ooba’s fourth quarter 2015 results continue to show property price growth in excess of inflation but slight dip in home loan approval rates.

Property statistics for the fourth quarter of 2015 released by ooba, South Africa’s largest bond originator, show house prices continued to grow in excess of inflation as the demand for residential property remained buoyant despite a weakening economy.

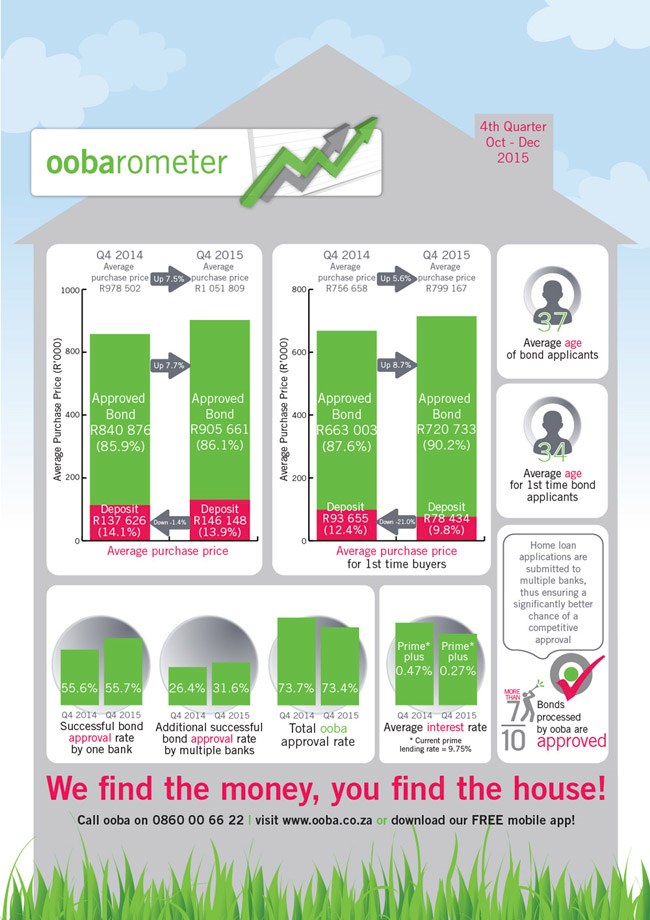

Compared to the fourth quarter of 2014, the Average Purchase Price increased by 7.5%, surpassing the R1 million mark from R978 502 to R1 051 809. The Average Purchase Price of First-time Buyers also continued to climb, increasing by 5.6%.

More significantly, the Average Deposit of First-time Buyers dropped by a notable 21%, compared to the fourth quarter of 2014, which is indicative of first time homebuyers continued ability to access finance in a competitive home loan market.

ooba’s Approval Rates in Quarter 4 2015 are 1% down on Quarter 3 2015, indicating the financial constraints that homebuyers are starting to face as a result of South Africa’s current tougher economic conditions.

Looking ahead at prospects for the property sector in 2016, Rhys Dyer, ooba’s CEO, is not expecting to see significant changes in the residential property market’s dynamics.

Says Dyer: “The market will remain constrained in terms of supply, specifically in the urban areas. The increase in property stock levels over the past seven to eight years was insufficient to meet the demands of South Africa’s growing population as well as the influx of people to the economic hubs of the country. Consequently, the market currently remains fairly well balanced in terms of supply and demand, and this is likely to continue in the early parts of 2016.”

Dyer points out that the supply of new properties did start to increase in the first half of 2015, with statistics for residential buildings completed growing by over 20% in the first half of 2015, but later dropping to 8% in the last quarter of 2015.

“The slower economic growth, exchange rate depreciation, which will drive inflation increases and consequently interest rate increases, and cost of living increases is likely to result in a slowdown in demand for residential property in 2016,” says Dyer.

This expected slowdown in demand, coupled with some improvement in property supply levels, will begin to impact property price growth into 2016. However ooba does not foresee significant reductions in property price growth this year. Property prices have been growing at between 6% and 7%. Dyer expects this growth rate to deteriorate slightly during 2016 to between 5% and 6%.

“On the home loan front, an increasing inflation environment off the back of the rand’s decline will intensify affordability pressure on homebuyers, which will likely increase home loan decline rates across banks,” adds Dyer.

Dyer envisages that the mix of home loan applicants will change in 2016. He expects a lower percentage of first-time home buyers, as they delay their decision to enter the market until the economic environment improves.

“We anticipate that more buyers will purchase within their affordability constraints and at lower levels, and that banks will drive buyers to put down larger deposits. Banks will be watching the consumer affordability position very carefully and will tailor their lending approaches, both in terms of the homebuyer and the property itself, to contain risk.

“Given the current affordability challenges faced by homebuyers, we encourage prospective home buyers, particularly first-time buyers, to use ooba’s bond origination service to successfully secure a home loan. With one of the highest approval rates in the market, our customers can focus on finding their dream home, while we find the money,” concludes Dyer.