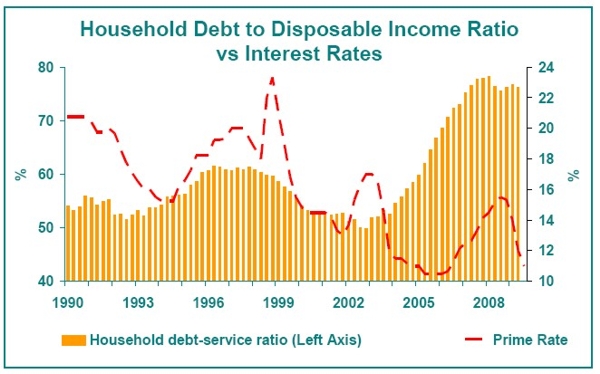

The seeming end of interest rate cuts leads to the question as to how much further the residential market recovery can go. The Monetary Policy Committee of the Reserve Bank (SARB) decided yesterday to keep its policy repo rate unchanged, implying an unchanged prime rate of 10.5%. To date this means that the SARB has reduced rates by 5 percentage points since December 2008, and by the 3rd quarter of this year the positive impact on residential property and mortgage loan demand had become noticeable. The SARB has little concern about any building inflationary pressures in the near term, expecting the consumer price inflation rate to hit the 6%-3% target range on a “sustained basis” by the 2nd quarter of 2010. For the time being, it appears to be comfortable with the repo rate at 7% and prime at 10.5%. It expresses some concern about electricity costs, with potentially huge tariff hikes to come, in the longer term, but decisions in this regard are only scheduled for early next year. As such, it would appear that rates are now settling down for a lengthy sideways movement, and indeed the Firstrand view is that prime will remain at 10.5% until the 2nd half of 2010 prior to the start of the next hiking cycle. Does this mean that the stimulus for residential property is running out before the market has gained much traction? Probably not quite yet. But the possible end of rate cuts may point to the current property recovery indeed being relatively short and of limited magnitude, and 2010 may well represent a “mini-peak” in the property cycle. There exists a common belief that interest rate cuts take up to 18 months to fully work through into an economy, and this seems not a bad rule of thumb to work on. In the 3rd quarter, FNB’s Residential Property Barometer activity level rating showed a more impressive uptick than in previous quarters, which suggests that the stimulus of recent rate cuts is still feeding through into the market and has some way to go. But for an interest rate sensitive market such as the residential property sector, an 18-month rule would imply that 2010 would gradually start to see this source of support run out (assuming no further rate cuts). Then, it will then be over to the economy to provide increased support for the residential property market through improved growth. What is the likelihood of this happening? Well, we have seen the Leading Business Cycle Indicator of the SARB starting to tick up mildly, and the signs are there that both the Global and South African economies are emerging from recession. But we should be mindful of the fact that both in South Africa and in the US, household financial fundamentals are not sound. Household sector borrowing growth has indeed slowed dramatically in recent times locally, but household income has been under such extreme pressure as a result of the recent recession, that the sector has had great difficulty in reducing its high debt-to-disposable income ratio, currently at 76.3%. The result of this high level of indebtedness relative to income is that households cannot take on new debt nearly as rapidly as was the case during the past rate cutting cycles of 1999 and 2003. This implies that households both at home and in places such as the US can’t be expected to spend the housing market or the economy to far more impressive levels of growth. Therefore, while Firstrand indeed believes that the recession is coming to and end, a forecast of around 2% real economic growth is seen as a realistic expectation, which is a far cry from the glory days of 5%+ a few years ago. How long does it take for those important household sector debt “fundamentals” to improve? If one looks at the last debt-to disposable income ratio’s cyclical decline, i.e. from around 1999 to 2003, the time span was approximately 4 years. Previous cycles also point to the process being a multi-year one. How does this decline in the ratio unfold? Well, normally not as a result of a decline in the rand value of household debt outstanding. Rather, it takes place through a period where nominal disposable income growth outpaces household credit growth, and it is a slow process. This process is struggling to get going during the current cycle because, although banks have gone through a period of conservative lending, the recession has exerted extreme pressure on household incomes. The income pressure looks likely to ease, as the economy recovers, but as in previous debt ratio improvements (declines), the expected downward trend in this ratio also promises to be a gradual multi-year trend. In the mean time, the high debt ratio curbs the pace at which the household sector can grow its borrowing, and thus the pace at which housing demand can grow.

Conclusion And so, another MPC meeting goes by with on unchanged rates, seemingly increasing the likelihood that interest rate cuts over (or nearly over) for now. This, accompanied with the ongoing high debt-to-disposable income ratio and mediocre near term economic growth prospects, suggest that 2010 could well represent next “mini-peak” in the current residential market recovery, especially if interest rate hikes towards late next year transpire. This is perhaps a little disappointing to many, with our average house price inflation forecast expected to measure a mere 5% for next year as a whole. So when could we expect a substantially more impressive performance for residential property? We believe that it is likely that we’ll have to patiently wait for at least another interest rate cycle, because the household sector needs to be on a far more solid financial platform than the present. When would this come about? We believe that it will probably take one more set of interest rate hikes, with Firstrand’s view that this could be late-2010/2011, and that thereafter, when rates ultimately start falling once more in the next cycle, the household sector will once again be on a firmer financial footing in terms of its debt levels relative to income levels. That firmer financial footing is what residential property relies heavily on, and it is unfortunately a slow process to get there.