|

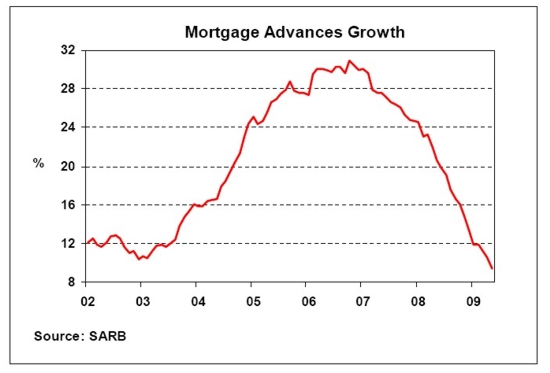

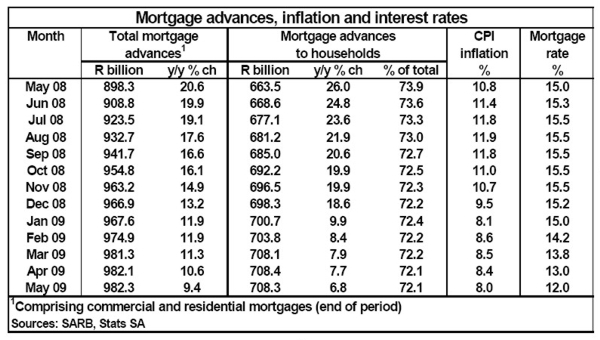

The year-on-year (y/y) growth in the value of total mortgage advances by monetary institutions (the net outstanding balance on mortgage loans at these institutions) slowed down to 9,4% in May 2009, from 10,6% in April, according to data released by the South African Reserve Bank. This was the lowest and also the first single-digit year-on-year growth in outstanding mortgage balances since September 2000. On a month-on-month basis the outstanding balance on mortgage loans was marginally higher in May, after growth of 0,1% was recorded in April compared with March. The year-on-year (y/y) growth in the value of total mortgage advances by monetary institutions (the net outstanding balance on mortgage loans at these institutions) slowed down to 9,4% in May 2009, from 10,6% in April, according to data released by the South African Reserve Bank. This was the lowest and also the first single-digit year-on-year growth in outstanding mortgage balances since September 2000. On a month-on-month basis the outstanding balance on mortgage loans was marginally higher in May, after growth of 0,1% was recorded in April compared with March.

Growth in the value of mortgage advances to households, mainly related to residential property, tapered off to 6,8% y/y in May from 7,7% y/y in April. The amount of outstanding mortgage balances in the household sector was slightly down to R708,3 billion in May, from R708,4 billion in April. Household mortgage advances had a 72,1% share in total mortgage debt in May, while having a share of 69,8% in total credit extended to the household sector in May.

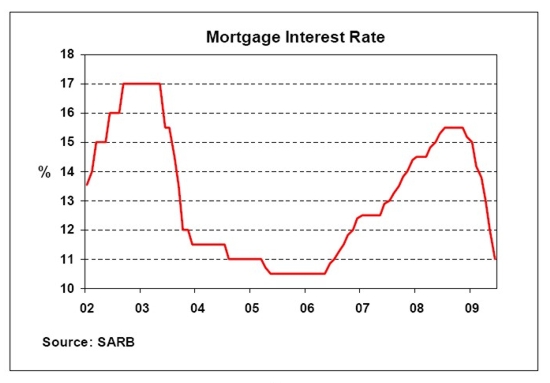

The ratio of outstanding household mortgage debt to disposable income was marginally higher at 49,5% in the first quarter of 2009, from 49,3% in the fourth quarter of 2008. This was the net result of markedly lower year-on-year growth in both mortgage advances to households and nominal disposable income in the first quarter compared with the final quarter of last year. The cost of servicing household mortgage debt as a percentage of disposable income was 7,1% in the first quarter this year, down from 7,6% in the preceding quarter, mainly due to declining interest rates in the first quarter.

Despite interest rates having been cut by a total of 450 basis points since December last year, mortgage advances growth is expected to slow down further in the near term on the back of prevailing economic conditions, which are a contributing factor in the relatively low demand for housing and mortgage finance.

|