3rd quarter survey was undertaken in mid-August.

__

Although confidence levels are steadily improving, Joburg survey respondents are slightly less upbeat with regard to activity levels

__

__

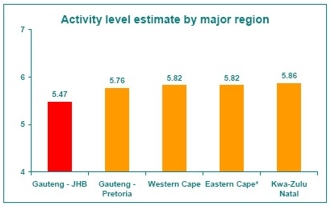

Although the region’s activity levels are steadily improving, the agents surveyed in Joburg rated the region as having the lowest activity level of all 5 major regions, at 5.47. The three major coastal regions’ agents surveyed, KZN (5.86), Eastern Cape (5.82), Western Cape (5.82) are now more upbeat in their estimates of activity compared with Joburg, while Tshwane (5.76) also has a slightly stronger reading than its neighbouring Gauteng city. Seller expectations appear to be becoming more realistic The percentage of properties sold at below asking price showed a significant decline from 86% in the 2nd quarter to 77% in the 3rd quarter, while the average time of a property on the market prior to being sold declined sharply from 21 weeks and 6 days in the 2nd quarter to 16 weeks and 6 days in the 3rd. These two indicators, when read together, point towards more realistic pricing by sellers. The greater realism may not only be due to sellers setting prices lower, but also due to the market catching up to price levels, therefore making previously unrealistic price levels now a little more realistic in a stronger market.

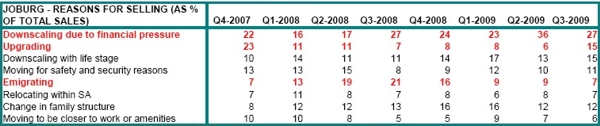

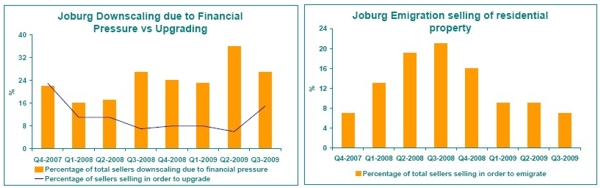

Reasons for selling reflect declining emigration and less financial pressure on households

In 2008, there were arguably 2 key reasons for selling that were largely contributing to the oversupply of property on the market. The big one was selling in order to downscale due to financial pressure along with emigration selling. Emigration selling reached an estimated peak of 21% of total selling (admittedly in a thin market at the time) in the 3rd quarter of last year, while selling in order to downscale due to financial pressure peaked at an estimated 36% in the 2nd quarter of this year. Since a year ago, emigration selling has declined steadily to 7% of total selling by the 3rd quarter of 2009, while selling in order to downscale due to financial pressure declined significantly off its 2nd quarter high of 36%, to 27% in the most recent quarter. A further reflection of better interest rate times was a quarter to quarter rise in selling in order to upgrade, from 6% of total selling to 15% of total selling in the 3rd quarter.

Main Joburg and Ekurhuleni Metro Estimated Price Trends (using Deeds data) still reflected recent oversupplies and widespread price deflation in 2nd quarter  Year-on-year price deflation was still widespread as at the 2nd quarter of 2009 in many regions of Greater Joburg. However, there were a few of the regions that were starting to appear to be turning for the better, either in terms of year-on-year price deflation starting to level out, diminish, or in some instances a rise in price inflation.

Year-on-year price deflation was still widespread as at the 2nd quarter of 2009 in many regions of Greater Joburg. However, there were a few of the regions that were starting to appear to be turning for the better, either in terms of year-on-year price deflation starting to level out, diminish, or in some instances a rise in price inflation.

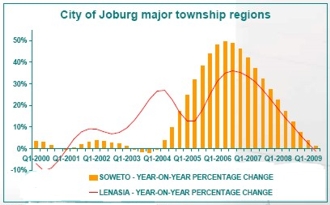

Soweto (avg. price = 290,611) showed y/y (year-on-year) price inflation of 1.2% in Q2 2009, but remained in mild deflation on a q/q (quarter-on-quarter) basis to the tune of -0.1%.

Lenasia (avg. price = R364, 496) slipped into price deflation with a Q2 y/y decline of -1.2%.

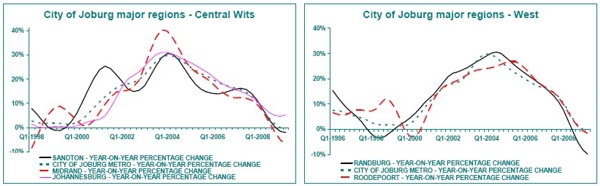

Randburg (avg. price = R936, 478) showed price deflation of -9.8% y/y in Q2 2009

Roodepoort (avg. price = R923, 936) showed slight price deflation of -1.6%

Midrand, an area of huge property development in the past decade, and thus probably of major oversupply, (avg. price = R893, 097) showed price deflation of -7.1% y/y in Q2 2009

Sandton (avg. price = R1.465m) showed price deflation of -2%

Johannesburg (avg. price = R1.088) showed price inflation of +5.2%, which was an improvement on the previous quarter.

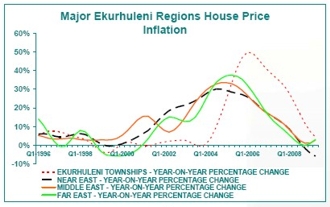

The Near East (Alberton, Bedfordview, Edenvale, Kemptonpark, Germiston) (avg. price = R852, 888) showed price deflation of -5.8% y/y in Q2 2009.

Middle East (Benoni, Boksburg, Brakpan) (avg. price = R785, 348) showed price inflation of +2.7%, an improvement on the previous quarter.

Far East (Nigel, Springs) (avg. price = R501, 215) showed price deflation of +3.0%, also improving on the previous quarter.

Ekurhuleni Townships (avg. price = R269, 943) showed inflation of +4.4% y/y but still decelerating.

__

Interpretation/Conclusion__ Although not expected to be a strong recovery, it is clear that a recovery in the Joburg residential market is well under way. Demand activity has risen consistently over the past 4 quarters, while other key indicators such as average time on the market and percentage of sellers achieving their asking price have also improved. Deeds data runs a bit behind, but while area price deflation was still widespread as at the 2nd quarter, one could begin to observe some of the Joburg regions’ price indices beginning to turn for the better. To date, the market improvement is largely the result of interest rate cuts, and banks’ responses to better market conditions by relaxing lending criteria have reinforced the trend.