The latest property statistics show a milder year-on-year growth in house prices.

Property statistics for January 2016 released by ooba, South Africa’s largest bond originator, show milder year-on-year growth in house prices, including first-time buyer house prices with slower month-on-month growth trends emerging.

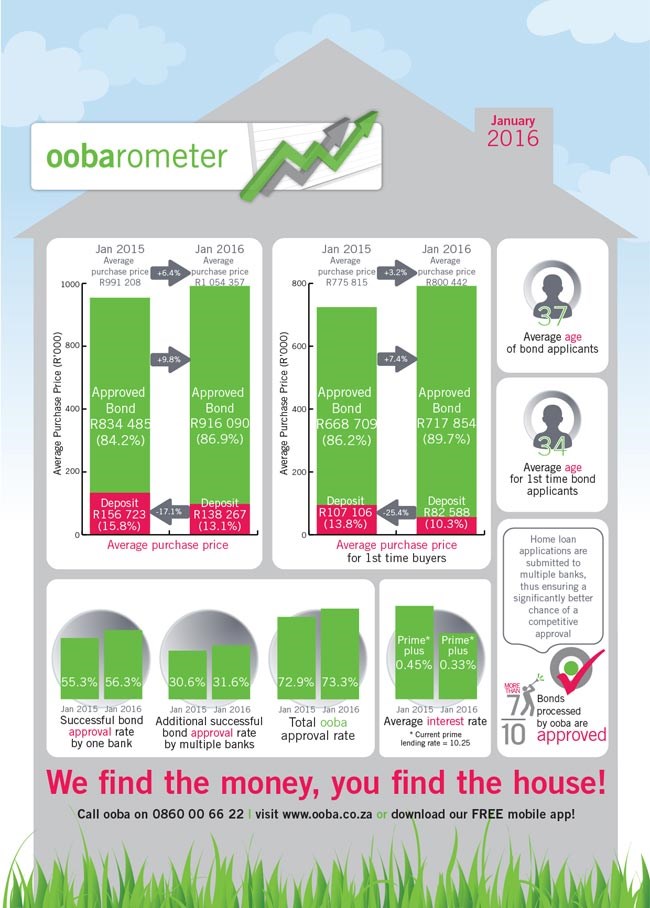

The average purchase price increased by 6.4% year-on-year to R1,054,357. The average purchase price for first-time buyers showed a smaller increase of 3.2% to reach R800,442.

Rhys Dyer, ooba’s CEO, says: “Average bond values are higher, which goes hand-in-hand with reduced deposit sizes. The average deposit fell by 17.1% year on year, while deposits from first-time buyers shrank by 25.4% year-on-year. Increased bond sizes and decreased deposit sizes show that lenders are still competing for market share in the home loan finance sector.”

However, Dyer cautioned that the property and home loan environments appear to be less buoyant going into 2016. Bank approval rates are only marginally up year-on-year, while month-on-month bank approval rates have declined. In the same way, average interest rates also improved year-on-year but deteriorated slightly month-on-month.

On the upside, Dyer says: “As long as first-time buyers continue to drive the property market, the ongoing shortage of housing stock will ensure that house prices continue to grow in 2016, albeit at a slower rate. In January, first-time buyers made up 54% of the applications received by ooba.

“The effect of the recent interest rate hike is not yet evidenced in ooba’s January statistics. Considering the tougher interest rate environment, poor economic growth forecast and the rising cost of living expenses we believe that housing affordability is going to be the greatest challenge for the residential property market in 2016,” adds Dyer.

“ooba’s home loan approval rate of 73% in January indicates that the company continues to secure approval for more than seven out of ten home loans that it processes,” says Dyer.

Given the increasingly complex home loan environment, first- time buyers and all buyers alike can benefit enormously from being prequalified for finance before putting in an offer on a property. “ooba’s free prequalification service provides buyers with a network of highly skilled prequalification experts located around the country who will assist buyers to access their credit report, assess their credit standing, calculate their affordability, compile the relevant paperwork and, within 24 hours, provide them with a prequalified loan certificate. This enables prospective home buyers to focus on finding their dream home, while we find them the money.” concludes Dyer.