So have you wondered why most of the market sells when it should be buying and buys when it should be selling, or perhaps does neither, waiting for a bolt of lightning or some other sign to act?

There is a lot of property that I would not buy right now, but I can’t understand why more investors are not tucking into the great deals that this market has on offer in the buy to let segment.

According to the FNB Estate Agent Survey for the 3RD quarter of 2010, released today, buy-to-let buying as a percentage of total property buying is at its record low point of 7%.(7% of the total market). Residential rental growth is “flat” according to Rode in his third quarter review, with only an average 4.4% Y on Y growth rate anticipated.

The fact is these broad statements distort the facts. You can buy good buy-to-let property yielding in excess of 9% from rental income on affordable properties. Interest rates have been cut by another 0.5% to give some relief to the economy, the lowest rate in the last 30 years, so a reasonable risk buyer who could get a bond at prime would pay 9.5% to finance the property, and with a 10% deposit the property would be cash flow neutral. There is also talk of a further interest rate cut in September.

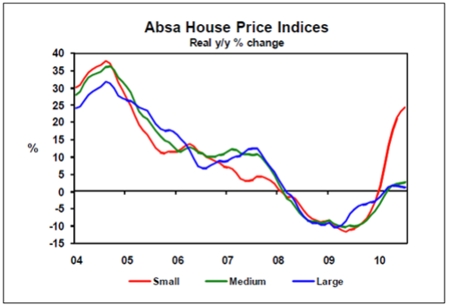

But add to that the fact that in addition to the rental income you should expect some capital growth, depending on the type of house and its location. Residential properties that give a strong return on the money that you have invested (yield) are generally in this small house category which is still powering along showing REAL price inflation of 24.1% in July.

That means after allowing for inflation you have grown your investment by over 20% per annum. But if you had a bond of 90% on the property and the income was covering the costs of the bond your real return on the cash deposit that you put down would be significantly higher than 20%.

So by reporting trends from statistics often do the reverse of what the purpose is in the first place. Remember to use a bit of common sense or you will be following the lemmings, buying at the top and selling at the bottom. That’s not really the objective!