The number of flats and townhouses completed last year ballooned by 51.4 percent year on year. This poses a potential threat to house price growth, says Standard Bank. The institution attributes the strong growth partly to base effects following four years of declining growth.

But Sibusiso Gumbi, a research strategist at Standard Bank, says that strong building activity might emerge as an additional source of downside pressure on house prices in the future if these building trends are not met by adequate demand.

Gumbi says that the real value of completed residential buildings increased by 6.6 percent year on year in the first quarter of this year from minus 0.8 percent in the fourth quarter.

In addition, 825 houses of 80m² or less were completed in the first quarter, a 20.8 percent improvement on the corresponding quarter last year.

Gumbi says that construction of flats and townhouses was also robust, with a 12 percent year-on-year improvement in the first quarter.

In the first quarter, 162 fewer dwellings larger than 80m² were completed, which representes a 5.8 percent year-onyear contraction, he says.

However, Jacques du Toit, a property analyst at Absa, is not concerned about the level of activity in the flat and townhouse segment and warns that percentage changes could give a false impression, particularly if off an extremely low base.

Du Toit says that the number of flat and townhouse plans that have been approved dropped year on year by 10.6 percent in 2008, by 44.2 percent in 2009 and by 25.7 percent in 2010.

The number of building plans approved for flats and townhouses was 12 275 in 2010 - more than 50 percent lower than the 33 113 approved in 2007.

The number of building plans approved for flats and townhouses improved by 20 percent in 2011 and by a further 4.8 percent last year.

But Du Toit says that the level of approvals last year - at 15 432 - was still more than 50 percent lower than the number of approvals in 2007.

Du Toit said the segments of the market that are growing the most are houses smaller than 80m², and flats and townhouses. There is a move away from houses larger than 80m².

He attributes this to affordability and lifestyle changes.

The flat and townhouse market is improving, particularly in metropolitan areas, because there is insufficient land for development and because of the increasing costs of land, services and transport.

The move away from houses larger than 80m² is caused not only by the cost of buying these houses and paying off the home loans but by the associated running costs, including rising electricity prices and rates and taxes.

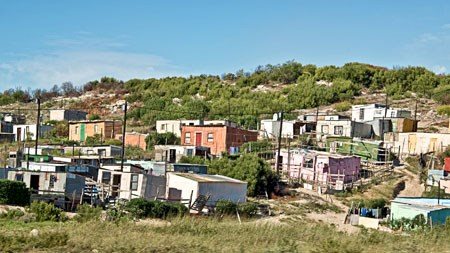

Statistics SA data shows that 73 percent of all new residential property that has been built since 1994 is houses smaller than 80m² and flats and townhouses.

This trend has resulted in independent mortgage provider SA Home Loans announcing its entry into the affordable housing market.

It is offering 100 percent loans over 20 years to qualifying customers. The loans will have variable interest rates. It has reduced its minimum property size to take into account the trend to smaller properties.

SA Home Loans chief executive Kevin Penwarden says that affordable housing is an important segment of the market, with properties valued between R250 000 and R500 000 making up more than a quarter of all registered residential properties.