The incidence of identity theft continues to grow the world over, with increased awareness and efforts to fight it apparently doing little to deter a rising number of perpetrators who regard it as one of the easiest, lowest-risk crimes to commit.

And the consequences for victims are getting worse, says Shaun Rademeyer, CEO of BetterBond, SA’s biggest bond originator. “Identity theft used to occur mainly to obtain credit cards which would be quickly maxed out and then thrown away.

“In most of these cases it would be relatively easy for the legitimate accountholder to prove that they were not responsible for the fraudulent expenditure and to get it reversed, so that they could avoid getting any black marks on their credit record.”

“However, he says, criminals have become much more sophisticated over the past few years and are using stolen identity details not only to empty bank accounts but to obtain cell phones on contract, furniture and cars on credit and even home loans. They are also able to delay detection of the fraud for long periods while the unpaid bills and instalments mount up and up.

“In short, they can now wreak major havoc with their victims’ credit records - and in fact with their lives - because they could be blocked from being approved for any sort of account, car finance or home loan for many months or even years while they battle to repair the damage.”

According to the latest figures available from the SA Fraud Prevention Association, it has recorded about 66 000 cases of fraud in South Africa over the past 10 years and 7000 of those cases were facilitated by identity theft.

“The organisation also said recently that the scale of identity theft is on the rise as more and more consumer transactions are performed electronically,” says Rademeyer, “and mortgage consultants are certainly encountering it more frequently as they check clients’ credit records in the course of helping them apply for home loans.

“So consumers really do need to become more aware of the risks and much more vigilant – the most important steps being to guard their ID numbers and to monitor their own credit reports regularly, so that they can react quickly if a lender or credit provider checks their credit history for some reason they are not aware of, which could indicate that someone is applying for credit in their name.”

He suggests following these recommendations from the Banking Association of SA and other experts to protect your identity:

- Never disclose personal information over the internet or telephonically, without knowing exactly who you are disclosing the information to and what it will be used for.

- Make sure all your electronic devices and online accounts are password protected – and use a different password for each one. Do not base your passwords on your names or birthday as these are very easy for cyber-thieves to crack. Change your passwords and pin numbers regularly.

- Be careful when you enter competitions or answer surveys because sometimes these are scams to source your information. “Getting to know you” emails are another trick perpetrators use to acquire personal information.

- Make sure your computer and cell phone have proper anti-virus protection which will block any attempt to get your bank login details or any other personal information via keystroke malware.

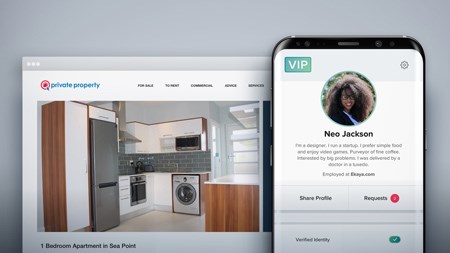

- Carefully consider the information you disclose electronically. This includes personal profile information on your business website, social networks, chat rooms and other online media.

- Do not carry all your identification documentation (such as your ID document, passport and driver’s licence) with you, unless absolutely necessary. Generally, only one document is necessary to conduct daily transactions, the rest should be locked away securely.

- Ensure your filing is always secure. Documents can be stolen or copied if left in your car or office.

- Report the loss of any credit card, debit card, store card or garage card as soon as you become aware of it

- Shred all old bank and credit statements and "junk mail" credit or card offers before trashing them, preferably with a crosscut shredder.

- Have your name removed from the marketing list of any company that sends you a pre-approved credit offer.

- Always make sure you formally cancel or close any unused credit card accounts, store accounts or paid off loan accounts.

- Delete all personal information and format the hard drive of any electronic devices such as cell phones, tablets, laptops or PCs before you dispose of them.

- Ensure that any personal information you give to a company is subject to a confidentiality clause and cannot be sold or used for anything other than the specified purpose before you disclose it.

- After applying for a loan, credit card, rental or anything else that requires a credit report, request that your ID number on the application be truncated or obliterated and that the report be shredded before your eyes or returned to you once a decision has been made. A lender or rental manager only needs to retain your name and credit score to justify a decision.

What to do if you are a victim of identity theft

Meanwhile if you believe you have become a victim of identity theft, notes Rademeyer, you should immediately report the matter to the police and get a case number, notify the bank or government department which issued you with any document that has been lost or stolen, and contact the Southern African Fraud Prevention Service (SAFPS) for further assistance on 0860 101 248.