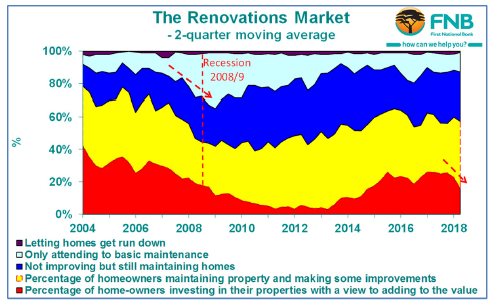

A new report reveals that although homeowners are still maintaining their homes, fewer of them are spending money on home improvements and upgrades.

The FNB Estate Agent Survey recorded a weakening in agent perceptions of overall home maintenance and upgrade levels in the 1st half of 2018. However, this was largely due to a perceived decline in the level of upgrades to homes as opposed to a weakening in general home maintenance levels.

Agents gave their perceptions regarding levels of home maintenance and upgrades, in 5 categories/levels of home maintenance and upgrades in the survey:

1. Owners are investing a great deal in improvements, renovations and value adding upgrades to their homes

This category showed a very significant weakening from 22.85% of total agents in the 1st quarter of 2018 to 15.5% of agents in the 2nd quarter, now significantly down on 26% highs reached in the 1st 2 quarters of 2017.

2. Owners are maintaining their homes well and making some improvements

This category has risen from 37.35% of agents in the 1st quarter of 2018 to 41.85% in the 2nd quarter, and is now noticeably higher than the 31% low recorded in the 3rd quarter of 2017.

3. Owners are not spending a great deal on improvements / value added features but they are still fully maintaining their homes

30.15% of respondents perceived this situation to be in the 2nd quarter of 2018, also mildly higher than the 28.65% in the 1st quarter.

4. Owners are really only attending to basic maintenance issues

This category also saw a slight increase from 9.85% of agents in the 1st quarter of 2018 to 11.85% in the 2nd quarter. Unlike the 3 categories above, a rise in this category is seen as a mild negative.

5. Owners are doing little to maintain their homes and are letting them get run down

This category actually receded form 1.85% in the previous quarter to 0.85% in the 2nd quarter of 2018.

Seen together, the 2 lowest categories have thus not receded significantly to date, which is important because these 2 categories are the ones that can point to the condition of an area deteriorating.

John Loos, FNB Property Sector Strategist says of the survey results, “This reflects a Household Sector that is increasingly financially constrained, thus cutting back on luxuries such as home upgrades, but not significantly financially stressed yet (financial stress would result in greater cutbacks in home maintenance too, such as was the case around the 2008/9 recession).

“The home maintenance situation is still perceived to be far stronger than it was during the 2008/9 recession, which is important from a mortgage lender perspective, lenders wishing to see the value of the security backing their loans being maintained as far as possible.”

He concludes with a note of caution, “With signs that a stagnant economy is here for the foreseeable future, along with rising personal and consumption-related tax rates, and recent petrol price increases, it is not inconceivable that levels of financial stress could gradually rise, which could start to exert greater pressure on home maintenance levels as well in the not too distant future.”