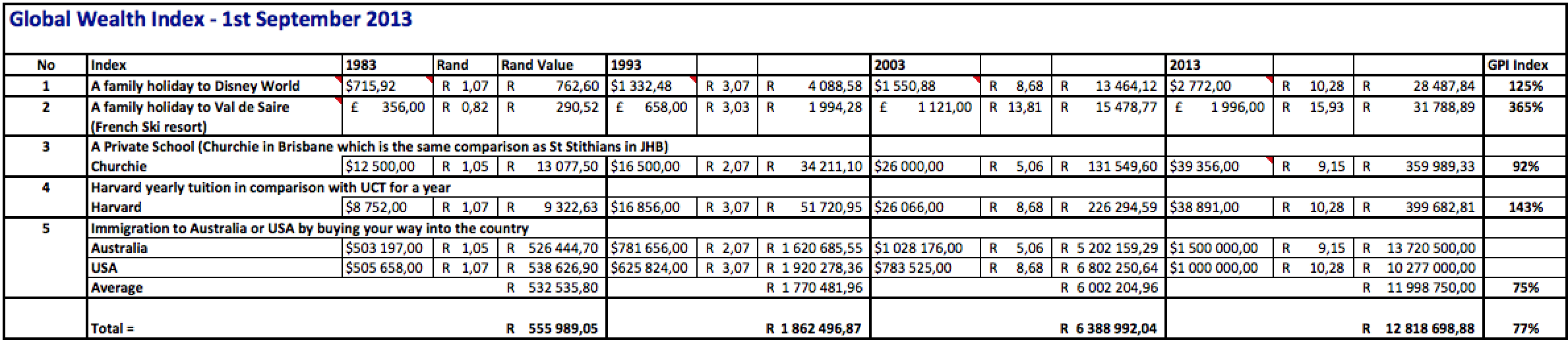

Most South Africans don’t know how to understand their wealth, in terms of Global Wealth. Therefore we have created the Global Wealth Index TM to understand the impact of cost escalation and the Rand Devaluation on our Global Wealth. Therefore like the CPI index and the basket of goods, we have our own Global Wealth Index TM. As our Global Wealth determines our freedom to make decisions for our futures, we have worked on the 5 most important components, which will determine our freedom in the future, no matter what we want to do for our children or us. Here are is the *Global Wealth Index* TM basket of goods and in the three major currencies (US Dollar, Pounds, Aus Dollar):

A family holiday to Disney World

A family holiday to Val de Saire (French Ski resort)

A Private School (Churchie in Brisbane which is the same comparison as St Stithians in JHB)

Harvard yearly tuition in comparison with UCT for a year

Immigration to Australia or USA by buying your way into the country (average of the two)

Basically in 1983 you need R555 989, 05 of wealth to be able to have the freedom to make whatever decisions you wanted for you and your children. It didn’t matter where you wanted to live; you Global Wealth Index TM determines the wealth you require to allow you the freedom of choice. On the 1st of September 2013 this amount of wealth is R12 818698,88. Therefore if you take the _last 30 years the annual decline in wealth is 77% per year_. Therefore unless your wealth is growing by 77% a year in South Africa and in Rand then you are losing against the Global Wealth Index TM. We believe the only way to be able to counter this massive reduction each year is to invest in First World Assets and First World Incomes with First World Currencies to ensure you can sustain your Global Wealth. Our book, Property Going Global (www.propertygoingglobal.com) which is based on Clem Sunter’s leading global scenario planning technique and our 4 dimensional GPS Model will show you how you can actually Create Global Wealth and Invest with Confidence; not just sustain it.

As you can see our Global Wealth Index TM shows us what has happened in the last 30 years, but more importantly where we will be in 30 years if we continue with the long-term trends. This is what we as South African’s have to plan for.