Perhaps you made the decision to buy a property in the name of a company registered with the Companies and Intellectual Properties Commission (CIPC). At the time when most people used this legal vehicle, it seemed like a wise decision as it saved transfer duties, it was easier to sell shares or membership and it was used to secure a legally-sound investment.__

Many property owners opted for this route in recent years so that they can use the property to generate rental income, which in turn would be ploughed back into the business account, or possibly even to protect it from creditors.

A very important yet unfamiliar requirement concerning properties registered in the name of a company was recently highlighted in a newsletter by attorney firm De Beer & Claassen:

All companies and close corporations are required by law to submit their annual returns with the CIPC within 30 days of the anniversary date of its incorporation. Failure to do so will result in the CIPC assuming that the company and/or close corporation is no longer doing business or is not intent on doing business in the near future.

A company or close corporation may be referred for de-registration in the following circumstances:

Upon voluntary application by the company / close corporation itself.

If the CIPC believes that the company or close corporation has been inactive for seven years or more.

If annual returns are outstanding for more than two successive years

Non-compliance with the submission of annual returns can accordingly lead to de-registration of a legal entity without consent of the members or directors of such a legal entity.

Riaan van Deventer, Head of Real Estate at Engel & Völkers Southern Africa urges all homeowners to whom this requirement would apply: “Don't always presume your auditors will bring this to your attention or submit these annual returns. The onus and responsibility is fully on you as the director of the company ((Pty) Ltd) or as a member of the close corporation (CC) to ensure your company's annual tax returns have been submitted on time. Ignorance of the law is no excuse and you need to be aware of the requirement for submitting annual returns with the CIPC to avoid de-registration of your company.”

Check that you still exist!

De Beer and Claassen earnestly advise you to urgently check with the CIPC to ensure “your company is still ‘alive’.” Otherwise you may go to the effort of marketing this property, find a satisfied and qualified buyer, and at the stage when the transfer of the house should take place, only to then establish that the property is not legally yours, as it has been de-registered and that the transfer of property cannot take place. This could have been avoided if you were legally compliant.

The Act makes provision to apply for reinstatement of a company; however this is a costly and time-consuming exercise and needs to be managed by an attorney. They also cannot guarantee that the original name has not been taken by new owners and this can encumber the whole process of reinstatement even further.

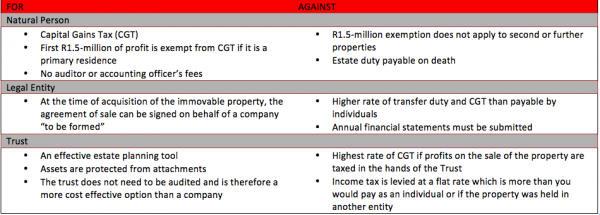

What are the differences between buying in a company (entity), trust or a natural person?

As the decision in which entity to buy your property is a complicated legal decision, it is highly recommended that the purchaser consults with an attorney prior to signing an agreement of sale, in order to obtain expert advice.