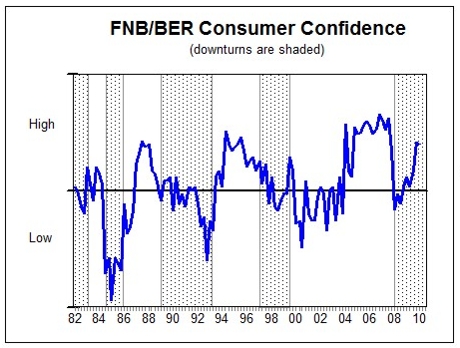

After surging from +6 in 4Q2009 to +15 in 1Q2010, the FNB/BER consumer confidence index (CCI) remained virtually unchanged at +14 in 2Q2010. Given that consumer confidence surged briefly by a hefty 27 index points when South Africa won the bid to host the World Cup Soccer Tournament in 4Q2004, consumer confidence could easily have increased once more during 2Q2010 as a groundswell of excitement took hold of the whole country in the last month before the start of the final event. Another reason why confidence could have risen further during 2Q2010, is that the prime rate was reduced by a further half a percentage point since the previous survey. The fact that consumer confidence held steady during 2Q2010 indicates that these positive factors were to some extent countered by negative ones. During 2Q2010, slightly fewer consumers expect an improvement in their own finances over the next 12 months compared to 1Q2010. Virtually unchanged were the consumers rating the present as the wrong time to buy durable goods (such as furniture, appliances and electronic goods). However, in terms of the third question making up the FNB/BER CCI, slightly more consumers than previously expect the economic performance to improve over the next 12 months. “Overall consumer confidence thus remained more or less steady as consumers’ somewhat more pessimistic views on their own finances were balanced by slightly more optimistic views about the economy”, said Cees Bruggemans, chief economist of First National Bank (FNB). A further elaboration of the three questions sheds perhaps more light.

Bleak employment prospects most likely undermined some consumers’ expectations about improvements in their own finances.

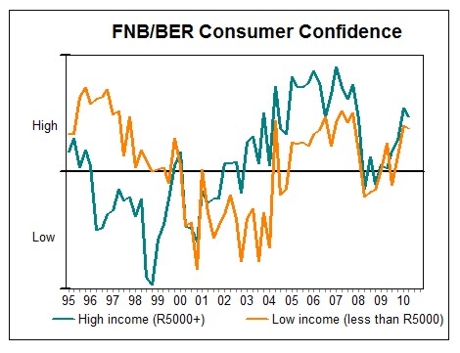

It is noteworthy that like in 1Q2010 only a small majority of consumers overall continued to rate the present as the wrong time to buy durable goods. However, also noteworthy, a far more negative sentiment on this score was still noticeably in certain important consumer segments and this despite the nominal interest rate being at a 30-year low and the price increases of durable goods remained subdued thanks to the strong rand.

The hesitancy of consumers to purchase big items and to commit themselves to more debt no longer appears to be only the result of tight bank lending standards, but rather reflects a relatively deep lingering uncertainty following the many global crises and shocks of recent years and a consequent ongoing willingness to reduce still very high outstanding debt levels.

A closer inspection of the results on the expected economic performance question indicates that the rise stems largely from consumers earning less than R2 000 per month. In their case, World Cup fever probably overshadowed any negative factors. The expectations of the middle income earners (earning between R2 000 – R10 000) about the economy increased to a smaller extent and those of high income earners (earning in excess of R10 000) remained unchanged compared to 1Q2010.

Other factors that could have weighed on consumer confidence during 2Q2010 include the following:

Renewed uncertainty in international financial markets due to primarily the dire fiscal situation of some European countries causing sharp falls in share prices and fluctuations in the rand exchange rate.

The net impact of political developments in South Africa is hard to gauge, yet may have an influence in shaping consumer confidence.

The fact that the FNB/BER CCI remained almost steady during 2Q2010 can also in part be attributed to a correction from the previous overly elevated level. In the past, confidence often pulled back after a particularly large increase between two consecutive quarters, as again happened during 1Q2010 when confidence increased by a particularly large 9 index points.

In Conclusion: The 2Q2010 results indicate that the FNB/BER CCI took a breather. It would probably have declined were it not for the World Cup. Bruggemans said: “Although consumer expectations about the economic outlook and own financial prospects remain very positive, there also lingers an apparently deep unwillingness in important consumer segments to buy consumer durables at this time and to incur the associated debt”. “Also, consumers’ overall high confidence and consequently high willingness to spend is unlikely to translate to bigger rises in actual spending until households’ ability to spend improves more pronouncedly”. This requires, among other things, a recovery in employment to boost income and a rebalancing of household balance sheets to stimulate credit spending.