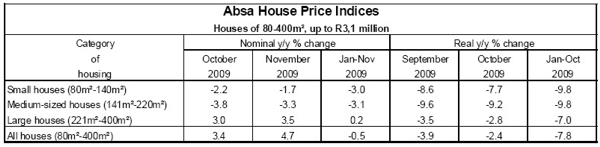

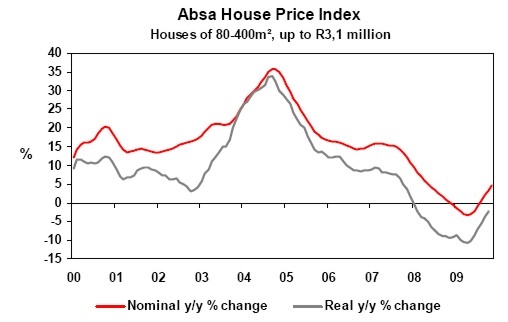

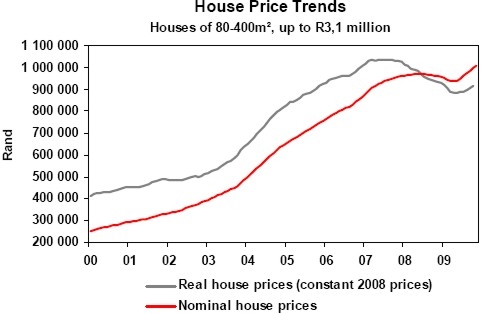

Based on Absa’s calculations, nominal year-on-year house price growth in the South African housing market picked up further in November 2009, with the prospect of price deflation of less than 0,5% for the full year. After adjustment for the effect of inflation, house prices continued to decline in real terms up to October this year, albeit at a slower pace. House prices in the middle segment of the market (see explanatory notes) were up by a nominal 4,7% year-on-year (y/y) to R1 006 300 in November, after increasing by a revised 3,4% y/y in October. Month-on-month price inflation came to 0,9% in November. In real terms, middle-segment house prices were down by 2,4% y/y in October, compared with a decline of 3,9% y/y in September after revision. The average price of small houses (80m²-140m²) declined by 1,7% y/y in nominal terms in November, compared with a revised drop of 2,2% y/y in the preceding month. As a result, the average nominal price in this category of housing came to R665 100 in November. In real terms, the average price of small houses was down by 7,7% y/y in October, after declining by a revised 8,6% y/y in September. In respect of medium-sized houses (141m²-220m²), nominal price deflation came to 3,3% y/y in November (-3,8% y/y in October after revision). This brought the average price in this segment to around R916 900 in November. Adjusted for inflation, prices declined by a real 9,2% y/y in October (-9,6% y/y in September after revision). The average nominal price of large houses (221m²-400m²) increased by 3,5% y/y in November this year, after rising by a revised 3% y/y in October. The average nominal price in respect of large housing was at a level of R1 419 700 in November. In real terms, house prices in this segment dropped by 2,8% y/y in October (-3,5% y/y in September after revision).

Various economic indicators point to a gradual recovery in the South African economy. These include the South African Reserve Bank’s leading business cycle indicator, which has risen uninterruptedly for a period of six months up to September this year; positive quarter-on-quarter real GDP growth of 0,9% in the third quarter; an improvement in the purchasing managers index, which measures manufacturing activity; and slightly higher levels of business and consumer confidence. However, households are still struggling with relatively high levels of debt in relation to income, tough labour market conditions and declining real disposable income. In view of these developments, housing market conditions are expected to improve further in 2010, but it is set to be a gradual process with nominal price growth forecast to remain in single digits over the next twelve months. In the first eleven months of 2009, nominal house price deflation averaged 0,5%, compared with the same period last year. If recent trends in price levels prove to be sustainable, nominal price growth of at least 5% can be expected in 2010. Real house prices are forecast to decline for a second consecutive year in 2009, with at best a small real increase next year, based on nominal house price and consumer price inflation trends and projections.