Two weeks ago I joined a group of property people on a road show (property Wealth Network) where we presented in the four major centres, on various property topics. The event was a great success and the venues filled up as the week progressed with the final function in Cape Town being overbooked with extra chairs blocking the isles.

There was a lot covered and I hope the other speakers will share some of their topics here on this blog. I spoke about my current view of the residential property market at the moment.

A mistake that investors make as a rule is misreading the market, buying high and running when the market turns sour. While property investment is not always driven by capital growth, or the increase in the value of the real estate, it is capital growth that motivates us mostly in residential investment, so it is important to buy at the right time.

No matter if you are a person who always the sees the glass half empty, or half full, you can’t ignore the signs that are shouting at us. We have the lowest interest rates since 1974, replacement costs of homes have swung firmly in favour of second hand homes creating a disincentive to create new houses. New emerging middle class buyers are entering the market and buying or upgrading adding more demand to the equation. On the supply side Developers are building half of what they were producing last year and the surplus stock that they were holding is being soaked up. And finally if you are not looking at the fundamentals that drive prices up, look at what is actually happening in the market. Rentals are firming, and all the indices are showing positive growth, even real growth.

And if you argue that i have a bias towards property, I will show you why:

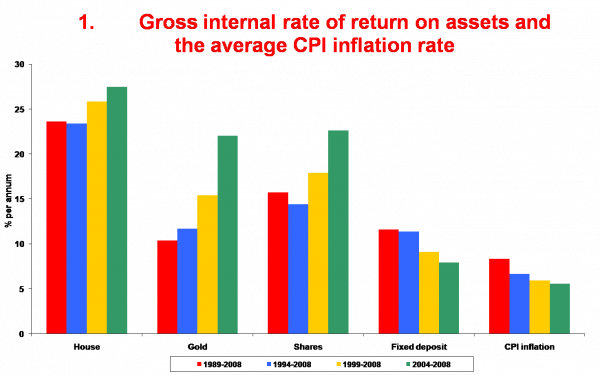

This graph shows how house prices fared against other asset classes. The graph, compiled by Jacques du Toit, Sectoral Analyst at Absa Retail Bank, shows that house price increases outperformed Gold, Shares, Fixed deposit and CPI Inflation over 5, 10, 15 and 20 years.

That is why Real Estate is in my view the best place to protect, hide and create wealth.